Dogecoin price prediction is back in focus after Elon Musk dropped another cryptic line on X.

There was a time when one tweet from Musk could move DOGE within minutes.

The crypto market today feels more cautious.

In 2026, traders are not chasing memes the way they did before.

Yesterday, Musk replied “Maybe next year” to a SpaceX DOGE-1 mission post.

That single comment was enough to restart the Dogecoin price prediction debate.

Will Dogecoin really see a space mission in 2027, or is this just another short-lived hype move?

Market mood is mixed. DOGE still reacts to Musk-related news, but the impact looks smaller.

Traders now watch liquidity, volume, and whether Doge can survive without constant attention.

The 2026 market is not the 2021 market.

Back then, jokes moved price. Now, structure and sentiment do the heavy lifting.

Elon Musk’s “Maybe next year” reply pushed the DOGE-1 mission back into focus.

The moment the reply surfaced, it was widely shared by crypto voices like Budhil Vyas, and the discussion around Dogecoin started heating up again.

The old space narrative returned, and traders noticed it, even without a strong price move.

The reaction was not explosive, but it was noticeable.

Right now, the tweet matters because patience is thin. If 2027 stays just a date, interest will fade.

If real updates appear, sentiment can warm again.

For DOGE price outlook, the timeline is acting like a psychological level rather than a real trigger.

According to analyst data shared by @TATrader_Alan, Dogecoin has already broken its downward trendline and is now trading above that level.

Price is also holding above the earlier consolidation zone, which means the market is not giving back the breakout easily.

On the momentum side, MACD has turned bullish and is moving toward the zero line.

This does not mean a fast rally is coming.

It shows that selling pressure is fading and the market is slowly shifting from weakness to balance.

Right now, the structure looks more like stabilization than excitement.

Traders are watching whether this level can stay protected or if price slips back into the old range.

