Due to the year-end holiday season, the cryptocurrency market is mainly facing a liquidity squeeze at this moment. Total crypto market capitalization is still under $3 trillion and has only achieved slight increases as investors remain cautious.

The overall sentiment has not been able to recover properly since the October 10 flash crash. Even though SEI is standing above major psychological levels, the selling pressure still prevails, and the market is considering the sustainability of the current price range.

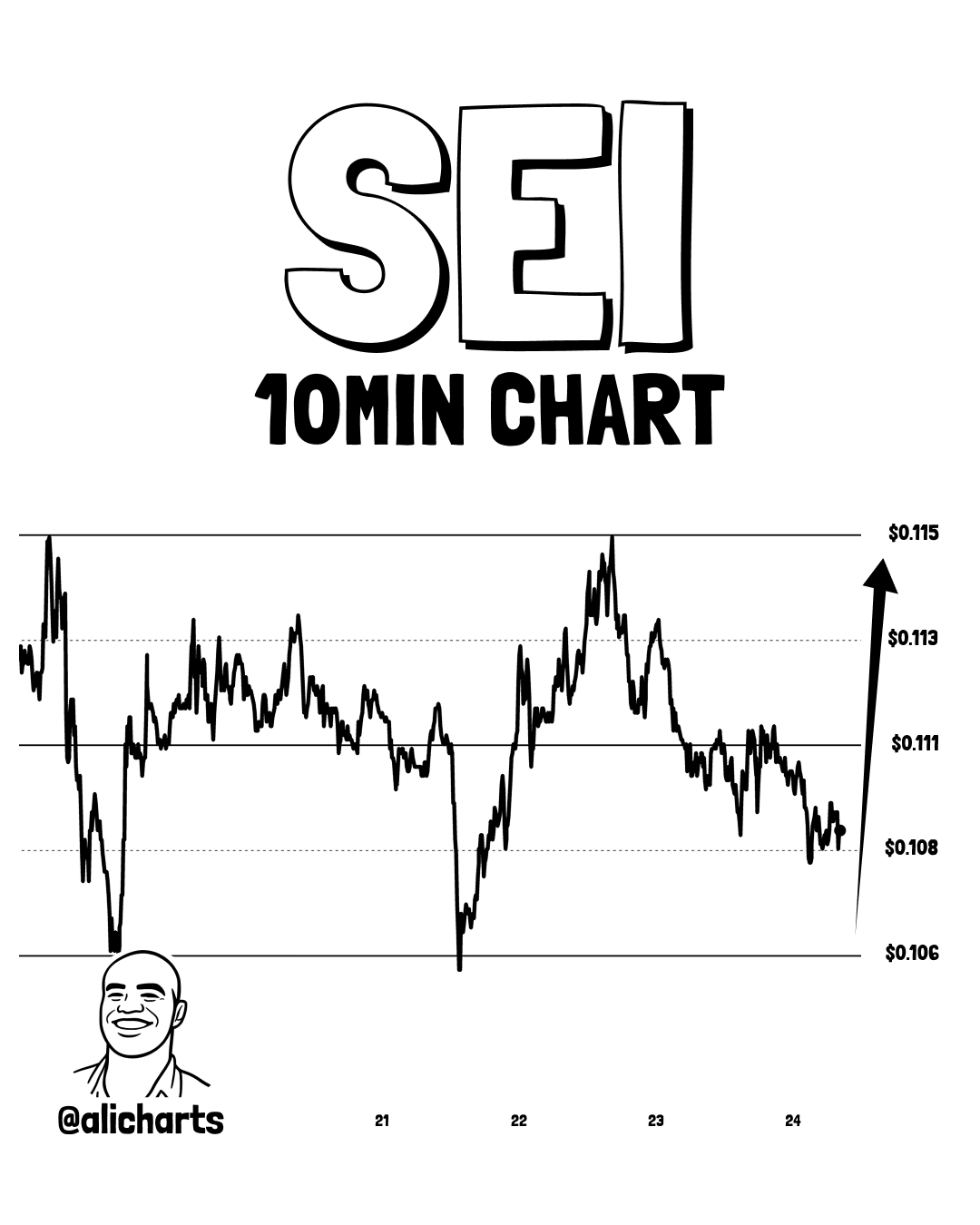

As the chart shared by the analyst, the main question arises: will the altcoin break the zone, or is it trading in a consolidation phase? Let’s examine the price prediction below.

SEI is obviously trading in a narrow range on the 10-minute chart with multiple unsuccessful attempts to break lower; the price has been fluctuating between about $0.106 and $0.113. Buyers are active at these levels because each dip toward the lower zone is swiftly repurchased.

Source: X

At the same time, price is struggling to push above $0.113–$0.115, which remains a short-term resistance area, telling us the market is undecided and waiting for a trigger. According to analysts, as long as SEI stays above $0.106, a push toward $0.115 remains possible.

As long as SEI stays above the support area, sudden breakdown risk looks limited, but without volume expansion, upside moves may remain slow.

The daily chart shows the bigger picture more clearly. SEI has already corrected significantly from higher levels near $0.30. After this drop, the price has entered a flat zone around $0.105 to $0.110, where volatility has reduced.

Source: TradingView

This type of structure emerges when sellers are exhausted but buyers are still insecure. Coin price is not moving strongly in either direction, and RSI is already sitting near the 35 level, which usually means sellers have pushed hard and the price may need a pause here before deciding its next direction.

Key levels from the daily chart:

Major resistance levels: $0.305, $0.400, $0.500

Strong demand zone: $0.105 to $0.110

Until price manages a daily close above $0.118–$0.120, the trend should be viewed as neutral.

If price can simply maintain its position above the demand zone, the price may gradually rise over time, possibly reaching $0.24 with just a gradual recovery rather than a complete trend change. But if the price drops below $0.105 with decent volume, then the structure starts to look weak again. In that case, lower levels would not be surprising.

However, sideways action is currently the most likely scenario. Before choosing a true direction, the price is mostly fluctuating within a range.

The SEI price prediction for 2026 is not really about what the chart is doing today; it depends on broader market sentiments, and the network keeps getting used. If the coin sticks around as a trading-focused chain and developers and users stay active, the price can slowly move up over the long run. This appears to be more of a patience game than a quick breakout story.

A gradual growth path appears more logical than explosive rallies. In a positive long-term environment, coin could trade much higher than current levels, but only if adoption remains consistent.

For 2026, a broad long-term range can be considered:

Conservative range: $0.80 to $1.20

Moderate growth range: $1.80 to $0.25

These levels assume steady ecosystem usage rather than speculative hype.

From a technical perspective, SEI is no longer in a strong sell-off phase. The charts suggest stabilization, not strength. Long-term progress will depend on how well the project converts this base into real demand.

Disclaimer

Crypto price predictions are for informational purposes only and not financial advice. The crypto market is highly volatile, and prices can change at any time. Do your own research before investing. We are not responsible for any financial losses.

Rahul Rathore brings over 3 years of hands-on experience in technical analysis, specializing in crypto, stocks, and market trend forecasting. With a deep understanding of chart patterns, indicators, and market psychology, Rahul delivers precise, actionable insights that help traders and investors make informed decisions. His analytical approach combines technical expertise with real-world market understanding, making his content reliable and highly valued by both novice and experienced traders.