The end of the $SON presale countdown is getting closer, and the listing on various exchanges has been confirmed already, so now one significant question is being talked about by investors: at what price will Spur Protocol list, and how far can $SON actually go?

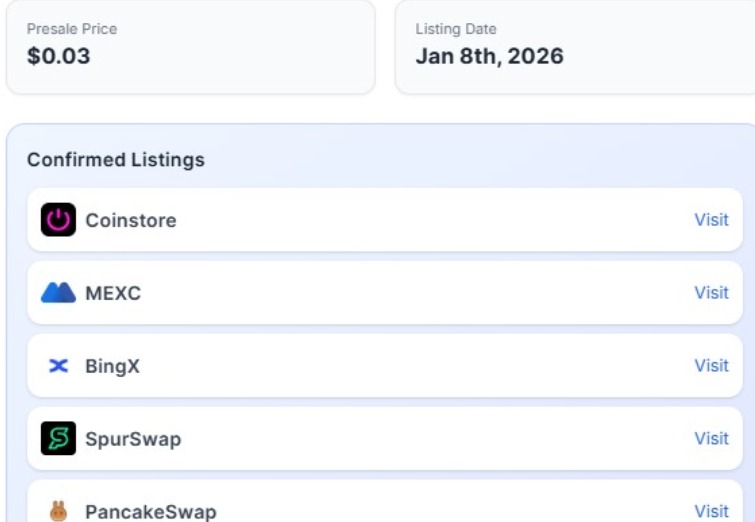

The date of listing Jan 8, 2026, will allow us to evaluate the expectation of price movements both for the short and medium term.

We will explain the probability of price predictions for Spur Protocol, which are grounded on presale data, tokenomics, and common market sentiments.

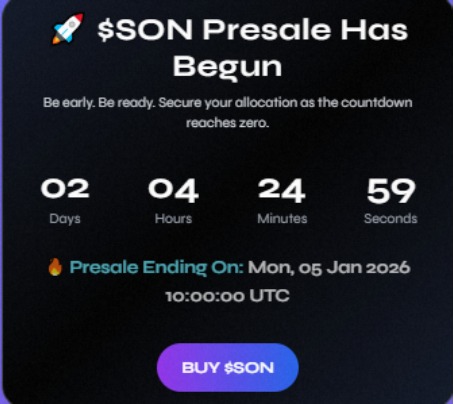

The presale for $SON token is on at the moment and the first round price of $0.03 per token will be maintained, with January 5, 2026, 10:00 UTC being the end of the countdown.

The official website indicates that up to now, more than 603,956 tokens have been sold already and the presale has an allocation of 8,333,333 tokens, thus revealing an early demand that is steady.

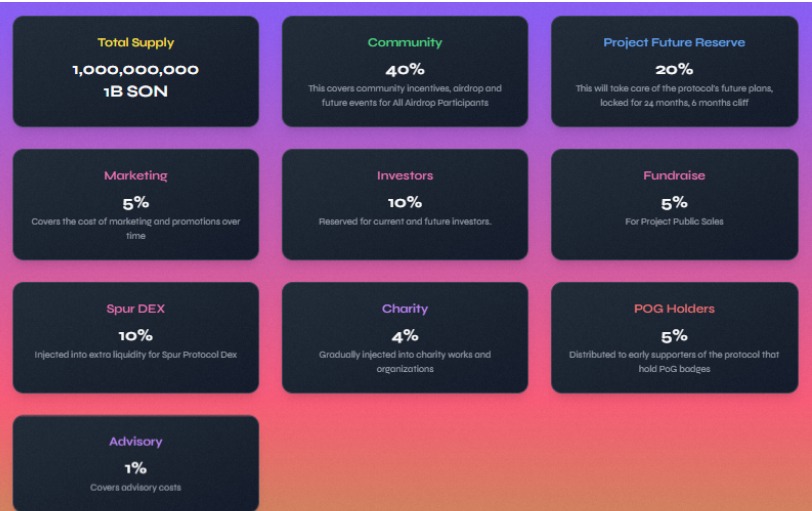

The total supply of 1 billion SON puts the focus on tokenomics for long-term growth. 40% of the supply is meant for the community and 20% is set aside for development with a 24-month vesting and 6-month cliff. This kind of setup could ease off the supply pressure post listing.

Currently, price speculation is primarily influenced by the listing schedule that has been confirmed. $SON was live on January 8, 2026, with listings on the Coinstore, MEXC, BingX, SpurSwap, and PancakeSwap exchanges.

The many platform listings from the beginning will definitely increase the accessibility and liquidity of the new asset. Thus, it is expected that there will be a high trading activity early on in the market mainly because of presale investors and short-term traders.

Spur Protocol communicated to its community that the holiday season is not an excuse for inactive development on the project. The group mentioned that if there would be any delays, they would be disclosed soon and urged users to remain active since more news is coming.

As a result of the $0.03 presale price and the present market outlook, the analysts anticipate a listing range between $0.20 and $0.60. This scenario depicts a robust demand, problem-free exchange launches, and early holders' selling pressure being well-monitored.

On the other hand, even with the top-tier exchange listing confirmed the aggressive moves may be resisted and not easy to push through. There is likely to be early volatility, as some of the presale participants might take profit just after trading starts.

In the near future, the $1 target would only be possible through massive capital imports, upturn in market sentiment and steady trading volume throughout exchanges. If the demand surpasses the early supply then, it would be able to reach the higher resistance levels.

Nevertheless, the possibility of hitting the $1 mark in no time is still not clear and it is largely reliant on the crypto market, in general, and $SON performance after listing.

Some analysts’ consensus points at the target of $3 to $5 as a medium-term prediction. Such prices would only be likely under a strong bull market; however, the prices would still be speculative.

The bullish prices would call for enormous ecosystem development, Spur Protocol adoption, and user retention that was not only launch hype.

YMYL Disclaimer: This piece is for information only and should not be used for financial advice because cryptocurrency is a highly risky investment tool. All information provided should be verified from authoritative sources, and do your own research before considering an investment.

Disclaimer: As always, this is not financial advice. Investors should manage risk and monitor confirmation levels closely.

This article discusses price scenarios based on technical indicators, historical patterns, and current market data. All price levels, forecasts, and potential targets are speculative and may not materialize.

Cryptocurrency markets are highly volatile and can result in significant losses. Nothing in this content constitutes financial, investment, trading, or any other form of professional advice. Readers should conduct their own research, consider their financial situation and risk tolerance, and, if needed, consult a licensed financial advisor before making any investment decisions.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.