Spur Protocol has once again pushed back its much-awaited token listing, shaking investor confidence at a time when the crypto market is already under pressure.

With the $SON token now scheduled to list in February 2026, many investors are asking one key question: Will this delay hurt $SON’s price, or can the project still deliver long-term value?

As uncertainty grows around presale reopening, exchange support, and future timelines, let’s break down the Spur Protocol ($SON) price prediction in a clear and realistic way—short term, long term, and everything in between.

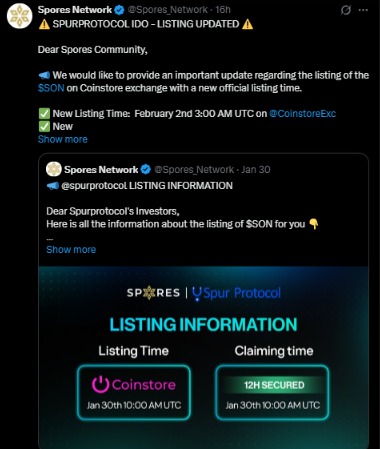

According to the latest update shared by Spores Network, the $SON token will list on Coinstore on February 2, 2026, at 3:00 AM UTC. Token claiming will follow on February 6, 2026, via the Spores Launchpad.

This marks the sixth delay, with previous dates moving from Q4 2025 to Dec 19, Jan 8, Jan 26, Jan 30, and now Feb 2. While the vesting schedule remains unchanged—10% unlocked at TGE and 10% monthly—the lack of clear trading details has raised concerns.

On-chain data shows that only 1.88 million tokens have been sold out of an 8.33 million allocation, leaving nearly 77% unsold. This weak presale performance has fueled speculation that the presale may reopen again.

The broader market crash plays a major role here. Around the same time, the total crypto market dropped nearly 5%, while major assets like Bitcoin and Ethereum fell 7–9%. Investor sentiment also plunged into Extreme Fear, limiting demand for new tokens.

Given the ongoing delays, fragile investor confidence, and limited transparency from the team, the token is expected to debut below its $0.03 IDO price.

If the launch proceeds without fresh exchange confirmations or a sentiment-boosting announcement, the token could open in the $0.018–$0.025 range. Selling pressure from airdrop recipients and TGE unlocks may further cap upside during the initial trading session.

In the near term, price action is likely to remain volatile. With a 10% TGE unlock, unresolved listing clarity, and a cautious broader market, it may fluctuate between $0.015 and $0.028.

Any meaningful rebound will likely depend on clear official communication, a stable platform experience, and confirmed exchange support. Absent these catalysts, consolidation or continued weakness could persist.

Over a longer horizon, prospects improve if the project delivers on its roadmap. Spur Protocol’s structured tokenomics favor a gradual supply release, helping to ease long-term inflation risks.

If the team successfully rolls out the Spur DEX, addresses technical concerns, and secures additional exchange listings, the token could regain momentum and potentially move toward the $0.05–$0.08 range in a more favorable market environment.

The next few weeks will be critical for the project. Clear communication, confirmed trading pairs, and product progress can rebuild trust. Without these, further downside remains possible.

So the real question remains: Can Spur Protocol turn delays into delivery, or will confidence continue to fade?

YMYL Disclaimer: This article is strictly informational in nature and does not constitute an investment recommendation. Investment in cryptocurrencies is extremely volatile, and market conditions can change quickly based on macro data. It is always essential to do your own research before making any investment.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.