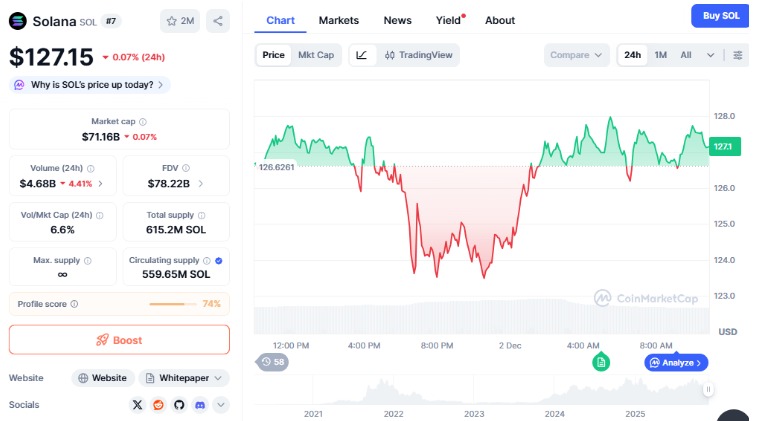

Solana traded near the $127 range during the past 24 hours as market conditions stayed mixed and institutional flows into Solana-linked ETFs paused after strong activity earlier in the week, giving traders new factors to reassess in the ongoing Solana price prediction outlook.

Solana moved within a daily band stretching from $128 to $124, with a modest decline of 0.07% across the session. Trading volume decreased 4.41% to $4.68 billion, while market capitalisation stood at $71.16 billion. The circulating supply reached 559.65 millions SOL, positioning the asset firmly within the large-cap group.

Source: CoinMarketCap

Early trading saw the token declining from $126.6 to $124 as market orders prompted short-term exits. Later, the price moved higher, forming a recovery that pushed it toward $127. This swing created a steady pattern for the rest of the session, resulting in tight trading between $126.5 and $128. The overall chart still indicates a downtrend from summer highs, keeping the price outlook cautious.

Momentum indicators offered mixed signals. MACD readings around 1.04 pointed toward neutral movement as the histogram continued rising. RSI near 34 gained slightly, showing early signs of stabilisation but still placed below the midpoint. Volume patterns remained light during the rebound, contrasting with earlier sell-offs that printed larger red bars.

The Bitwise SOL ETF recorded zero inflow on Friday, marking its first flat reading after notable entries earlier in the month. BSOL retained $527.79 millions in assets under management, remaining the largest institutional product linked to SOL. Across all SOL ETFs, cumulative inflows reached $618.59 million with combined AUM at $888.25 millions.

Source: sosovalue

Data from SoSoValue recorded inflows of $39.5 million on November 24 and $31 million on November 25. Certain sessions moved in the opposite direction, including –$8.10 million on November 26 and –$13.55 million on December 1. The ETF pause arrived during a period when some institutions adjusted their exposure to altcoins, which often carry higher day-to-day swings than Bitcoin. The SOL price prediction narrative remained sensitive to such shifts in institutional behaviour.

Chart readings placed immediate support near $120–$122 and resistance around $140. A move above the $140 level would indicate a stronger recovery phase, while a break under $120 could open a path toward the $100 area. Market observers noted that trading volume will continue to influence the solana price prediction trend.

Source: TradingView

Technical readings showed improving momentum but still below levels typically linked with sustained upside. As long as it holds above short-term support zones, traders will continue assessing whether the current pattern shifts from a corrective phase toward a broader recovery structure.

Shristy Malviya is a skilled English Blog Writer and Content Writer associated with Coin Gabbar, specializing in producing well-researched and SEO-friendly content on cryptocurrency, blockchain innovation, and financial technology. She is passionate about making complex industry topics accessible and valuable to a wide audience. Shristy’s work reflects her commitment to delivering credible and high-quality information that aligns with current market trends. Outside her writing career, she enjoys reading books, an activity that deepens her understanding of global markets and continuously inspires her professional growth.