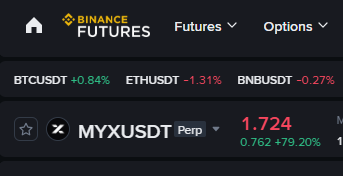

The broader crypto market has turned mildly positive, with major coins posting small gains. But MYX Finance has clearly moved at a different speed.

Over the past 24 hours, MYX has surged nearly 79%, now trading around $1.73. While the broader market struggles to gain momentum, this move stands out sharply.

Such aggressive upside during a mildly positive market environment usually grabs attention fast.

Traders who were barely tracking this altcoin a few days ago are now actively reassessing its structure.

The rally has not only erased recent weakness but also pushed price through key resistance areas that had capped previous attempts. Naturally, conversations around MYX Finance price prediction 2026 are picking up again.

Still, a vertical move like this always raises one question.

Is this a short-lived liquidity spike, or is there a real catalyst driving sustained interest?

Let’s break down what is happening beneath the surface.

The rally was largely driven by aggressive activity on Binance Futures, where it ranked among top short-term gainers.

Rapid leveraged buying likely triggered short liquidations, creating a squeeze that accelerated the spot price.

At the same time, this was not an isolated move. While the total crypto market cap rose just 0.80%, high-beta tokens also posted strong gains.

This points to targeted speculative rotation rather than broad market strength.

The key risk now is whether futures momentum is sustained or begins to cool.

The biggest trigger behind 70% surge is now clear. Tweet shared by MYX. Finance on X says Consensys, the company behind MetaMask and Linea, has led MYX Finance’s latest strategic funding round and has become its largest investor.

This is more than just funding. It signals institutional-level backing and long-term infrastructure alignment.

Three Key Impacts

Ecosystem Strength: Token is already a leading derivatives DEX on BNB Chain and a dominant player on Linea. With Consensys onboard, its positioning within the Linea ecosystem could strengthen further.

Volume Milestone: This altcoin has crossed $95M in cumulative trading volume, reflecting strong user engagement and platform activity, a meaningful base for this altcoin price prediction 2026 discussions.

Development Acceleration: With backing from firms like Mesh, Systemic Ventures, and Ethereal Ventures, product expansion and ecosystem growth may move faster.

Why This Matters for Price

When a major infrastructure player like Consensys becomes the largest investor, it brings credibility, network access, and ecosystem trust. That shift often changes trader psychology.

Short liquidations and fresh long positioning likely amplified the move toward the $1.75+ zone.

On the 4-hour chart, price had been in a sustained downtrend, respecting a falling channel for several weeks.

Price gradually compressed toward the lower boundary and formed a base near the September 2025 low.

That base acted as a structural support zone.

From there, buyers stepped in aggressively, triggering a rally that pushed price above the upper trendline of the falling channel.

This breakout signals a potential short-term trend shift.

RSI had dipped into oversold territory during the decline but has now recovered toward the 55 level, reflecting improving momentum.

At the same time, price is trading above the 21 EMA, which is now acting as dynamic support.

Key Support Levels:

$1.48

$0.95

Key Resistance Levels:

$1.76

$2.48

$3.47

Holding above the $1.48–$1.50 zone keeps the breakout structure intact on the 4-hour timeframe.

The recent 79% rally confirms that price has likely moved out of pure accumulation. However, instead of chasing aggressive upside targets, a structural and adoption-driven approach makes more sense.

Consensys backing marks a major credibility shift, but sustained upside will depend on real liquidity growth, V2 adoption, and continued derivatives volume expansion.

If price holds above the $1.60–$1.70 zone, the MYX Finance price prediction 2026 path could unfold gradually rather than vertically.

MYX Price Forecast 2026 (Conservative Targets)

Period | Potential Low | Potential High | Market Condition |

Q1 2026 | $1.40 | $2.10 | Post-rally consolidation |

Q2 2026 | $1.80 | $3.20 | V2 adoption momentum |

Q3 2026 | $2.60 | $4.00 | Ecosystem expansion |

Q4 2026 | $3.40 | $5.50 | Broader market recovery |

The Logic Behind the Targets

Supply Absorption: After a sharp 79% rally, consolidation near the $1.50–$1.70 zone would allow healthier base formation before the next expansion.

Institutional Support: A $3–$5 range remains realistic if platform volume growth continues and ecosystem integration deepens.

Risk Factor: Competition in the derivatives DEX space remains high. Sustained dominance on Linea and BNB Chain will be key.

The recent surge explains why MYX Finance is up today, but sustainability will depend on follow-through volume and structural strength.

Derivatives momentum, institutional backing, and ecosystem expansion are supportive factors, yet consolidation above key support remains crucial.

If momentum stabilizes rather than fades, the broader MYX Finance price prediction 2026 outlook can remain constructive, though gradual rather than explosive.

Disclaimer: Cryptocurrency markets are highly volatile. This price prediction is based on technical structure and current developments, not financial advice. Investors should conduct independent research and assess risk tolerance before making decisions.

Rahul Rathore brings over 3 years of hands-on experience in technical analysis, specializing in crypto, stocks, and market trend forecasting. With a deep understanding of chart patterns, indicators, and market psychology, Rahul delivers precise, actionable insights that help traders and investors make informed decisions. His analytical approach combines technical expertise with real-world market understanding, making his content reliable and highly valued by both novice and experienced traders.