With Binance Wallet confirming Warden Protocol (WARD) as the first project featured on Binance Alpha on February 4, excitement is building fast across the crypto market. The announcement has already sparked strong interest from traders and airdrop hunters alike.

But the big question remains: can it turn early hype into real price growth, or will it face heavy sell pressure after launch?

Let’s break down the WARD price prediction step by step, from listing day action to long-term potential.

Warden Protocol is positioning itself as a decentralized infrastructure layer, focusing on agents, validators, and ecosystem-driven growth.

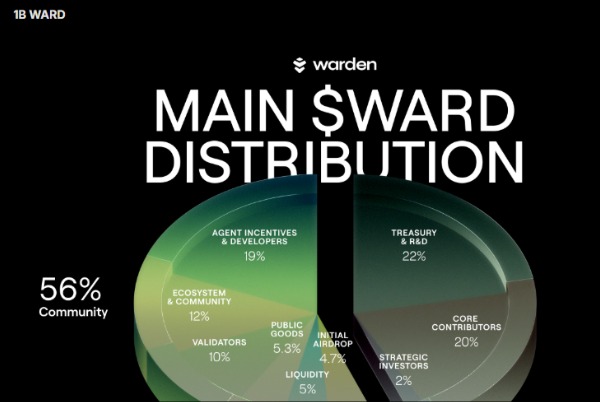

What stands out most is its community-first tokenomics, with 56% of the total supply allocated to the community through incentives, ecosystem funding, validators, and airdrops.

The project has a fixed total supply of 1 billion tokens, designed to balance growth and sustainability:

56% Community Allocation

Agent incentives & developers: 19%

Ecosystem & community growth: 12%

Validators: 10%

Public goods: 5.3%

Liquidity: 5%

Initial airdrop: 4.7%

44% Long-Term Support Allocation

Treasury & R&D: 22%

Core contributors: 20%

Strategic investors: 2%

This distribution reduces extreme insider dominance while supporting long-term protocol development—an important factor for price stability.

At launch on Binance Alpha, the token is expected to trade between $0.08 and $0.15. Early price action will likely be driven by:

Airdrop claim selling

Speculative buying

Initial liquidity conditions

A short-lived spike toward the upper range is possible, especially if demand outpaces early selling. However, a pullback is common during the first few trading sessions as early holders lock in profits.

Once the initial volatility settles, WARD’s price will depend heavily on ecosystem activity and community engagement. If validator participation grows and incentive programs stay active, the token could stabilize between $0.12 and $0.25.

Positive catalysts such as ecosystem partnerships, developer updates, or expanded Binance Alpha exposure could help gradually trend higher rather than rely on hype-driven spikes.

Looking further ahead, WARD’s long-term success depends on whether it becomes a widely used infrastructure network, not just an airdrop-driven token.

If the team effectively deploys the 22% treasury and R&D allocation, attracts builders, and achieves real adoption, it could target $0.50 to $1.00+ in a favorable market cycle. Reaching the upper range would require sustained network usage and broader crypto market support.

Disclaimer: This article is for informational purposes only and not financial advice. Always do your own research before investing.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.