The crypto market expected a huge launch for Cardano’s Midnight token, but within hours, the $NIGHT Price Crash became the biggest news story.

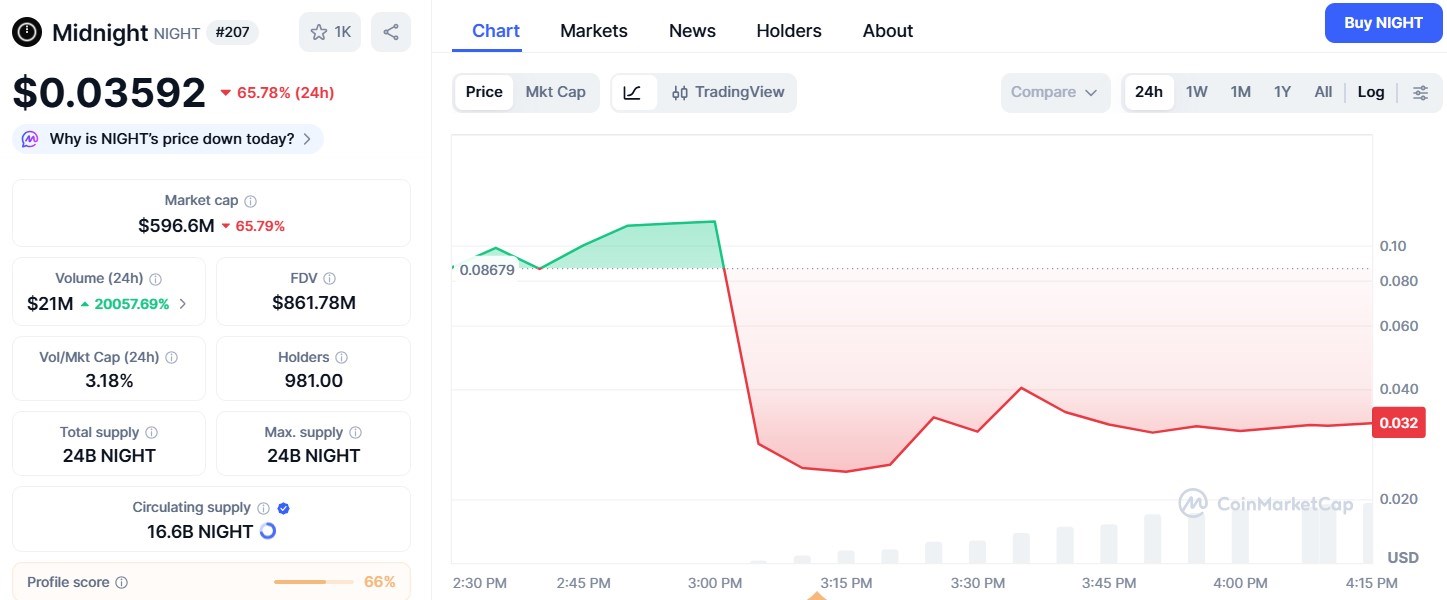

The asset listed today across major exchanges including Binance, OKX, Bybit, Kraken, Gate.io, KuCoin, HTX and more, but still opened at a $0.08679 low.

After the debut, it immediately fell to around $0.035, creating a steep 65% meltdown. This has raised a big question: Why did it crash, reasons, and what is the Midnight token price prediction from here?

Midnight token Cardano started strong near $0.086, but extreme sell pressure quickly pushed it down. As per CoinMarketCap chart, even though the 24-hour volume jumped 20,000% to $21M, buyers could not absorb the large number of tokens entering the market.

This sudden $NIGHT Price Crash shows a classic listing dump pattern with long red candles, weak support, and thin liquidity. A major reason behind the crash was the huge 16.6 billion tokens already circulating out of a 24 billion total supply, which made price stability difficult.

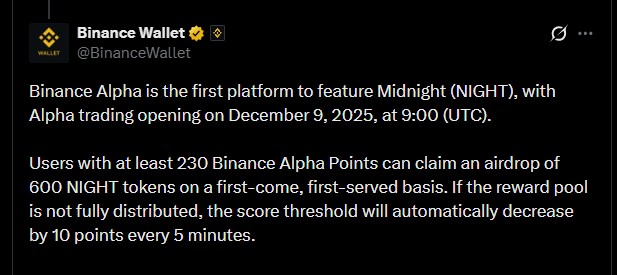

1. Binance Airdrop = Instant Selling

Binance wallet official X account offered users with 230+ Alpha Points a chance to claim 600 coins. When trading started, many users immediately sold their airdropped tokens to book profits.

This $NIGHT airdrop sell off created a massive wave of early selling and contributed to asset’s meltdown.

2. Crypto Market Was Already Weak

Bitcoin and Ethereum dropped around 2%, and overall market sentiment remained low. The Crypto Fear & Greed Index at 22 (fear) shows investors are avoiding new tokens.

3. Very Large Circulating Supply at Launch

Launching with 16.6 billion tradable tokens made it impossible for the market to hold the launch price. Most cryptocurrencies start with lower float, but this asset entered with too much supply too fast.

4. Price Chaos on Cardano DEXs

On Cardano DEXs, some users paid extremely high amounts. One user bought 0.39 coins for 4761 ADA, showing unstable price discovery across platforms.

These four factors together explain today's price meltdown clearly.

There is still some hope for recovery. Popular ADA analyst Angry Crypto Show highlighted a strong statement by Cardano founder Charles Hoskinson:

“Every 6 months we can make the Midnight privacy box better, faster and cheaper. Once trading starts, no one has any incentive to compete. It already works with ETH and SOL.”

Such Midnight token news boost long-term confidence and help rebuild investor interest.

Short Term $0.028 - $0.045: Due to selling pressure and market fear, NIGHT price crash may hit downtrend towards $0.030, but small bounce attempts could push it to $0.045.

Mid Term: $0.045 – $0.065: After the airdrop chaos ends, midnight price may stabilize and slowly move toward the $0.05–$0.065 range.

Long Term: $0.10 – $0.15+: If privacy technology grows and Cardano adoption increases, NIGHT price prediction 2026 could target a move above its listing price.

Midnight NIGHT price crash happened mainly due to airdrop selling, weak market conditions, a large supply, and DEX mispricing. But traders should note that the fundamentals of the $ADA privacy network remain strong, and long-term growth is still possible.

Disclaimer: This article is only for informational purposes, it does not support any financial advice. Always DYOR before investing in the cryptocurrency market.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.