How often do we see a token explode into the global market, collapse within hours, and still be called a future giant? Rayls (RLS) is exactly that kind of dramatic launch. Investors looked shocked as the price fell sharply, yet analysts insist the long-term opportunity is bigger than ever. In this deep dive into Rayls Price Prediction, we uncover why the price dropped, why the chart is stabilizing, and what the 2025–2030 future could realistically hold.

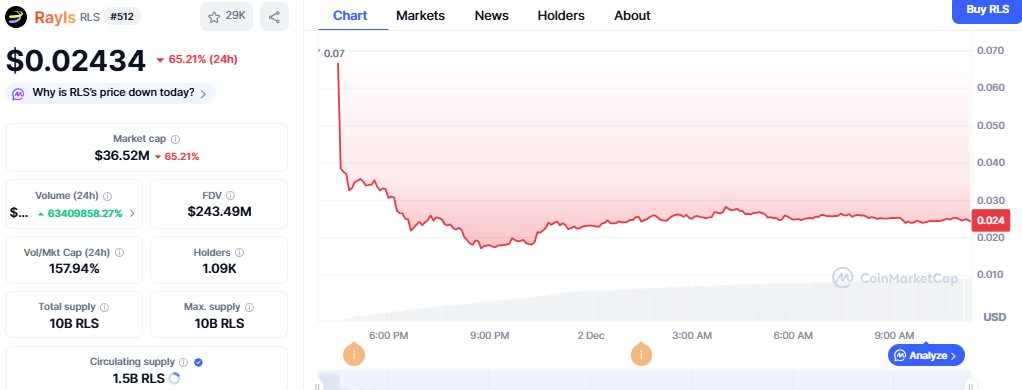

The big moment for Rayls was supposed to be December 1, 2025, when it went live on Binance Alpha, Coinbase, Kraken, Bitget, and Gate.io. Immediately after opening at the impressive $0.07, it drew in a huge amount of attention. Then, like a plot twist, the price collapsed to $0.017 within hours. Many new investors panicked, asking one question: why is RLS price down today?

Source: CoinMarketCap

The answer lies in the high selling pressure from early token airdrop users, and early round wallets rushing to book profits. Liquidity on some exchanges was thin, making the fall even sharper. But the story didn’t end there. The price slowly found stability near $0.02445, with a strong $36.59M market cap and 1.5 billion tokens circulating. The RSI between 51 and 53 now signals that panic has cooled, and the market is moving into recovery mode.

Source: TradingView

Short-Term Prediction: Despite its shaky first day, it is entering an interesting accumulation phase between $0.024 and $0.026. The chart shows a steady recovery from the $0.016 low, and the emotional hype around the Rayls listing date, airdrop claims and strong Binance Alpha interest is helping restore confidence. If momentum continues building, RLS may test the $0.035 level again, and a move above $0.040 could send the price closer to $0.050.

The short-term question is simple: can it regain its listing strength? Based on the current market structure and volume patterns, the price prediction 2025 points toward the $0.04–$0.05 region.

Mid-Term Analysis: If adoption grows among banks, fintech companies and global settlement systems, analysts believe it could enter a powerful expansion cycle. The mid-term RLS coin price prediction ranges between $2.5 and $10, signalling a potential 100X rise from current levels. Unlike meme-driven spikes, this analysis is tied directly to real institutional use cases.

Long-Term Prediction: The long-term vision is even more compelling. It could eventually evolve from a private institutional chain into a public, interconnected global settlement network. If this transition succeeds and banks begin processing real financial flows on the blockchain, the price potential becomes enormous. Long-term expectations place RLS between $25 and $50, and in a full institutional supercycle, the price could cross $100. This is the foundation of the widely discussed price analysis 2030, which hints at nearly a 1000X rise from today’s levels.

Rayls Price Prediction shows that the listing-day crash is not the whole story. While the RLS price is down today, the long-term architecture and institutional vision make it one of the most ambitious projects in crypto. A short-term rebound, a mid-term 100X rise, and a long-term 1000X path all remain possible.

Disclaimer: This is for educational purposes only. Always do your own research before any crypto investment.

Deepmala Upadhyay is an experienced crypto journalist, content strategist, and News writer with over 5 years of expertise in writing and the crypto industry. Holding a Bachelor's Degree in Computer Science and a deep understanding of blockchain technology and financial markets, she excels in delivering exclusive news, in-depth research blogs, and expertly crafted on-page SEO content. As a team lead and content writer at CoinGabbar, Deepmala is responsible for analyzing blockchain technologies, cryptocurrency, price movements, and the crypto market with precision and insight. Her keen ability to create well-researched, impactful content, combined with her expertise in market analysis, makes her a trusted voice in the crypto space.