The Solana ecosystem sees new memecoins every day, but Nietzschean Penguin (PENGUIN) just did something historic.

After a 16,200% (162x) one-week surge, the token has crossed a $116 million market cap and drawn huge social attention.

This is not a quiet pump.

The move is being linked to a viral political moment that pulled fast money into the trade.

While large-cap tokens are still searching for direction, PENGUIN’s parabolic run is forcing traders to ask a harder question—is this just another speculative spike, or the start of a trend that can stretch further?

This shift has put PENGUIN price prediction 2026 back into focus as traders try to read whether sentiment or structure is really driving the move.

This move is not coming from charts alone. A mix of viral attention, social buzz, and fresh speculation is shaping how traders are reacting to this memecoin today.

Viral Momentum and Social Hype

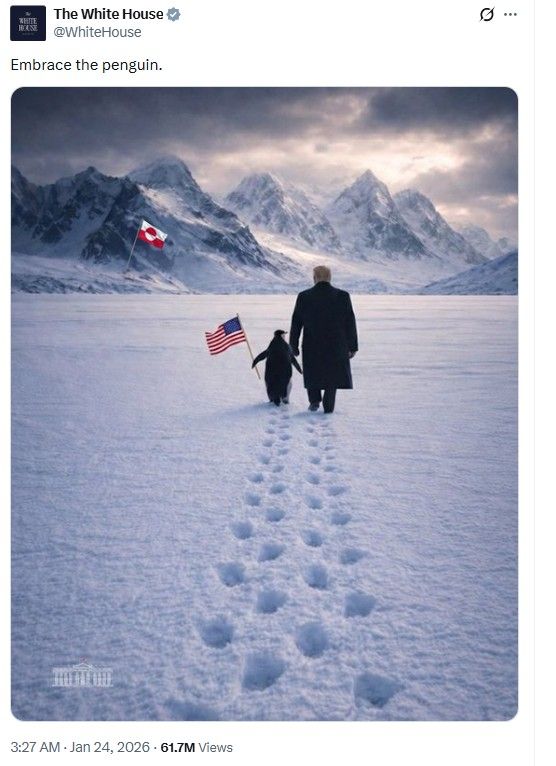

The rally picked up pace after a penguin-themed post from the White House went viral on January 24, turning this memecoin into a political meme overnight.

Social media engagement stayed high around 67.12M, and retail traders kept rotating capital into the token as influencers amplified the move.

This kind of viral loop often pulls in fast money, especially in meme-driven markets.

Binance Listing Speculation Adds Fuel

Unverified chatter around a possible Binance listing has added a speculative layer to the rally. A post shared by Crypto GVR (@GVRCALLS) on X sparked discussion in community forums, even though no official confirmation exists

In meme coin runs, such listing talk alone can attract short-term buyers who try to move ahead of any potential announcement.

Price Action Confirms the Story

According to BSCN, the pumpfun-launched memecoin jumped more than 43% in a day and over 13,700% in a week, despite a pullback after earlier highs.

Even with market cap cooling from $150 million to around $97 million, price strength has held, showing that buyers are still defending the move rather than exiting all at once.

On the lower timeframe chart, price is trading inside a broad consolidation range between $0.07249 and $0.1355 after its parabolic move.

Price is currently holding near the $0.1170 area, above the previous breakout zone, showing that buyers are still defending the move rather than exiting fully.

This structure often appears after explosive rallies, when early buyers pause while new traders decide whether to chase the move or wait for a dip.

What the Indicators Say

RSI: RSI is near 62, showing positive momentum without entering the overbought zone, which keeps room open for further upside.

21 EMA: Price is trading above the 21 EMA, turning it into short-term support and keeping the trend tilted in favor of buyers.

Trading activity around PENGUIN has expanded after price moved out of its accumulation zone. Data shared by ACXtrades volume analysis notes that the token has broken above its base and is now holding near the $125 million market cap level, which is acting as a short-term balance point for buyers and sellers.

If participation remains strong, nearby reaction zones sit around $137 million and $170 million, where price may pause before testing higher historical levels.

For now, volume behavior suggests traders are still engaging with the move rather than walking away from it.

In the short term, PENGUIN is trading in a consolidation phase after its sharp rally.

As long as price holds above the recent range, upside attempts toward $0.1355 and $0.1673 remain possible.

Short-Term Invalidation: A drop below $0.06709 would weaken the current structure and signal fading momentum.

On higher timeframes, Fibonacci extensions point to key reaction zones at the 1.618 level near $0.2762 and the 2.618 level around $0.4331, where price may slow or consolidate during the next leg up. These levels often act as checkpoints after parabolic meme coin runs.

If momentum continues to build, higher extensions come into view at the 3.618 level near $0.5964 and the 4.236 level around $0.7032, marking the upper projection zone shown on the chart.

Long-Term Invalidation: This outlook weakens if price drops below the base structure near $0.07249, which would signal that the broader recovery move is failing.

In the context of PENGUIN price prediction 2026, as per expert view, the rally is being driven mainly by viral attention and speculative flow rather than long-term fundamentals.

As long as price stays above the $0.07249 base zone, short-term upside toward $0.1355 and $0.1673 remains open. A break below this support would signal that momentum is starting to fade.

YMYL Disclaimer: This content is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency markets are highly volatile, and readers should conduct their own research or consult a financial advisor before making any investment decisions.

Rahul Rathore brings over 3 years of hands-on experience in technical analysis, specializing in crypto, stocks, and market trend forecasting. With a deep understanding of chart patterns, indicators, and market psychology, Rahul delivers precise, actionable insights that help traders and investors make informed decisions. His analytical approach combines technical expertise with real-world market understanding, making his content reliable and highly valued by both novice and experienced traders.