Is Midnight (NIGHT) the next dominant of crypto privacy even if Zcash's price has very much increased and the world of zero-knowledge technology is becoming more interesting? Brought by price increase, large short liquidations, and an explicit roadmap, the Midnight story is quickly attracting the attention of both traders and long-term investors.

With privacy tokens coming back into the limelight and the Cardano ecosystem getting ready for a major upgrade, NIGHT is now in the middle of all that speculation. Let's analyze what is giving the price the momentum—and where the price could head next.

The privacy coin sector has recently regained much of its lost attraction due to Zcash's price boost that almost brought it to the second most important crypto power after Monero. With this reformed narrative, Midnight is bent on becoming a privacy-centric blockchain by road-mapping its way to get the best out of the zero-knowledge (zk) proof technology.

Midnight, unlike the privacy coins of the past, adopts an approach of compliance-friendly privacy but still looks like a scalable solution for decentralized applications, payments, and enterprise use cases. The handling of the situation in such a way is placing NIGHT at the crossroads of innovation and regulation, which is one of the most important themes in crypto markets nowadays.

Cardano's founder, Charles Hoskinson, has no doubt about the future of Midnight and its growth. The founder of Cardano remarked that Midnight would bring in a revolutionary change to the decentralized exchange (DEX) activity of Cardano.

As Hoskinson predicted, the DEX volume of Cardano, which is about $4.3 million at present, will be able to reach billions once the stablecoins and cross-chain bridges are implemented on the Midnight platform. This claim has by no means more than a little impact in positively affecting the market and has certainly empowered Midnight to become one of the core infrastructure layers in the Cardano ecosystem.

The price catalysts have come the way of Midnight through the mainnet coming ahead and the corresponding timeline for the DEX launch.

Traders won't miss or overlook what Midnight is up to as all the expected launches are categorized into detailed timelines:

Q1: Federated mainnet launch

Q2: Incentivized testnet

Later in the year: Full mainnet launch

The sequence of this rollout has led to the creation of a demand for NIGHT based on anticipation, as the investors have already begun positioning themselves to benefit from not only the ecosystem expansion but also increased liquidity and wider adoption.

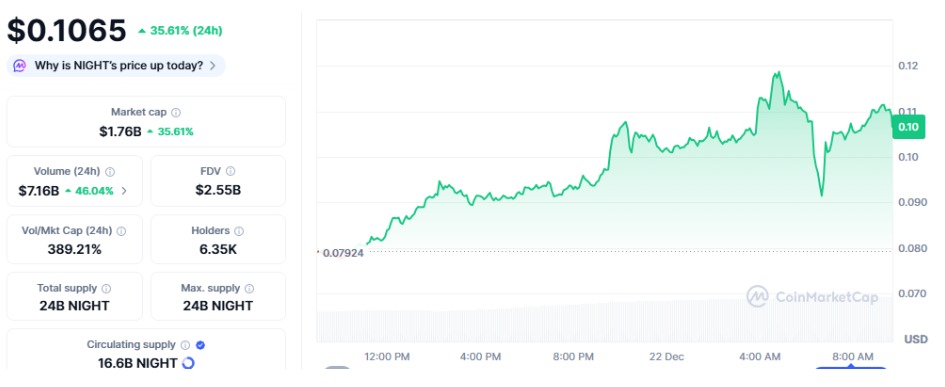

NIGHT's trading performance was quite impressive, as it showed a bullish breakout and the price is trading at $0.1065 which is a 35.61% increase in one day. The market cap of NIGHT to $1.76 billion while 24-hour trading volume also recorded an increase of 46.04%, reaching $71.6 million.

The volume-to-market-cap ratio of 389%, which is exceptionally high, is an indication that traders are aggressively taking part in the rally, confirming that the increase is supported by liquidity rather than being a result of thin speculation.

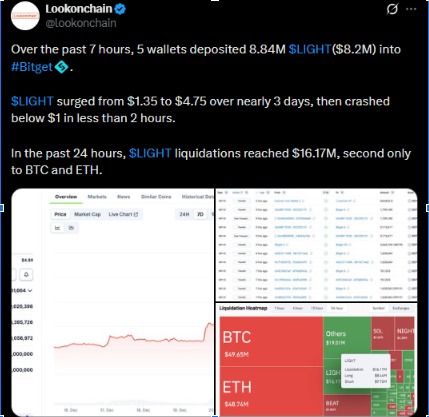

As per On-chain data Lookonchain indicates that $LIGHT experienced extreme price fluctuations during this time. Specifically, five wallets transferred about 8.84 million tokens (equivalent to around $8.2 million) to Bitget in a matter of seven hours, which could mean the start of selling pressure.

A huge price increase from $1.35 to $4.75 over the course of almost three days was followed by a rapid downward trend below $1 in less than two hours. The quick reversal of the price triggered a serious derivatives fallout, with $LIGHT liquidations amounting to $16.17 million in the last 24 hours—only behind Bitcoin and ahead of Ethereum.

Bringing to light how the overall market situation plus the activities of the large wallets and the use of high leverage had cumulatively increased the rally and the subsequent decline by a great deal.

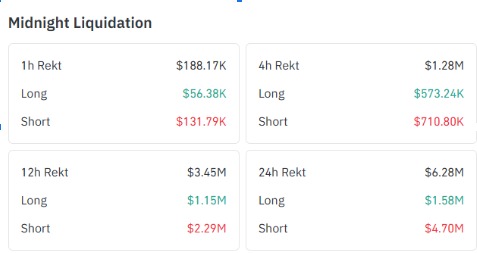

As per Coinglass Data, Market volatility went through the roof when liquidations totaled around $6.28 million in just 24 hours. Most of the losses were on the side of the bearish traders who got $4.70 million liquidated while long positions exchanged for only $1.58 million.

The imbalance in these market activities really pointed out the occurrence of a typical short squeeze, in which traders betting on the fall of the price were forced to buy back their positions, thus contributing to the price rise. These situations very often strengthen the trend of short-term bullishness.

Looking at the hourly chart, NIGHT has gone through an incredible revival, rising from the December 9 low of $0.035 to a recent peak of about $0.11989.

Even though the price was unable to break through the resistance at $0.12000 for a while, it eventually retreated in a very normal way and then it was supported at around $0.08930, which is close to the 100-day EMA. More importantly, NIGHT is still trading above $0.10000 which is the support area for the bulls enabling them to keep the existing trend.

NIGHT is above the 25, 50, 100, and 200-period exponential moving averages now which shows the presence of a strong bullish control in the different timeframes. That usually means that there is a growing FOMO (Fear of Missing Out) among traders and investors.

On the other hand, the Relative Strength Index (RSI) and other momentum oscillators are all showing uptrends, which is another way of saying that there is still buying pressure coming from the markets and not selling.

Looking at the current technical setup, the indicators of momentum, and the strong fundamental catalysts, it seems that NIGHT Price Prediction is ready for another upward move.

Immediate resistance near : $0.1200

Breakout target: $0.1350–$0.1500 (short term)

Support Area: $0.1000 and $0.08930

In case, If bulls manage to turn $0.1200 into support successfully, NIGHT may hit new high, particularly as the mainnet launch is getting closer.

On the contrary, if the price drops below $0.1000, it might lead to a short-term consolidation before the next uptrend.

Disclaimer

Crypto price predictions are for informational purposes only and not financial advice. The crypto market is highly volatile, and prices can change at any time. Do your own research before investing. We are not responsible for any financial losses.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.