Bitcoin price prediction is getting tricky after the recent upside move failed to follow through. Price pushed higher, then started to stall. Buyers were active at first, but they could not keep control for long. Each bounce was met with selling, and momentum slowly faded. That is usually where problems begin.

Whether Bitcoin is declining is no longer the question. The question is whether this move turns into a push toward the old or whether the price gets stuck in a consolidation range. After a rally, when the price fails to hold strength, the market often needs a reset. Sometimes that reset happens sideways. Other times, it happens lower.

Right now, BTC does not look like it is in attack mode; it looks cautious. When the price starts defending instead of pushing, the market usually asks for more proof before choosing a direction. This is why the current market trend outlook matters more than short-term reactions.

On the 1-hour chart, Citcoin is not showing much strength after the sell-off. Price did try to lift, but those moves did not last long, and selling showed up again. pricre is sitting around the $91,000 to $91,500 area, and right now it feels more like the price is just hanging there. If this zone gives way, things can slip quickly. A break below $90,500 would put pressure back on the chart, and from there, the next area that usually comes into play is around $89,200 to $88,800.

Source: @Karman_1s

On the upside, BTC needs to move back above $92,800–$93,200 to ease short-term pressure. Even if the price moves higher, the falling trendline overhead could still cap the move and trigger another rejection. Without a clean break above that area, rallies are likely to stay corrective and fit the current BTC short-term trend, where risk remains tilted toward further weakness.

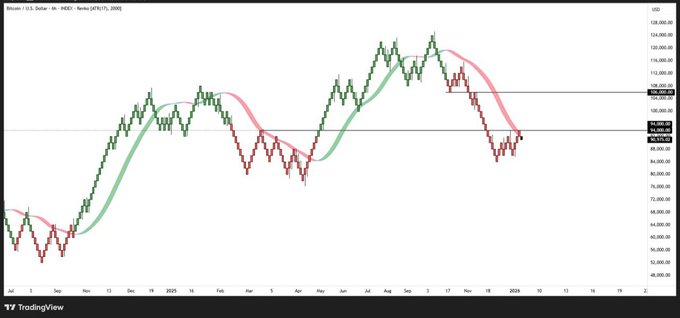

After a strong rally, BTC was not able to hold higher levels and slowly slipped into a falling channel. Price kept struggling on the upside, and every push started getting sold. Over time, this led to a structure in a falling channel where lower highs kept forming, and momentum stayed weak. The market did not collapse fast, but pressure kept building in the background. In any case, if the piece closes below the pattern, the risk of downside will be higher.

Source: TradingView

At the moment, BTC is trading close to a key support zone around $90,000–$90,500. This area is doing the work of holding the price for now. If BTC breaks below this structure and gives a clear downside close, the risk of further downside increases sharply. In that case, price can slide toward $88,500 and then $87,200.

On the upside, even a bounce can face resistance near $91,500–$92,000 and the 50 EMA. For now, this keeps the BTC market structure under pressure, with downside risk still very much alive.

According to an analyst, BTC has still not proven itself, and the 6-hour chart backs that view. After the earlier rally, the price failed to hold strength and started drifting lower instead of building a solid base. Moves higher look weak, and follow-through is missing. This usually means buyers are not fully committed yet.

Source: @nehalzzzz1

BTC is still trading below the areas where strength usually shows up. Until the price gets back above the $92,500–$93,000 zone and holds, bounces are hard to trust. Right now, moves higher feel weak. If pressure stays, price can slide toward $88,000 first, and if that does not hold, the next downside areas come near $85,500 and $84,000.

