XRP has seen a minor decline over the past 24 hours, with its price hovering between $2.82 and $2.94. As of now, it is trading at $2.86, indicating a slight recovery after a recent dip. However, the market remains uncertain, with the price lingering in the middle of the range, reflecting indecision among investors.

XRP has dropped 1.4% in the last 24 hours, along with a 0.7% decline on Ethereum. It has been far more difficult recently, with an 8.3% drop in the last seven days. However, XRP has stabilized, with prices slowly showing signs of recovery in the short term.

Despite the current short-term bearish trend, some foresight trends predict a long-term appreciation of the coin backed by major underlying developments.

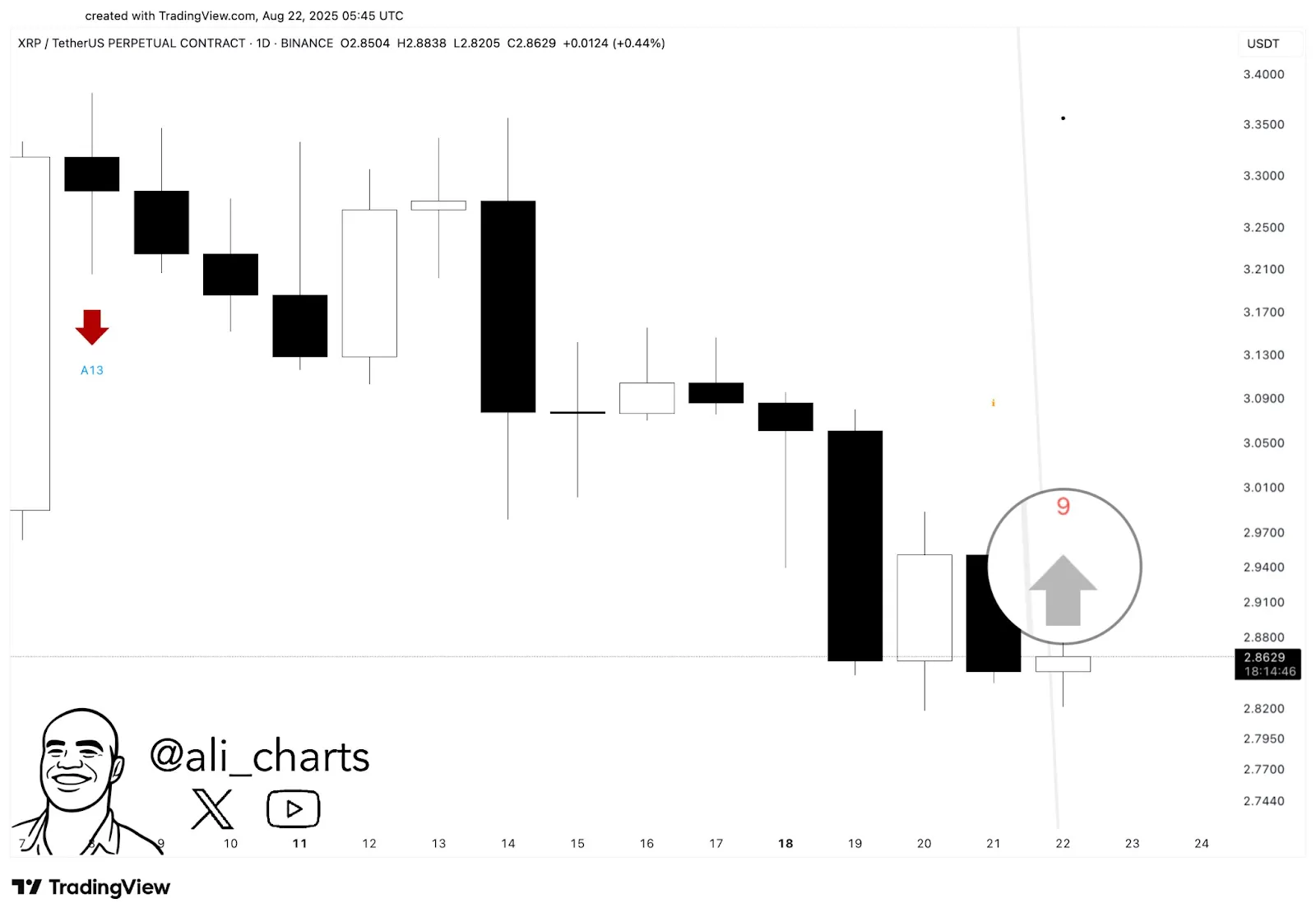

Looking from the technical point of view, one notices a shift in momentum in the recent price actions of XRP. The TD Sequential indicator used by Ali Martinez registered a sell setup around August 8, indicating a possible XRP price top.

Source: X

Consequently, prices fell significantly from $3.35 to nearly $2.82 on August 20. The TD Sequential flipped to a buy setup on August 21, alluding to the possibility that the downtrend is getting close to exhaustion.

The altcoin's price is moving through major levels of support and resistance that play critical roles in the movements that will shape its future price movement. Immediate support lies between $2.82 and $2.85, where buying interest has emerged earlier. Failure to hold on to this time level may set up the next level of support at $2.75.

At the resistance end, XRP is confronted by the major supply zones of $2.97–$3.00, where price has been previously rejected. Clear break above this might then see a rally to the next resistance level of $3.05–$3.10. However, the highest resistance is still found above in the $3.30-$3.35 zone, where another sell signal in early August was generated.

This pullback type of price action amid a somewhat bearish market scenario suggests that the altcoin is currently going through a consolidation phase that might see an adverse momentum shift if support levels hold and resistance sees a break.

Meanwhile, due to the continuous partnership with SBI Group, Ripple, the largest XRP holder, has strong fundamentals. Ripple has signed a memorandum of understanding (MOU) with SBI VC Trade, which is a subsidiary of the Japanese financial conglomerate SBI Holdings. Pursuant to the MOU, intentions are set to distribute Ripple USD (RLUSD) in Japan - a major step toward Ripple's stablecoin offering.

RLUSD is a fully backed, enterprise-grade stablecoin with compliance and transparency as its primary concerns. It is backed by solid reserves, including U.S. dollar deposits, short-term U.S. government bonds, and other cash equivalents. It backs its promise of not being a risk to institutions as they require in the stablecoin with monthly attestations from a third-party accounting firm. The partnership made an assurance of Ripple's efforts to achieve regulatory clarity and globally increase its footprint in the financial ecosystem.

Kelvin Munene is an experienced crypto and finance journalist with over five years in the industry, known for delivering detailed market insights and expert analysis. Holding a Bachelor’s degree in Journalism and Actuarial Science from Mount Kenya University, he is recognized for his thorough research and strong writing abilities, especially in cryptocurrency, blockchain, and financial markets. Kelvin consistently offers timely, accurate updates and data-driven perspectives, helping readers navigate the complex world of digital assets. His work focuses on identifying emerging trends, analyzing market cycles, exploring technological advancements, and monitoring regulatory changes that influence the crypto sector. Outside of journalism, Kelvin enjoys chess, traveling, and embracing new adventures.