XLM is still struggling to find strength, which keeps the Stellar price prediction on the cautious side. Price is not falling fast right now, but it is also not moving up with confidence. Bounce attempts look slow and shallow. Buyers are present, but they are not pushing hard.

Right now, XLM is mostly moving sideways inside a weak structure. There is no panic, but there is also no clear sign of a reversal yet. Based on this setup, the Stellar price prediction remains dependent on how the price behaves near key resistance and support levels.

On the higher timeframe, Stellar continues to trade inside a falling channel. This channel has been guiding the price lower for a while now, and nothing has changed structurally.

Chart Source: TradingView

The 21 EMA is acting like a wall. Every time price moves toward it, selling shows up. Price fails to close above it and drifts back down. RSI is sitting near 39, which shows weakness, not exhaustion. That usually means pressure can stay for longer. If Stellar breaks the support level of $0.2065, it might touch the next demand zone of $0.1500.

As long as the price stays inside the channel, the setup remains valid. A sustained breakout would change that.

On the 4-hour chart, XLM is still weak following a downward trendline. Small bounces happen, but they fade quickly. Price struggles to hold above short-term resistance.

Chart Source: TradingView

Bollinger Bands have started to tighten, which shows volatility is drying up. A move is likely to come, but unless buyers step in with volume, the direction is more likely to follow the existing trend. In the short term, if Stellar fails to break the trendline, price could slide back toward the $0.2080 area, with the next demand zone sitting near $0.2035. This setup only changes if the price breaks the trendline and manages to hold above it.

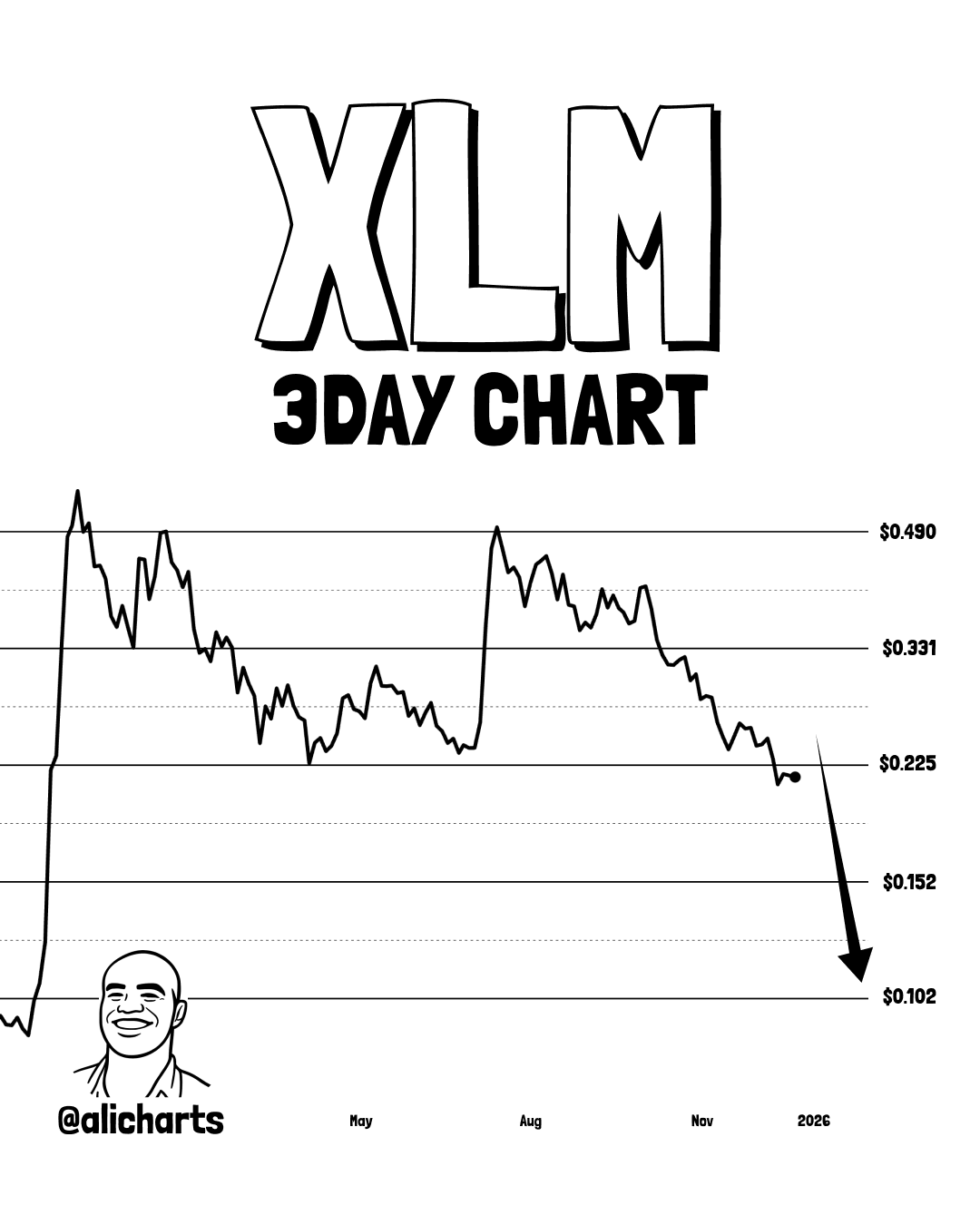

According to an analyst, XLM is still trading below important price levels that previously acted as support. Price has failed to reclaim these zones, and they are now behaving like resistance.

Source: X@alicharts

As long as XLM remains below these levels, downside pressure stays active. A weak hold at current support could open the door for a move toward lower demand areas.

Expert says Stellar has slowed down on the downside, but the structure is still weak. The falling channel and rejection near the 21 EMA keep pressure on price. Until Stellar breaks above resistance and holds there, risk stays tilted lower. Right now, the market looks undecided, not bullish.

Disclaimer This article is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency markets are highly volatile; do your own research before making any investment decisions

Rahul Rathore brings over 3 years of hands-on experience in technical analysis, specializing in crypto, stocks, and market trend forecasting. With a deep understanding of chart patterns, indicators, and market psychology, Rahul delivers precise, actionable insights that help traders and investors make informed decisions. His analytical approach combines technical expertise with real-world market understanding, making his content reliable and highly valued by both novice and experienced traders.