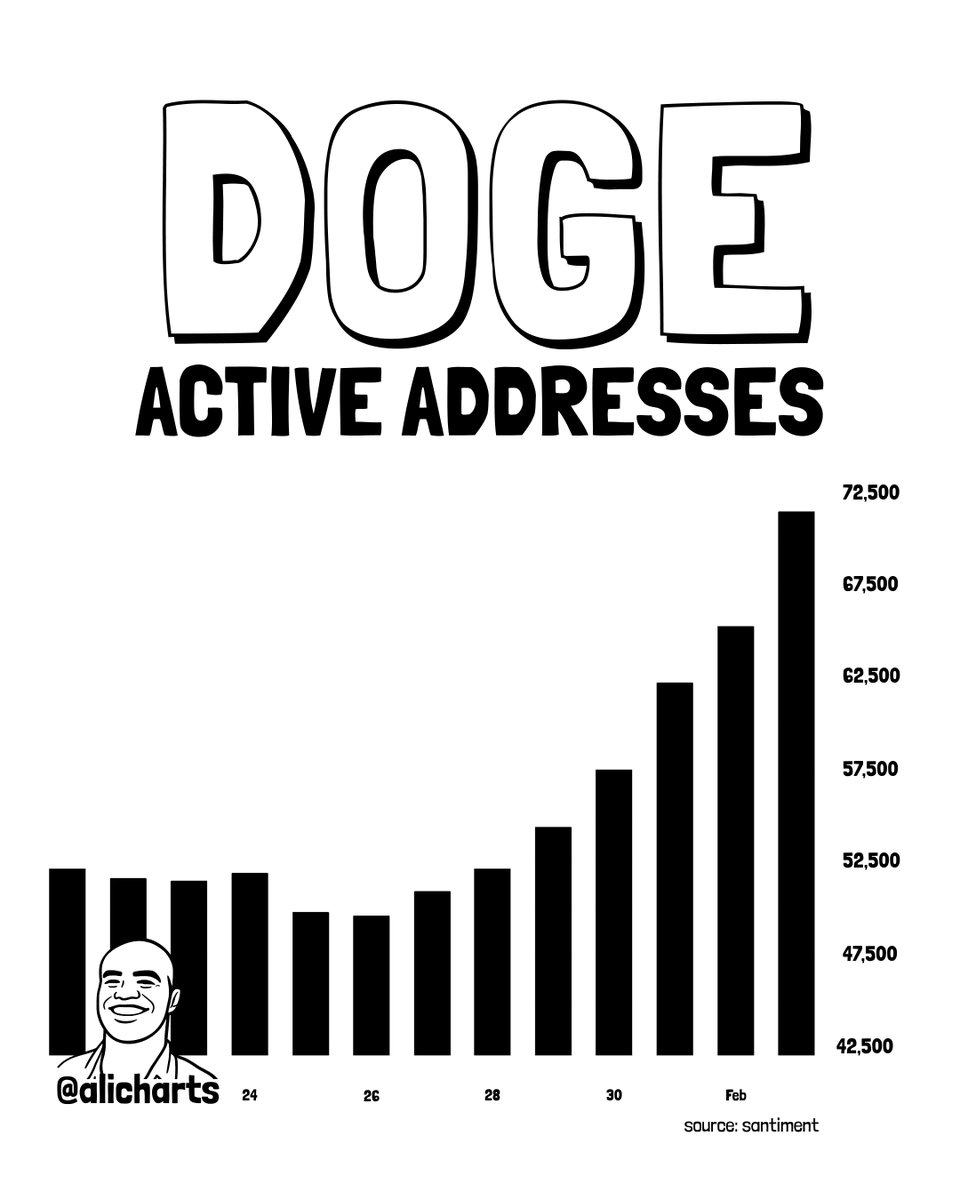

According to data shared by @alicharts, Dogecoin network activity jumped 36% in one week, with active addresses rising above 71,400.

This shows more wallets are moving DOGE, not just holding it.

This data matters because price moves look stronger when network activity supports them. If this activity slows down, momentum can fade again.

According to analyst data shared by @LLuciano_BTC, DOGE is finding interest around the 0.10 area. This level is not being treated as a random bounce zone.

It lines up with earlier demand and trendline support visible on the chart.

Price earlier moved inside a long downtrend and then started reacting from this zone. Instead of collapsing, it slowed down and began stabilizing.

That behavior usually shows buyers stepping in quietly while sellers lose urgency.

On the chart, the breakout structure opens two clear upside paths if this base holds:

TG1: near $0.20989 , where earlier selling pressure existed

TG2: near $0.30754, close to the previous high zone

This setup only works if the current support stays protected.

A clean move below $0.10000 would weaken the structure and turn the move into another failed attempt.

For now, the chart is less about speed and more about whether price can survive above this base long enough to attract follow-through buying.

Dogecoin is no longer driven only by jokes. Elon Musk still brings attention, but the reaction is more cautious than emotional. The DOGE-1 timeline is keeping sentiment alive, but it is not moving price on its own.

From a Dogecoin price prediction view, charts matter more than tweets. Holding above the breakout zone and the 0.10 area keeps the upside path open. Losing that base would quickly weaken the structure and change the DOGE forecast.

For Dogecoin price prediction, the next move depends on whether buyers stay active when the story goes quiet or if interest fades again.

Until then, the Dogecoin market outlook remains tied to structure first and headlines second.

YMYL Disclaimer: This article is strictly informational in nature and does not constitute an investment recommendation. Investment in cryptocurrencies is extremely volatile, and market conditions can change quickly based on macro data. It is always essential to do your own research before making any investment.

Rahul Rathore brings over 3 years of hands-on experience in technical analysis, specializing in crypto, stocks, and market trend forecasting. With a deep understanding of chart patterns, indicators, and market psychology, Rahul delivers precise, actionable insights that help traders and investors make informed decisions. His analytical approach combines technical expertise with real-world market understanding, making his content reliable and highly valued by both novice and experienced traders.