StakeStone ($STO), a decentralized liquidity infrastructure protocol, experienced a huge price surge. A major upgrade announcement made by Binance was the main contributing factor for the recent surge. On the Spot market, Binance had listed $STO for trading on May 2, 2025. This listing caused a gradual uptick in the price by 70% since May 1, increasing the market cap to $46 million.

But what is this sudden rise all about, and will it hold? What are the factors that move StakeStone's prices? Let's discuss.

The huge rise in the price has come & has been facilitated through the announcement made by Binance on May 2, 2025, where they confirmed the listing of the token on their Spot exchange; Binance is the world's largest cryptocurrency exchange. A listing has an almost immediate effect on price. The listing was also one of a series of Binance HODLer airdrops, which has created even more buzz among investors.

During the 24 hours following the announcement, volume on $STO jumped by 936% to $227.50 million, indicating the rising demand and optimistic sentiment about StakeStone's future.

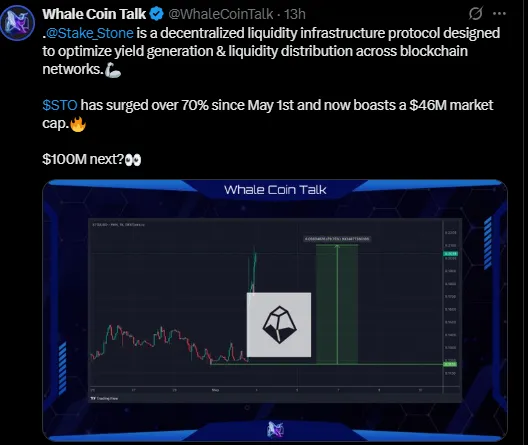

On May 1, the price increased by 70% and reached an intraday high of $0.21; the price retreated a bit and is currently consolidating at $0.19-$0.21 levels. As per recent charts, StakeStone appears to have developed a bullish pennant or symmetrical triangle. These types of chart patterns are typically preceded by breakouts upwards, indicating a continuation of the previous uptrend.

Source: TradingView

The moving averages confirm the bullish view since the short-term moving averages are above the longer-term moving averages. The Relative Strength Index (RSI) is currently at 73.79, indicating that the coin is overbought, so some pullback may occur before this upward drive continues in a consolidation phase.

When the token breaks $0.21 resistance, the next possible target could be $0.23-0.25. Traders should also look out for support at $0.19 and $0.16. Breaking $0.21 confirms the bullish trend, but short-term overbought signals should shine a caution light.

The momentum of the StakeStone could be additionally maintained strong by the listing and bullish technicals, but beware of the overbought signals. Time has only to tell if $STO can keep up with the spurt for the coming weeks.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.