Shards Protocol has officially announced the listing of its native token AURA on MEXC exchange. To be exact, the trading of the SHARDS/USDT pair shall begin on June 17, 2025, at 10 AM UTC. Witnessing the listing will be a milestone achievement for the project and provide liquidity for the wider audience.

So, the big question still remains—will AURA sustain that initial momentum to $0.50 and beyond?

AURA is the native utility token of Shards Protocol, a Web3 infrastructure project around verifiable identity, reputation-based incentives, and user-driven governance. Unlike attention models, Shards proposes a recognition economy—one that rewards contributions and trust metrics rather than engagement manipulation.

With these foundations, AURA does not just conduct transactions; it powers the rise of an on-chain reputation layer aimed at reworking the dynamics of identity and trust in decentralized ecosystems.

There is a total supply limitation of one billion tokens, and nearly 963.29 million tokens are in circulation. Hence, an investor or trader ends up with great early advantages once listing occurs inasmuch as little inflationary pressures occur on the project.

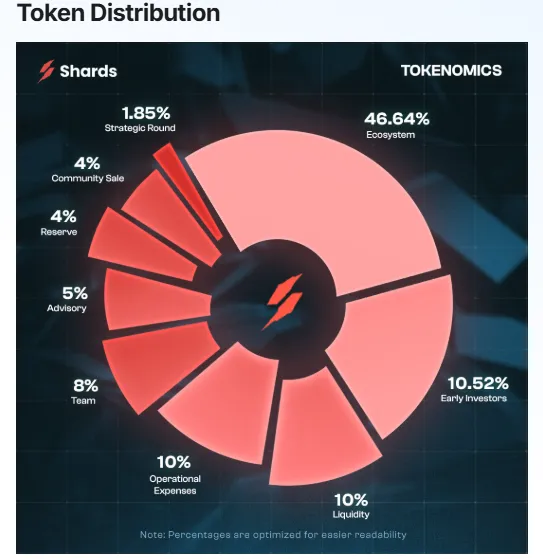

The model given to the tokenomics is really quite balanced. The largest portion is assigned to the ecosystem, amounting to 46.64%, for long-term protocol development. Other allocations are as follows:

10.52% to early investors

10% for liquidity

10% for operations

8% to the core team

5% advisory

4% reserve

4% community sale

1.85% for strategic investors

The high-level distribution displays a transparency declaration for growth and decentralization, allowing the protocol to develop in a sustainable manner.

The MEXC listing is expected to release the global liquidity. During the early hype and community-building moments, the initial trading range could settle somewhere between $0.15 and $0.25. Given that it is an asset with low inflation and high circulating supply, strong buy-side pressure will translate into a swift price breakout.

If this project manages to harness new strategic partnerships, large listings, and community-driven catalysts that may come to fruition in the coming week or two, the $0.30 resistance level may be tested in the near term by way of AURA stabilization. Importantly, there may be high volatility; however, these should provide a strong layer of underlying support.

Long-term price prediction will thus completely depend upon execution in its ecosystem. The slow trickling of 46.64% ecosystem reserve would fund integration, further develop the platform, and incentivize developers—into demand for its utility.

As the Web3 identity and reputation narrative strengthens in DeFi, gaming, and DAOs, the token could well become the infrastructure token. With steady activity and adoption, the token has the potential to climb above $0.50 in the next 12–18 months.

This price target, however, holds weight if the protocol manages to push through with roadmap milestones, wallet integrations, staking mechanics, and governance frameworks.

This may just be the beginning for MEXC listings ! As user awareness grows, therefore, the question now becomes: Will the coin step up to be the reputation token for decentralized ecosystems and hit $0.50?

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.