Warden (WARD) did the one thing most new tokens fail to do after launch—it did not break down.

While airdrop pressure and early listings usually drain momentum, token price action chose to build structure instead of noise.

That restraint is now starting to show.

Over the last 24 hours, Warden is up nearly 30.90%, pushing it into the market’s top gainer conversation and forcing traders to take a second look.

The breakout above $0.1350 has changed the tone. This is no longer about survival.

In the context of WARD Price Prediction 2026, the $0.50 zone no longer feels unrealistic—it feels early.

The real question now is intent: is this just a post-listing bounce, or is Warden quietly positioning itself before the broader market catches on?

Airdrops usually bring fast exits and broken charts. token moved differently.

As highlighted by Eagle Crypto, the airdrop rollout rewarded early users across chains, creating activity without forcing immediate exits.

That structure mattered.

Instead of a one-sided sell-off, supply was gradually absorbed as the market adjusted.

Early exchange liquidity helped smooth this process, allowing price to stabilize rather than slip into a thin-book breakdown.

The result was not a prolonged bleed, but a controlled reset.

That kind of behavior often appears when short-term sellers rotate out and remaining holders start looking beyond the airdrop toward Warden Protocol’s AI Agent infrastructure.

Another reason behind WARD holding strength is the shift in token utility.

Warden Protocol recently announced the launch of its Agent Launchpad, highlighting staking and launchpad power as core mechanics.

This ties WARD to airdrops and preferential allocations, giving holders a reason to stay positioned rather than sell immediately.

The shift toward ecosystem participation gained further attention after Josh Goodbody highlighted the Agent listing update, signaling expanding on-chain activity.

Around the same time, Kwala Intelligence pointed to Warden Protocol’s $4.4 million funding, reinforcing confidence in its long-term infrastructure focus.

Such utility-driven incentives often reduce short-term selling pressure and support price stability.

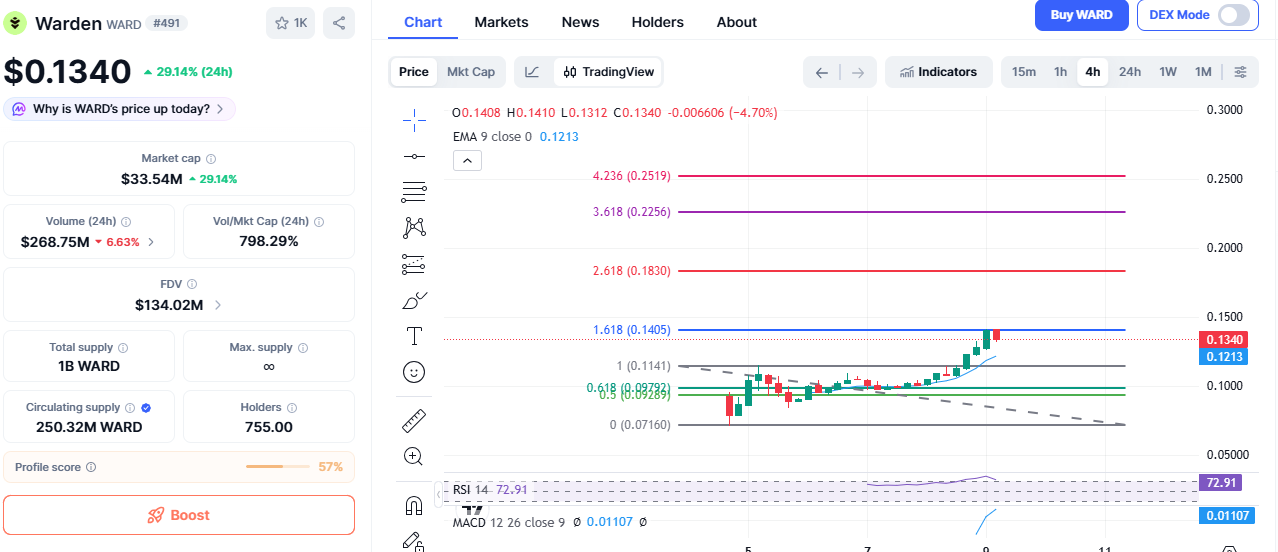

As per the CoinMarketCap chart, price opened and first built a base around $0.1141.

After that, price found support in the 0.5–0.618 Fibonacci zone, where it managed to sustain for a while.

During this phase, the 9 EMA also acted as support, helping price stay stable.

Today, price has broken above its previous high and printed a new high near $0.1405, which aligns with the 1.618 Fibonacci level.

At the same time, RSI is trading around 73, indicating strong momentum.

In the short term, this also opens room for a mild pullback or cooling phase before the next move.

Warden (WARD) has formed a strong support base near $0.1141, which is helping stabilize price after the airdrop-related selling pressure.

Short-Term Outlook (Q1-Q2 2026)

Immediate Target: If price manages to move above $0.1405, the next upside zone appears near $0.1830.

Current Trend: RSI is hovering around 72.91, reflecting strong buying momentum. At the same time, this level also leaves room for short-term consolidation before the next directional move.

Long-Term Outlook

Bullish Scenario: With growing AI Agent adoption, WARD could gradually move toward $0.25 and potentially test the $0.50 psychological level over time.

Key Risk: The bullish structure remains valid only if price holds above the $0.1141 support zone. A breakdown below this level would weaken the current bullish outlook.

WARD is still trading in a price-discovery phase rather than a distribution phase.

The ability to absorb early selling and hold structure suggests demand is coming from positioning instead of short-term speculation.

As long as key support zones remain intact, the WARD Price Prediction 2026 outlook stays constructive, with upside likely to develop gradually rather than through sharp spikes.

YMYL Disclaimer: This article is strictly informational in nature and does not constitute an investment recommendation. Investment in cryptocurrencies is extremely volatile, and market conditions can change quickly based on macro data. It is always essential to do your own research before making any investment.

Rahul Rathore brings over 3 years of hands-on experience in technical analysis, specializing in crypto, stocks, and market trend forecasting. With a deep understanding of chart patterns, indicators, and market psychology, Rahul delivers precise, actionable insights that help traders and investors make informed decisions. His analytical approach combines technical expertise with real-world market understanding, making his content reliable and highly valued by both novice and experienced traders.