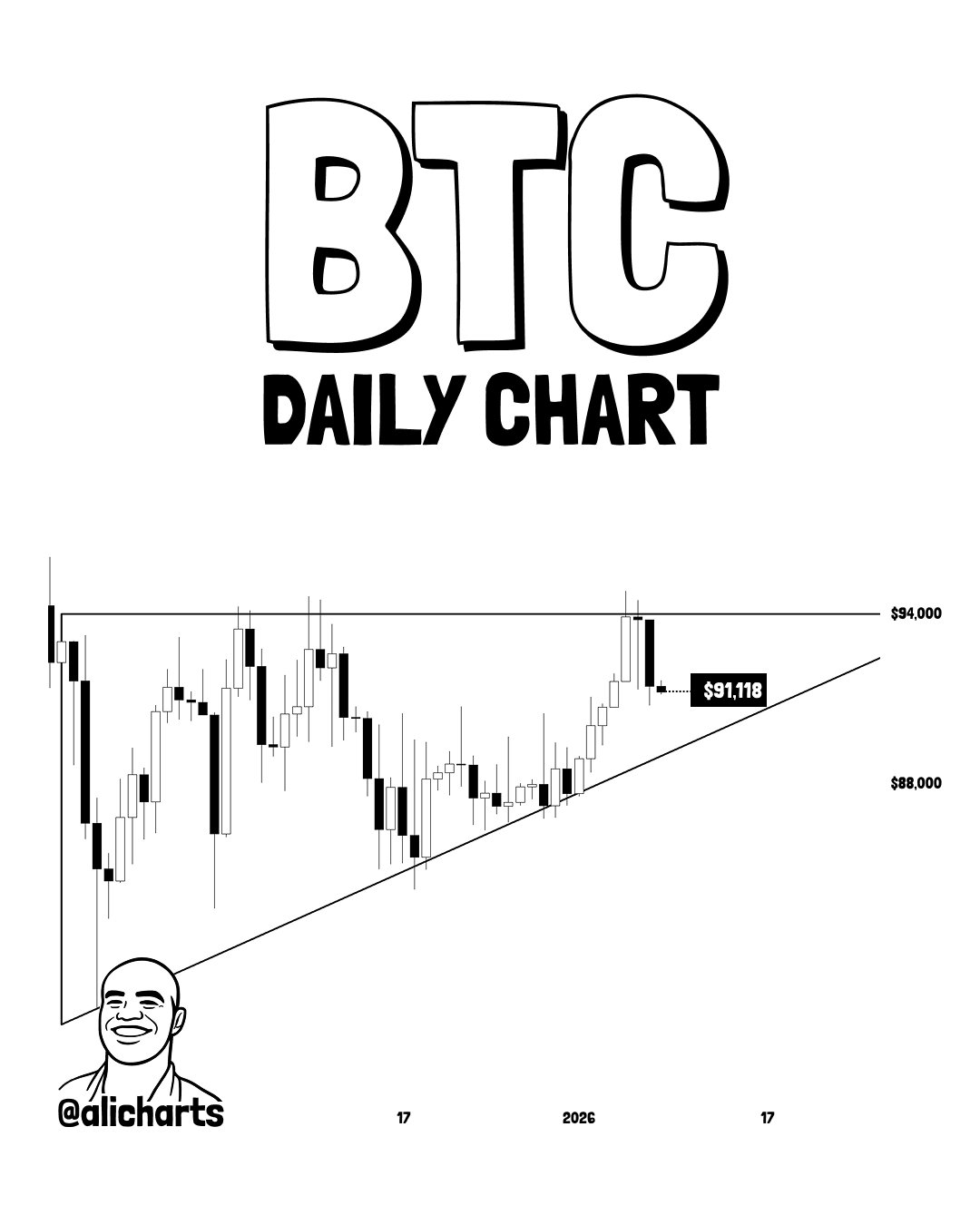

Bitcoin Long-Term Price Prediction on Daily Chart

On the daily chart, BTC is still moving inside a broad $88,000 to $94,000 range, and that is where most of the confusion is coming from. Price tried to push higher, but daily candles could not hold strength above resistance. At the same time, sellers have also not been able to force a clean breakdown yet. This kind of movement usually means the market is waiting for a stronger trigger.

Source: X @alicharts

If BTC manages a daily close above $94,000, upside targets open toward $97,500 first and then $100,000, where heavy selling pressure is likely to show up again. On the downside, a daily close below $88,000 would shift the structure clearly bearish and open room toward $84,500, followed by $81,000. Until price breaks out of this range, the daily market trend stays unclear and reactive rather than directional

Expert View

Bitcoin is currently stuck inside a range, and the price is not showing clear strength yet. Until BTC gives a strong daily close outside this zone, caution makes more sense than confidence. For now, the Bitcoin price prediction stays mixed, with the next move likely decided only after the price breaks out or breaks down clearly.

YMYL Disclaimer: This article is strictly informational in nature and does not constitute an investment recommendation. Investment in cryptocurrencies is extremely volatile. It is always essential to do your own research before making any investment.

Rahul Rathore brings over 3 years of hands-on experience in technical analysis, specializing in crypto, stocks, and market trend forecasting. With a deep understanding of chart patterns, indicators, and market psychology, Rahul delivers precise, actionable insights that help traders and investors make informed decisions. His analytical approach combines technical expertise with real-world market understanding, making his content reliable and highly valued by both novice and experienced traders.