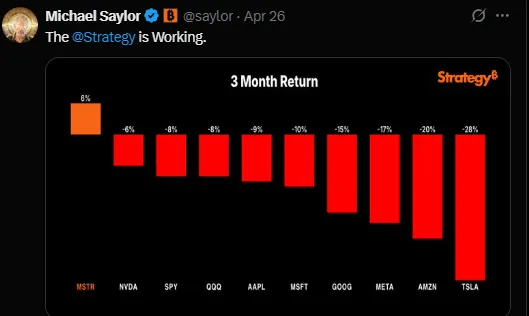

For investors, the first quarter of 2025 had something of a mixed bag. While big tech and several broader indices could not withstand the pressure of macroeconomic headwinds, stocks related to Bitcoin made gains. Below is a comparison of the three-month price returns for a basket of high-profile stocks and ETFs, along with the major factors-from revenue misses to trade policy shocks-that have affected their recent performance.

In the last three months, some selected tickers had a record with MicroStrategy leading the bitcoin-fueled rise, while Tesla recorded the greatest decline.

The following is a breakdown of which stock/ETF performed how and the major forces behind the performance.

On the back of the Bitcoin rally to over $100,000 in late 2024, MicroStrategy's stock was up by 6% over the past three months, outperforming some big-name technology stocks. MicroStrategy, being one of the largest corporate holders of Bitcoin, has its fortunes largely tied to the price of this cryptocurrency. Michael Saylor's aggressive strategy in Bitcoin-buying is often touted on social media as "The @Strategy is working," and it has delivered fruit almost instantaneously.

The company recently announced a new round of Bitcoin buying, bringing its total to 553,555 BTC, valued at over $52 billion, with an average price of $64,459. Saylor's conviction that Bitcoin is "digital gold" remains intact; he once said he couldn't sleep fearing that others might take it all first.

NVIDIA ( NVDA ) stock has plunged significantly after a report that the Chinese state-of-the-art tech enterprise Huawei is preparing to create a new advanced AI chip in response to President Trump's export restriction on all Nvidia chips to China. The company's shares collapsed further this month after the chipmaker indicated in a regulatory filing that the H20 chips made only for the Chinese market had been banned from export into the US due to increasingly strict trade rules of the US government.

The company's policy change would be noted by a $5.5 billion loss, whereas it is estimated by JPMorgan analysts that the ban would be able to cut up to $16 billion off Nvidia's revenue this year. Overall, Nvidia stock has lost nearly 19% as a top performer in AI chip stocks. The downfall is attributed to a slowdown in investor sentiment that reversed the effect of scrutiny on AI spending from Big Tech Titans and Trump's trade war.

The behavior of the S&P 500 benchmark (which is tracked by SPY) suggests a broad-based market pullback. Following the bulge in 2024, turbulence hit the equity markets during Q1 2025 due to resurrected economic uncertainty and geopolitical tensions. Noteworthy was the return of fears surrounding a U.S.-China trade war, which soured the mood of a market already skittish: President Trump, inaugurated in January, moved to levy tariffs on key trade partners in early April, troubling investors. Further, the Federal Reserve was bent on keeping interest rates high in its fight against inflation, acknowledging the adverse impact on equities. As of mid-April, the S&P 500 had declined by 8%, cyclical sectors and erstwhile high-fliers being under pressure. In essence, a lot of macro headwinds from tariffs to tightly constrained financial conditions pushed down the broad market small consolation for SPY, with its somewhat meagre dividends.

The Nasdaq-100 ETF, also known as QQQ, has fallen nearly 8% in early 2025. This pattern is in line with the S&P but differs in the participation of tech mega-caps in the downward trend. Tech giants such as Alphabet and Meta, under the "Magnificent Seven" umbrella, witnessed losses of 15-20% due to concerns about expenditures and growth. Rising interest rates, ambiguous earnings, and new tariffs were major contributors to the bearish sentiments of the investors, with headwinds affecting global tech demands. As of April, the Zacks Tech sector had now lost about 17% for the year so far. As investors became apprehensive and cashed out from the AI-fueled gains of 2024, QQQ lagged, posting a high-single-digit loss over the last three months.

Apple's share price fell about 9% in the last three months due to macroeconomic and company-specific issues. Particularly, it was because of escalating trade tensions between the U.S. and China, which contributed significantly when tariffs were imposed in early April, causing the stock to plummet by more than 11% in the week following the announcement. A 90-day pause on the tariff did not provide much certainty. Also, demand for iPhones was weak in China due to local competition such as Huawei and Xiaomi. It reported a year-on-year decline of 11.1% in revenue from Greater China in its fiscal Q1 2025, with higher services gains offset by lower hardware sales and threats from international trade, thus keeping pressure on Apple stock.

Microsoft's stock has seen nearly a 10% drop from its three-month high, although the fiscal Q2 results (Oct-Dec 2024) were very solid, showing a 12% top-line growth, driven primarily by the performance of Azure cloud. But then concerns set in, as management's forecast for cloud revenue growth-31-32% for Azure-came in lower than Wall Street's expectations of 33%. Also, capital expenditure on AI data centers accelerated to $22.6 billion, much above expectations. Investors still have confidence in Microsoft's AI ventures with OpenAI and GitHub Copilot, but are looking for clearer signs of profits. Heavy spending and a cautious cloud outlook translated to a 4-5% drop in after-hours trading, reflecting market apprehension in this AI craze.

Over three months, the stock of Alphabet (GOOG) has fallen by almost 15%, but this has been driven by ever-growing problems in the first quarter of 2025. The shares fell by more than 22%, hoping investors became more scared by the rising regulatory risks. The core advertising growth has slowed, with global ad budgets increasing by only a mere 2% in the year 2025. In addition, there is a judgment of a US court on the alleged monopolization of digital ads by Alphabet, adding to the regulatory angst, which contributed to investor skepticism notwithstanding the announcement of a share buyback of $70 billion. Alphabet's $75 billion capex plan, up 43% from 2024, is intended to beef up AI infrastructure, although its implementation will wear heavily on cash flow. At the same time, core advertising growth has slowed down, going only 2% up on the global ad budget for 2025. Q4 2024 ad revenues came in under expectations, while operating margins dropped to 23% as well.

Amazon's stock fell by 20% in the last three months due to slower growth and unrest among investors. Even after double-digit revenue growth and skyrocketing operating income for Q4 2024, the company's outlook for Q1 2025 does not meet analysts' expectations. Amazon puts the first three months' revenue at a $151-155 billion range, which is indeed lower than what the consensus projected at ~$158 billion. Key problems are rising competition from Microsoft and Google Cloud developing their AI technologies, and a trend of customers cutting down on cloud spending. Furthermore, a strong U.S. dollar is expected to cause a revenue reduction of about $2.1 billion in Q1. All of these causes contributed to the great downside of twenty percent on stock prices at Amazon.

In the early part of 2025, Tesla faced major challenges, with its stock declining nearly 30% in the last quarter and more than 40% year-to-date by late April. The primary culprit behind the fall was the price cuts made by Musk aimed at boosting demand against rising competition. While deliveries of vehicles went up, the discounts hurt Tesla's financials in a substantial manner, with automotive revenues down 20% YoY in Q1 2025, while net profits plummeted by 71%. The margins, meanwhile, crushed downward, nosediving to the low teens from around 21% the previous year. This was compounded by macroeconomic and geopolitical situations, such as the new U.S. tariffs of up to 145% on certain Chinese components and China's retaliatory measures. Definitely with an uncertain global economic environment and weaker demand, Tesla is now battling for profitability, yet charging ahead with its long-term vision.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.