The crypto market is no stranger to volatility, but what happens when a token sees an 86% plunge in one day? That is exactly what happened to Polyhedra Network’s native token ZKJ, which on June 15 touched its all-time low of $0.2530. With abnormal trading behavior, liquidity drains, and cascading liquidations causing havoc, investors are now pondering- can it recover from this meltdown or shall there be further downside?

The price plunge came heavily after a series of abnormal transactions and liquidity withdrawals, particularly in the ZKJ/KOGE trading pair. In fact, during the same period, KOGE—the governance token of 48 Club DAO—also plummeted by 55%.

On June 15, Polyhedra Network aimed at the community on X, stating that the fundamentals of the project remain strong, and the sudden crash in price was due to abnormal on-chain activity and not due to a flaw with the protocol. The team reassured that they were actively investigating the matter, and development was back on track.

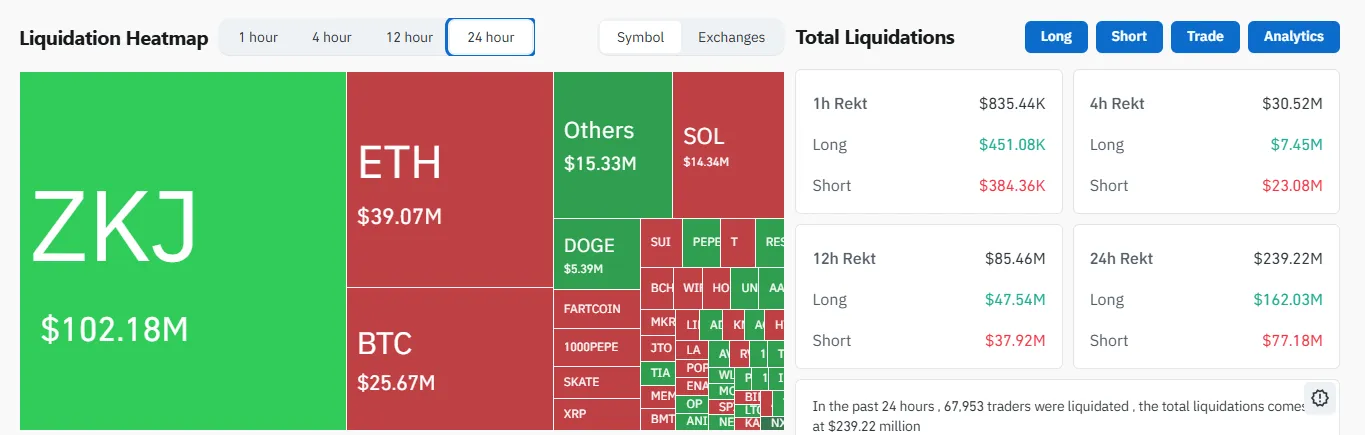

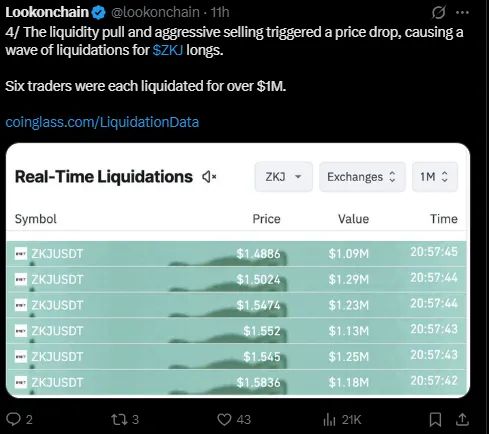

According to CoinGlass, the selloff set off a very strong wave of long liquidations. Over $102.81 million positions were liquidated in just 4 hours. Over 67,976 traders have faced liquidation within 24 hours, with total liquidation amounts of $239.23 million.

The data hints at certain wallets having a premonition of the crash. Some whales started swapping KOGE for ZKJ and then dumping ZKJ, thereby exerting further downward pressure on the price. The whale addresses like, 0x6aD390b069316ca0877a039AccDC5e02beDe2EBb 0x0781325b3688714065b15C8d9fC0d4827628bdE7" 0xef78554c8384ad94e874D2b27A21085C45Dfb456 0xb7Ba3Cf568224457814254C826d7104a92169b3E 0x1A29375eE09B38AFAa23BeD65f30C85230E27599 0xBdc0f711Bc1eB7C20feD017eA521228cEA8A9912, were considered among the top sellers, unloading a total of 5.23 million coins for about $9.66 million.

The disorder has not gone unnoticed. Binance acknowledged the major price fluctuations in ZKJ and KOGE, attributing them to large holders undercutting liquidity, which began the cascade of liquidations.

With the view of rectifying the problem and making the market more fair, Binance announced a major policy change: starting June 17, trading volume between Alpha token pairs will no longer be included in Alpha Points calculations. This is a direct strike against manipulation and concentration risk.

From a technical standpoint, the token is deeply oversold. On the daily chart, the token broke below its long-held support of $1.90, free-falling to as low as $0.2530. It now trades near $0.3276, marking an 85%+ drop.

Indicators flash a possible short-term bounce:

RSI is at an ultra-rare low of 1.75, signaling oversold conditions.

MACD, however, remains bearish but may show small signs of divergence that hint toward a bottoming pattern.

Source: TradingView

If the token manages to stabilize above the $0.40 zone, we may see accumulation and a relief rally toward $0.70–$0.90. However, if bearish sentiment continues and trust erodes further, a dip toward $0.20 remains in play.

Will the whales return—or has ZKJ’s momentum run its course? Only time—and transparency—will tell.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.