Bitcoin (BTC) is back in the limelight, lighting off renewed institutional support, bullish technicals, and whale activity beyond the $103,000 mark. With Metaplanet listed in Tokyo expanding its Bitcoin treasury and MicroStrategy's relentless buying alongside Robert Kiyosaki's $250K prediction, the bullish narrative keeps building for BTC.

Taking the price forecast, we analyze the key signals in the market, technical indicators, and macro catalysts driving Bitcoin toward a possible $135,000 target in the months ahead.

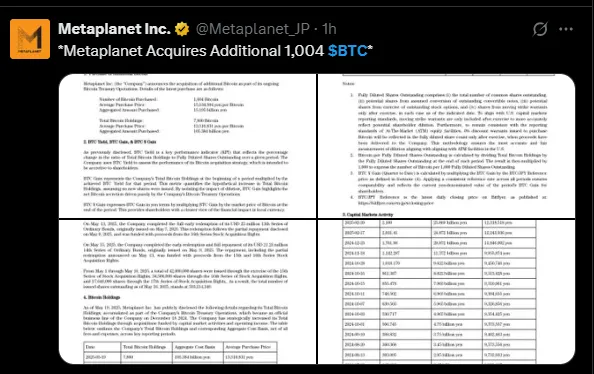

Japan-based Metaplanet has officially joined the heavyweight Bitcoin purchaser club. The recent purchase of 1,004 Bitcoins at approximately $97.5 million brings the company's portfolio to 7,800 Bitcoins, or approximately $726 million invested. Being the strategic decision of having asset as a primary treasury asset and competing with MicroStrategy for attention in Asia, corporate acceptance is now growing within Asia.

The move reinforces the narrative of BTC as digital gold-a long-term hedge against inflation and central bank instability. And not even with Metaplanet are the waves being stirred.

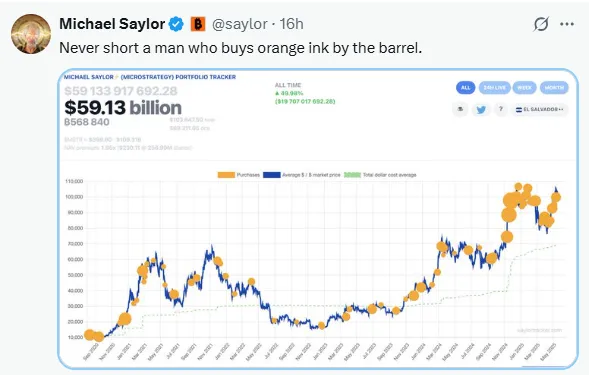

Michael Saylor continues to be considered the foremost militant maximalist for Bitcoin. In a recent tweet, Saylor reinforced his legendary bullish stance with a chart showing the never-stopping accumulation of MicroStrategy, even during market downturns. The company now holds a jaw-dropping 568,840 BTC valued at over $59 billion with $19.7 billion booked as unrealized gains.

These famous words of Saylor, "Never short a man who buys orange ink by the barrel," truly describe his conviction and long-term vision for the world's largest cryptocurrency. His strategy has financially catapulted him and set MicroStrategy as the corporate investment standard in the crypto space.

Adding fuel to the fire, Robert Kiyosaki with his reframed Bitcoin call now sets it at $250,000 as an almost outrageous landmark. With a tirade against the "Marxist Central Bank system" of abuse, Kiyosaki warned of a continuing meltdown in economic terms and urged his followers to HODL their Bitcoin along with gold and silver as safe-havens.

He doubled down in a tweet: "Buy more. Do not sell." As fears of inflation rise with bankruptcies rising and trust in fiat systems eroding, Kiyosaki's anti-establishment rhetoric is resonating with both retail and institutional investors.

As posted on X by Crypto Rover, Another prompt for saddle confidence in the market is whale activity. One high-profile trader brilliantly snatched $10 million profits in 24 hours on Hyperliquid, and convincingly clung to the mammoth 337 million long BTC position-the very presence of this position speaks volumes for potential further upside-goes to show greater institutional interest perpetuating the rally.

The upward momentum of BTC with backing by smart money is more than just hype; it is about big bets and courageous strategies.

The weekly chart displays a bullish structure on the asset side. It has moved towards higher highs after breaking past a key resistance at $69,000, now turned into a very strong support. Currently trading at approximately $103,000, the price is comfortably above and supported by the rising 20, 50, and 100 EMAs, which currently sit at $92,310, $82,171, and $68,278, respectively.

The next possible breakout could target psychological resistance levels at $125,000 and $135,000, if the asset continues maintaining strength above the crucial $92K–$95K consolidation zone and conducts a retest of the 127.20% Fibonacci extension of $86,756 soon after.

Source: TradingView

On the flip side, the downside should be carefully watched. A clean break of $92K to the downside could initiate a short-term correction toward $82K or even $68K. Otherwise, unless there is a major breach of support, the bullish outlook remains.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.