SOON will be going live on Binance Alpha on the 23rd of May, and humongous amounts of expectations have been built among the crypto community. It has a good tokenomic model and aims to start an instant sustainable ecological model and hence has attracted a lot of interest among early adopters and investors. The humongous question now, though, is: How high will SOON go after going live? Let's break down everything-the allocation, and short-term and long-term forecasts.

The $SOON is considered a jewel in the SOON Ecosystem, with governance, staking, and premium access options available across various decentralized applications and services. Intended to reward participation and maintain a degree of decentralization, the token aligns developer interests with those of end consumers and investors.

It is just about not only a governance token but the backbone for ecosystem incentives, access layers, and community-building activities, sincerely rooted in a fair token distribution model plus sustainable tokenomics.

The announcement by Binance of the listing of SOON on its Alpha platform has garnered very intense excitement. Trading shall begin on the 23rd of May, together with the redemption of airdrop rewards through Binance Alpha Points. The official event page will be launched with complete rules for the activity.

Listing under Binance support usually generate very high initial demand because of the increased visibility and FOMO buying. Considering that the coin already has strong community allocation and a viable use case, the token is likely to perform well in its early trading sessions.

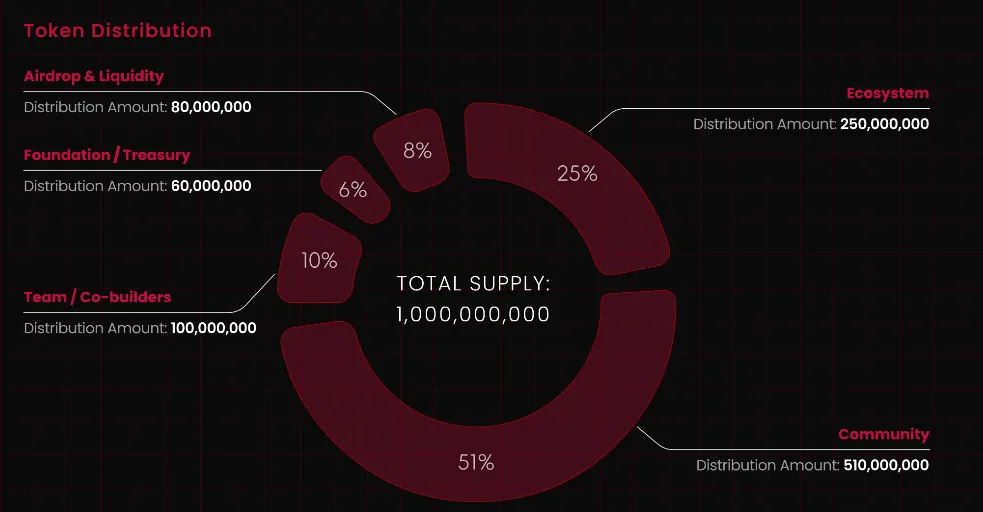

SOON's tokenomics reflect a deliberate and strategic allocation model across six key segments:

51% (510 million tokens): Community incentives

25% (250 million tokens): Ecosystem growth and partnerships

10% (100 million tokens): Team and Co-builders

8% (80 million tokens): Airdrop & Liquidity

6% (60 million tokens): Foundation and Treasury

Since more than half of the supply is thought out and aimed at community building, the project is still firmly focused on decentralization and community engagement.

With its conservative circulating supply at inception—8 percent for airdrop and liquidity—the altcoin has been reported to post an extremely successful listing pop. Analysts are estimating it to list roughly $0.30-$0.80 based on previous Binance Alpha listings and present market strength.

In the early moments of trading, rarity combined with hype and demand may push the token closer to the upper range price. However, the short-term price is highly liable to correction as airdrop recipients begin their claims and start selling some of their tokens.

Setting aside the excitement around found value, the future will depend on the expansion of the ecosystem, developer participation, and real-world utility at a large scale. The token potentially exhibits gradual and sustainable price growth if the project successfully yields results for its roadmap while hitting strategic partnerships.

With no development issues, the pace of the project as per market sentiment, the altcoin may reach $0.50 to $1.00 in six to twelve months. The valuation will largely be a consequence of growing demand for staking, very lucrative utility features, and mass adoption in the ecosystem.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.