Investors are left guessing whether Spur Protocol ($SON) will surprise them with its abrupt listing delay or the uncertainty will hold back its momentum.

With Bitcoin going bearish and the market getting more and more tense, the focus is now on $SON’s next move. The delay has cast a shadow of doubt—but it has also aroused fascination. So, what is the next scenario for investors?

Let’s break it down in a simple, clear way.

Bitcoin has recently struggled to keep its head above the $95,000 resistance level and eventually fell under $90,000, which is a sign of short-term weakness. Analysts are alerting that in the event BTC goes below $88,000, prices could very well be dragged down to $75,000.

Spur Protocol, in such a fragile market, had to postpone its listing initially set for January 8. The situation naturally raised worries among investors, who had already been cautious due to the general volatility of the market.

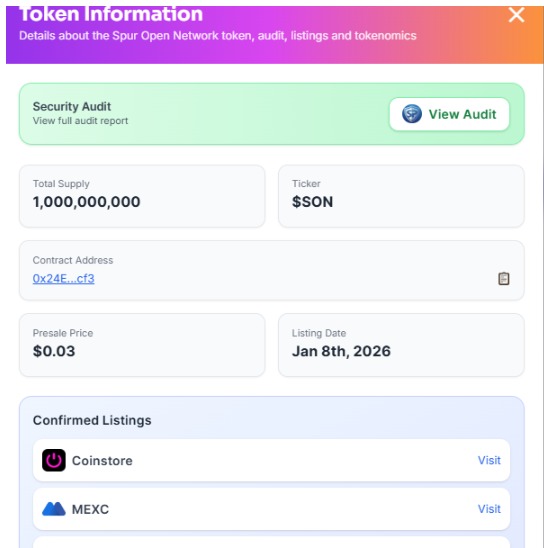

Source: Official Website

However, the rumors are that there might be a new potential listing date, which is February 16, and that would be the same day as the launch of BlockDAG. If this is the case, the timing might really be on $SON’s side since it will be riding the wave of BlockDAG hype.

The Spur Protocol presale was concluded on January 5, 2026. Out of a total of 8,333,333 tokens attributed to the project, just 608,225 tokens were sold, 7.3% of the total.

This low presale demand could not only affect the sentiment of the market but also provide a lesser amount of selloff that is going to happen right after the launch. Fewer early holders frequently imply that there will be a little bit less panic selling, which can consequently help the prices get stabilized during the initial trading period.

Even though there were concerns regarding the presale, $SON’s tokenomics are still a strong point. The distribution of supply is geared towards long-term growth and not quick exits:

40% – Community incentives and airdrops

29% – Development (locked for 24 months)

10% – Investors

10% – Spur DEX liquidity

5% – Marketing

5% – Public fundraising

5% – POG holders

4% – Charity

1% – Advisors

This arrangement prevents early dumping and boosts price growth over time.

Short-Term Price Forecast

In the case if token gets listed without any more delay, the token would probably be launched almost at its presale price of $0.03. At first, there would be some price volatility, particularly with the current market conditions.

Mid-Term Price Outlook (2026)

A confirmed date for listing, good communication, and being on MEXC, BingX, Coinstore, and PancakeSwap may well restore the investors' trust. If the market mood brightens, the token might be able to go higher than its launch price.

If the delays continue or there is a lack of transparency, $SON will find it hard to build up and will thus be trading at lower than expected prices.

YMYL Disclaimer: This article is strictly informational in nature and does not constitute an investment recommendation. Investment in cryptocurrencies is extremely volatile. It is always essential to do your own research before making any investment.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.