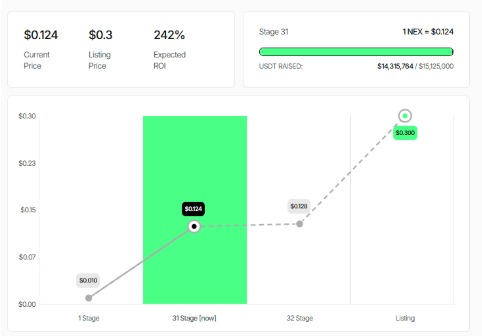

Are you wondering if Nexchain (NEX) can reach its anticipated listing price of $0.30? This revolutionary AI-built blockchain has already caught investor attention with its strong funding progress and innovative technology.

With 1 NEX currently priced at $0.124, early investors may see a potential 242% ROI, making this one of the most talked-about projects in the crypto space.

Since its presale launch , NEX has shown a steady growth trajectory, rising from $0.01 at the initial stage to the current $0.124. With Stage 31 fundraising almost complete at $14.3M out of $15.1M, the project is on track for strong momentum.

The upcoming Stage 32 projects a price of $0.128, steadily approaching the $0.30 listing target. Such consistent growth indicates robust demand and increasing market interest among early adopters. With only the final stage remaining, the listing is expected by the end of March 2026.

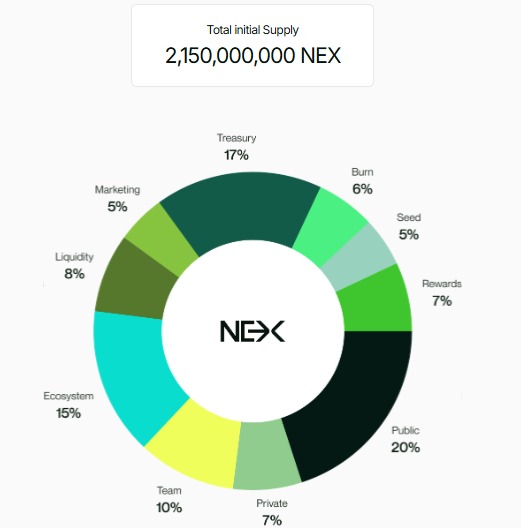

Understanding Nexchain’s tokenomics is key to predicting its price. Out of 2.15 billion NEX tokens:

Public Sale: 20%

Treasury: 17%

Ecosystem: 15%

Team: 10%

Liquidity: 8%

Rewards: 7%

Private Sale: 7%

Burn: 6%

Seed Sale: 5%

Marketing: 5%

This allocation ensures strong public access, healthy liquidity, and sustainable ecosystem growth, which can fuel price increases over time.

With an initial circulating supply of ~523.5M NEX, the listing price at $0.30 gives a market cap of approximately $157M. High allocation for public sale and liquidity can drive strong early trading activity.

If demand is high, the price could spike slightly above listings, potentially reaching $0.32–$0.38, making it a lucrative moment for early adopters.

In the next few months, Nexchain’s price will likely be influenced by market sentiment and adoption signals. Treasury, ecosystem, and reward allocations could create selling pressure once unlocked, but active staking, partnerships, and community engagement may sustain momentum.

Expect prices to range between $0.35–$0.45, with occasional spikes if exchange listings or positive news emerge.

Long-term growth depends on real adoption and ecosystem development. Effective use of treasury and rewards for community engagement, combined with token staking, could limit sell pressure.

With a fully diluted market cap (FDMC) of $430M, a realistic long-term price target is $0.55–$0.65, assuming steady growth and consistent investor interest.

This article is for informational purposes only and not financial advice. Cryptocurrency investments are highly volatile. Always conduct your own research before investing.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.