The strongest crypto projects eventually face a stress test. Right now, that test seems to be unfolding for Solana.

The Solana price prediction narrative has shifted sharply from optimism to caution. On-chain activity remains strong, and institutional participation has not disappeared, but price structure is starting to crack.

That contrast is what makes this moment uncomfortable.

SOL is now hovering near a critical support zone around $80.

This level has acted as a structural floor in recent months, but repeated tests are weakening it.

Momentum indicators are cooling, and buyers are no longer defending levels with the same aggression.

The real concern is not just whether SOL can bounce. The bigger question is what happens if $80 fails. If that line gives way, the chart opens room toward deeper correction levels, potentially near $48.

This is no longer just about upside targets. It is about whether the market structure can hold under pressure.

On the 4-hour TradingView chart, SOL was moving inside a symmetrical triangle, but the structure has now broken to the downside.

This breakdown shifts short-term momentum in favor of sellers.

Price is currently near $84. The immediate support sits at $80, followed by $76. If both levels fail, the next downside target opens near $67.

On the upside, the 50 EMA is acting as dynamic resistance, capping recovery attempts.

Short-Term Support

$80

$76

Short-Term Resistance

$88

$99

On the daily timeframe, SOL has been in a sustained downtrend for several weeks.

After the sharp decline, price is now forming a near-term bearish flag pattern, which typically signals continuation rather than reversal.

If this flag breaks to the downside, lower levels could come into play quickly. The overall trend remains weak, and buyers have not yet shown strong follow-through.

On the upside, the 21 EMA is acting as dynamic resistance. Price has consistently struggled to reclaim it, keeping pressure on recovery attempts.

RSI is around 42, which is not in the oversold zone. This suggests there is still room for further downside before exhaustion conditions appear.

Long-Term Support Levels

$78

$67

$48

Long-Term Resistance Levels

$99

$125

$147

A breakdown from the flag would likely shift focus toward the lower zones, while reclaiming the 21 EMA would be the first sign of structural improvement.

On the weekly timeframe, SOL is trading near a major zone around $85. This level has acted as a strong base before, but it is now under pressure.

A weekly close below this zone could open the door toward lower levels near $67.

The 9 and 21 EMA have also formed a bearish crossover, signaling that momentum is favoring sellers. As long as price remains below these EMAs, upside may stay limited.

Key Weekly Support

$85

$67

$48

Key Weekly Resistance

$107

$131

$205

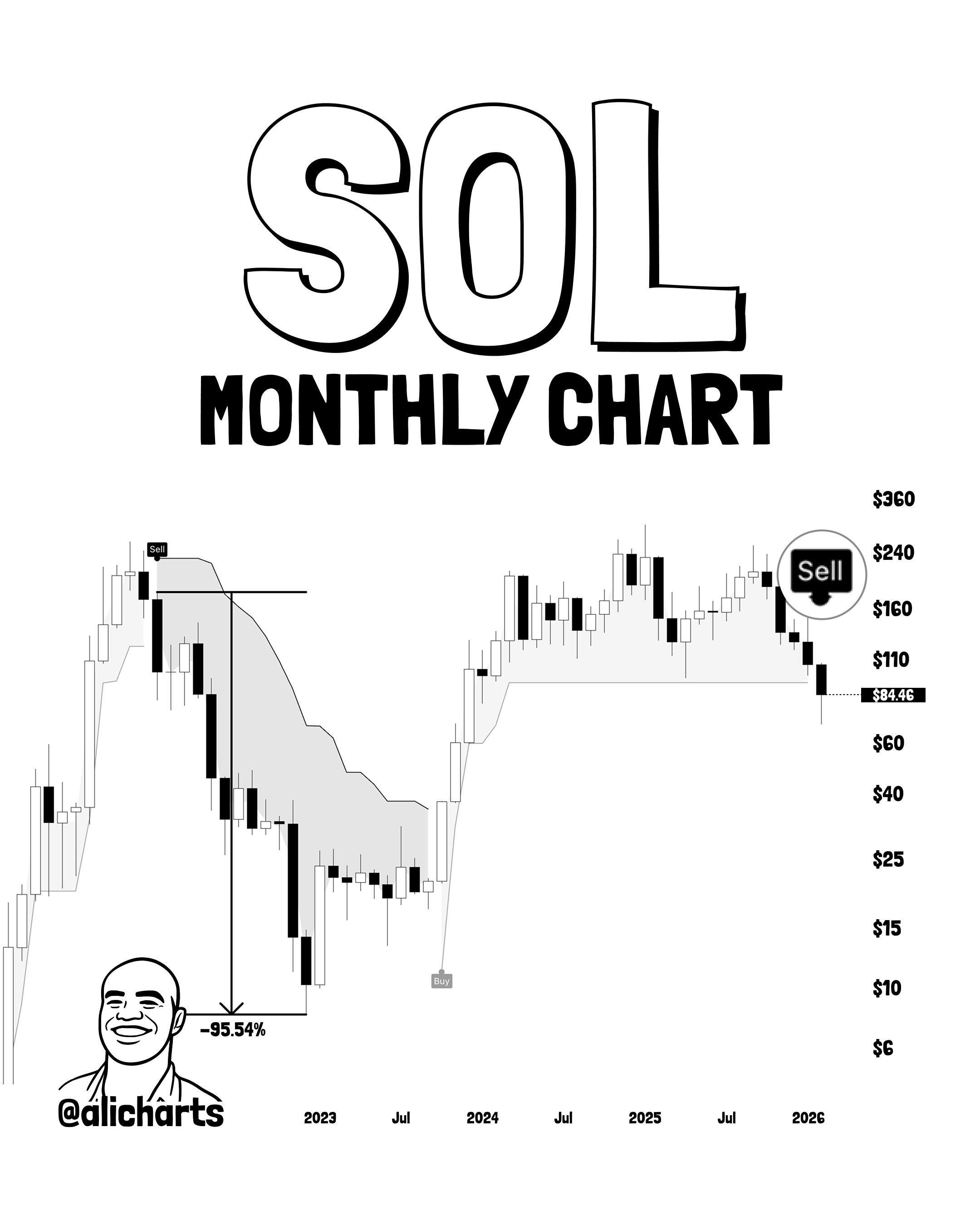

As highlighted by crypto analyst Ali Martinez, SOL is once again testing a major long-term zone near $85 on the monthly chart.

The last time this level was decisively lost, the market eventually saw a drawdown of nearly 95% from the cycle high.

If SOL confirms a monthly close below this support, a deeper downside toward the $40–$20 range could open.

In a similar structural breakdown scenario, projections could even extend toward the $9 region.

That said, historical patterns do not guarantee identical outcomes. A strong reclaim above support would weaken the bearish scenario.

The Solana price prediction now stands at a critical crossroads, with key support levels under heavy pressure across multiple timeframes.

If $80–$85 fails to hold on higher timeframe closes, the downside risk toward deeper zones increases significantly.

However, a strong reclaim above resistance and key EMAs could stabilize structure and delay further correction.

For now, the Solana price prediction remains cautious, with risk management more important than aggressive positioning.

Disclaimer: Cryptocurrency markets are highly volatile. This price prediction is based on technical structure and current developments, not financial advice. Investors should conduct independent research and assess risk tolerance before making decisions.

Rahul Rathore brings over 3 years of hands-on experience in technical analysis, specializing in crypto, stocks, and market trend forecasting. With a deep understanding of chart patterns, indicators, and market psychology, Rahul delivers precise, actionable insights that help traders and investors make informed decisions. His analytical approach combines technical expertise with real-world market understanding, making his content reliable and highly valued by both novice and experienced traders.