XRP is in the news again after a $2.2 billion token unlock and a huge whale accumulation spree.

Ripple unlocked 1 billion tokens from escrow in just 7 hours, worth more than $2.2 billion combined.

Ripple claimed a 500M token is set to be unlocked, with another 500M going into unknown wallets, feeding fears over transparency and that this could trigger a selloff.

These large unlockings tend to move the price short-term, triggering speculation from investors across the cryptocurrency landscape.

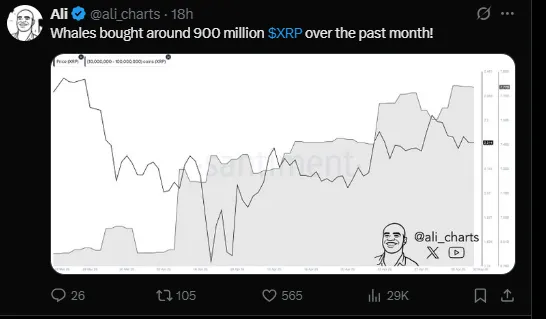

On-chain data revealed that over the last 30 days, whales have bought 900 million XRP despite uncertainties and fluctuations in the market.

Institutional and whale confidence in the coin is indicated by the new wallets added with 10 million-100 million tokens.

This accumulation perfectly coincides with an escrow unlock and can be seen as preparing for a possible rally.

As of early May, the altcoin prices are trading between $1.96 and $2.50. Experts have pointed out that the asset is currently experiencing a consolidation period. According to Egrag Crypto, Altcoin is creating Candle 5 within a historical MACRO channel, typically associated with explosive price breakouts.

Technical targets based on this formation point to $17 as the first breakout line.

A complete MACRO breakout offers the target projected at $55, expected to show another parabolic move.

Realistic Profit Zone: Laddering Between $17 and $27

Though $55 may be an exciting target for bulls, honest traders would consider leaving a phased profit-taking range somewhere from $17 to $27.

The exit will thus be laddered to mitigate and maximize gains as Ripple approaches significant technical resistance.

With $2.2B released and 900M XRP accumulated by whales, the market is all set to be very volatile. Volume spikes, RSI divergence, and price reaction against $1.50 and $3 will be among the trade signals of interest.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.