Due to the year-end holiday season, the cryptocurrency market is mainly facing a liquidity squeeze at this moment. Total crypto market capitalization is still under $3 trillion and has only achieved slight increases as investors remain cautious.

The overall sentiment has not been able to recover properly since the October 10 flash crash. Even though Bitcoin is standing above major psychological levels the selling pressure still prevails, and the market is considering the sustainability of the current price range.

Crypto analyst Crypto Seth highlights the drastic change of the market conditions and cites the first week of October and first week of December as references of BTC’s weekly charts. He marks the day of October 10 as the turning point when the fall of a major exchange caused the market crash that eventually turned into a flash crash.

That one incident is said to have led to liquidations worth between $40 and $100 billion and cut the liquidity of the entire crypto ecosystem down to almost nothing. Consequently, many altcoins observed 40-90%-based wick crashes, whereas market makers suffered massive financial losses that created gap-like holes in their balance sheets.

The crash initiated a near 12-week-long phase of forced selling in the space. Prices declined consistently during this time and the unwinding of leveraged positions coupled with the failure of liquidity to recover to any meaningful extent accounted for the price decline.

Such an extended selling phase is the reason for Bitcoin's struggle to regain bullish momentum even though it has been relatively strong in comparison to altcoins. Structural damage—rather than emotional—was the cause and hence the recovery became slow and complicated.

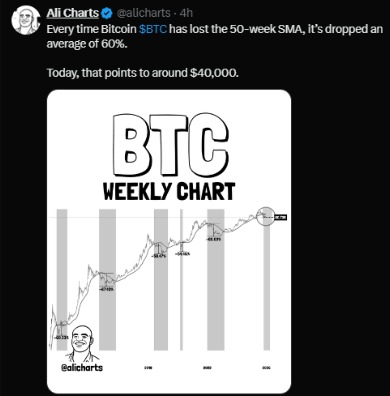

Prominent analyst Ali Martinez highlights a critical historical pattern. Each time the asset has lost the 50-week simple moving average (SMA), the asset has dropped an average of 60%.

Each time the 50W SMA level has been lost, it has led to a major corrective phase. Typically, around 60% of the breakdown point.

Looking back:

October 2011: BTC dropped 50% after losing the 50W SMA.

August 2014: A breakdown triggered a 67% correction.

May 2018: BTC corrected 60% once the 50W SMA was lost.

March 2020 (COVID crash): BTC fell 55% after breaking below the 50W SMA.

December 2021: Another 66% correction followed a confirmed breakdown.

At the present time, BTC is trading at around $88,000. Historical downside risk implies that if the bearish target set by the pattern is about $40,000. Although this is not a certainty, it does support the idea that traders are taking a prudent approach towards the market and that.

According to The Bitcoin Therapist, BTC may still have room for one final euphoric move. He suggests BTC could surge to $120,000, then extend toward $160,000, before entering a major corrective phase.

On the other hand, he cautions that such a rally would come with a subsequent steep pullback, which could bring down to the $50,000 mark. This situation is consistent with the historical cycle tops, where blow-off rallies usually precede deep corrections.

The technical analysis is suggesting a bearish scenario. A head and shoulders pattern has been formed in the Bitcoin price chart, which is a definitive signal for the reversal of a bullish trend.

After the big rally in 2025, BTC already made the left shoulder, head, and right shoulder pattern and then fell through the main support levels. The breakdown shows that the bears are becoming more powerful while the momentum indicators are turning to the weaker side.

Currently, Bitcoin's price is around the $87,000–$88,000 range. The chart also predicts a possible recovery and resistance area between $98,000 and $106,000.

If the buyers manage to take back this area, a bullish Bitcoin movement is possible. On the contrary, if it fails to cross this hurdle, a plunge to the early 2026 level could happen, especially as the RSI momentum is getting weaker.

The future of Bitcoin is conditional on the return of liquidity and the buyers' ability to hold the critical support areas. The opportunity for a bullish turn is still present; however, the increasing number of bearish signals indicates that the risk in the short term is higher.

Will the reversal of Bitcoin’s market trend at the end of the year be a shock, or will it necessitate a long correction period before the next bull market? We may find the judgment as we approach 2026, which could be the basis for the next phase of Bitcoin’s long cycle.

Crypto price predictions are for informational purposes only and not financial advice. The crypto market is highly volatile, and prices can change at any time. Do your own research before investing. We are not responsible for any financial losses.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.