Hyperliquid was trading near $34.73 at the time of writing, posting a 4.73% gain over the past 24 hours, even as the broader crypto market faced strong selling pressure. Bitcoin briefly dropped toward $70,000, Ethereum slipped below $2,100, and most major cryptocurrencies moved lower.

In contrast, HYPE continued to outperform the market. The token has risen 6.76% over the past week and is up 30.53% over the last month, making it a clear standout during a period of widespread weakness.

Derivatives data suggest the rally is driven by reduced leverage rather than aggressive speculation. Open interest increased to $1.65 billion, while trading volume fell 18% to $805.70 million, according to CoinGlass.

This pattern typically signals that traders are scaling back risk instead of chasing price spikes, a dynamic that can help keep prices relatively stable during volatile market conditions.

Several developments have boosted short-term demand for HYPE tokens.

On February 4, Ripple announced that Ripple Prime, its institutional brokerage platform, added support for Hyperliquid.

This allows institutions to trade on-chain perpetuals and derivatives while managing risk alongside traditional assets such as FX and fixed income.

The market responded positively, lifting HYPE despite broader crypto weakness. While the integration does not directly impact XRP, it strengthens Hyperliquid’s position in perpetual trading.

The same day, Hyperion DeFi Inc. (NASDAQ: HYPD) revealed plans to use its HYPE holdings as options collateral. The strategy focuses on generating yield from options premiums, fees, and staking rewards rather than directional bets.

Hyperion is working with Rysk Protocol to launch an on-chain options vault on Hyperliquid, which could later open to other institutional holders and help reduce liquid supply.

Meanwhile, Hyperliquid’s HIP-4 upgrade introduces fully collateralized “outcomes” trading, appealing to traders seeking defined risk.

The update builds on earlier improvements that have driven strong growth, with over $1 billion in open interest and nearly $5 billion in daily volume.

An upcoming token unlock on February 6, releasing about 9.92 million tokens worth roughly $300 million, has so far failed to unsettle the market, with past unlocks absorbed without sharp pullbacks.

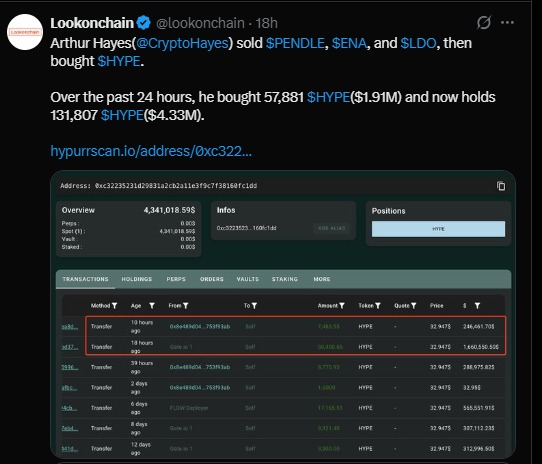

Arthur Hayes has once again drawn market attention with a strategic portfolio shift. According to Lookonchain, he sold $PENDLE, $ENA, and $LDO and rotated the funds into $HYPE, signaling rising confidence in the token.

In the past 24 hours, he bought 57,881 $HYPE worth about $1.91 million, bringing his total holdings to 131,807 tokens valued near $4.33 million, a move traders are viewing as a potentially bullish signal.

Based on the daily chart, HYPE/USDT is showing early signs of a trend reversal, supporting a cautiously bullish price outlook in the near term.

After spending several months in a sustained downtrend, price has broken above the descending trendline and reclaimed the mid-range resistance near $32–$35, signaling renewed buying interest.

The move is backed by a strong bullish candle and rising volume, suggesting conviction behind the breakout. Currently, the price is trading above the Gaussian channel midline, a signal that short-term trend bias has flipped bullish and momentum is shifting in favor of buyers.

Momentum indicators also support this shift. The RSI has moved above 58, trending higher and approaching bullish territory, which indicates strengthening upside momentum without being overbought yet.

If HYPE can hold above the $32–$33 support zone, the next upside targets lie around $38–$40, followed by a potential retest of the $44–$48 region where previous resistance and moving average bands converge.

However, failure to sustain above $32 could lead to a short-term pullback toward $28–$30 before another attempt higher.

This article is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency investments are highly volatile. Always conduct your own research before investing.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.