Can $BIRB become the next strong community-driven Solana token, or will early volatility slow its momentum after listing?

As Moonbirds prepares to debut on major centralized exchanges, investors are watching closely. With Birb Games launching at TGE, a large community token allocation, and growing hype around Solana-based gaming tokens, expectations are high. But will demand match the excitement once trading begins?

Let’s break down the $BIRB price prediction, starting with its market setup and tokenomics.

Moonbirds is launching with a total supply of 1 billion tokens and a pre-market price of $0.12. The token will list on MEXC and ByBit at 11:00 UTC.

Additionally, the token will be available on KuCoin starting at 13:00 UTC.

Additionally, Binance Alpha will be the first platform to feature Moonbirds (BIRB) on January 28, where eligible users can claim airdrops using Binance Alpha Points.

Still, like most new listings, early price volatility is expected.

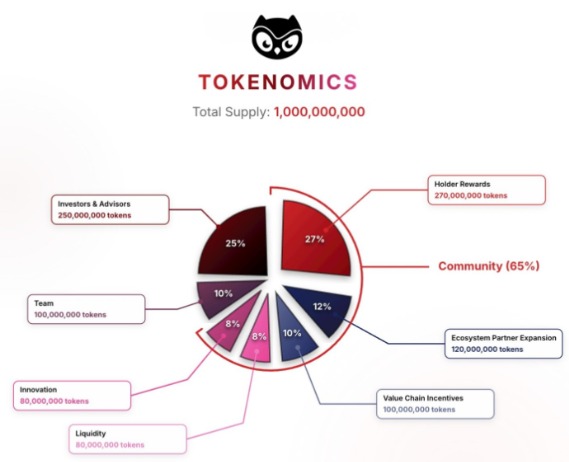

Understanding tokenomics is essential for evaluating any crypto project. The project has a fixed total supply of 1 billion tokens, designed to support long-term ecosystem growth.

Community Allocation – 65%

Supports long-term user growth and decentralization.

Holder Rewards – 27%

Distributed to Birb and Friends to encourage participation.

Ecosystem Partner Expansion – 12%

Performance-based incentives for partnerships and adoption.

Value Chain Incentives – 10%

Rewards contributors for strengthening infrastructure and operations.

Liquidity – 8%

Reserved for CEX listings, market making, and deposit campaigns.

Innovation – 8%

Future-focused reserve for ecosystem development.

Team – 10%

Long-term incentives are aligned with project growth.

Investors & Advisors – 25%

Strategic backers providing capital and guidance.

This distribution prioritizes community growth while ensuring operational and strategic stability.

Moonbirds introduces Nesting 2.0, which plays a key role in early token distribution.

SBT allocations are fully unlocked at launch

Nested Birbs receive their first monthly unlock on Day 1

Moonbirds, Mythics, and Oddities NFTs receive 25% of the total supply

Team and investor tokens are locked for 12 months, followed by 24-month vesting

This structure reduces immediate sell pressure and supports long-term alignment.

In the first few weeks after listing, volatility will likely dominate price action.

With 8% of tokens allocated to liquidity, early trading volume may be limited. This could lead to sharp price moves, especially if short-term holders sell to secure quick profits.

Expected short-term range:

$0.10 – $0.15 (initial stabilization zone)

If community incentives and Birb Games participation gain traction, the price could recover toward:

$0.18 – $0.22

Still, corrections are likely due to speculative trading and the large 25% investor and advisor allocation, even though these tokens are locked.

As the market absorbs early selling pressure, attention will shift to ecosystem growth and community rewards.

With 27% allocated to holder rewards and 12% for ecosystem partnerships, user engagement could increase meaningfully. Birb Games also helps recycle unclaimed tokens back to the community, reducing long-term sell pressure.

Expected mid-term range:

$0.22 – $0.30

This phase will depend heavily on adoption, liquidity depth, and real participation from NFT holders and players.

Over the long term, the project's success depends on execution.

Nearly 30% of the supply is dedicated to innovation, ecosystem growth, and team incentives, which supports sustainable development rather than short-term hype.

If partnerships expand, Birb Games gain popularity, and Solana activity remains strong, the project could establish a higher valuation.

Long-term price potential:

$0.35 – $0.50

Reaching this range will require consistent user growth, strong liquidity management, and continued community trust.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments involve risk. Always do your own research.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.