When the broader crypto market stays quiet, one coin sometimes breaks the silence.

Today, that coin is Midnight (NIGHT).

NIGHT price is up 12.35% in the last 24 hours and is now trading around $0.0648. While most of the market is moving flat, this altocin is clearly outperforming.

That is why traders are suddenly searching, "Why is NIGHT price up today?"

This move has restarted the Midnight price prediction 2026 debate.

As a privacy-focused sidechain within the broader Cardano ecosystem, Midnight often attracts ecosystem-driven capital when Cardano sentiment improves

Some traders believe this is early momentum building toward larger Midnight price prediction 2026 targets. Others think it may be short-term buying pressure or smart money accumulation.

When an altcoin rises against weak market sentiment, it usually means something is shifting underneath—liquidity, network growth, or trader positioning.

And the chart has started reacting before the crowd fully understands why.

So what is driving the NIGHT price surge? Let’s decode it.

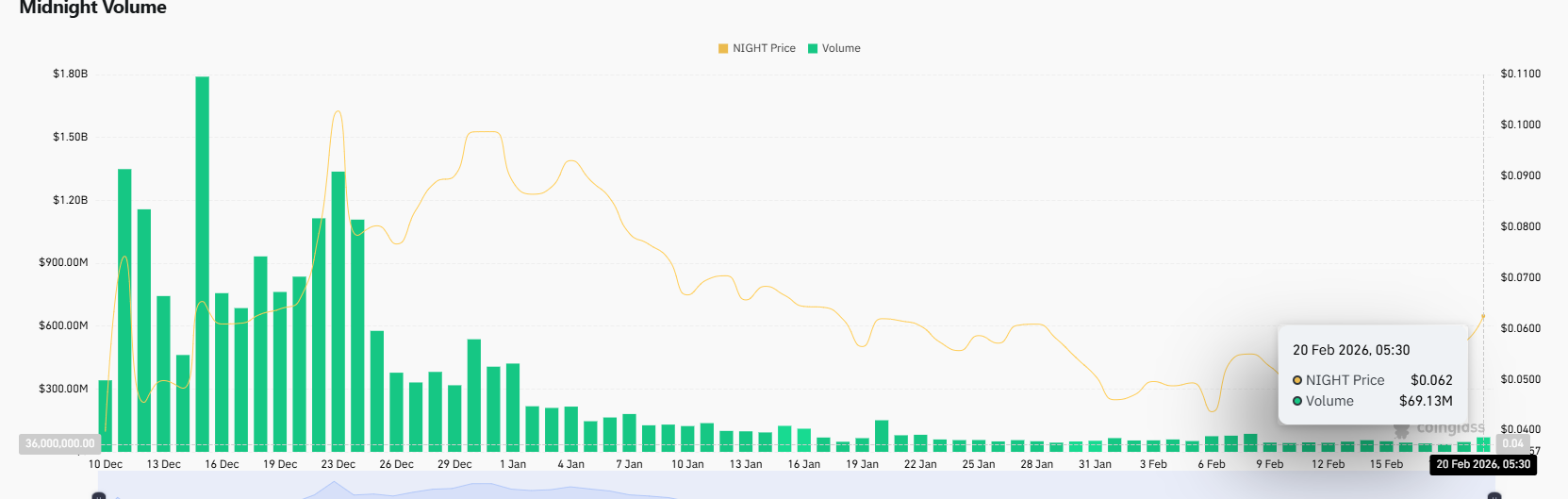

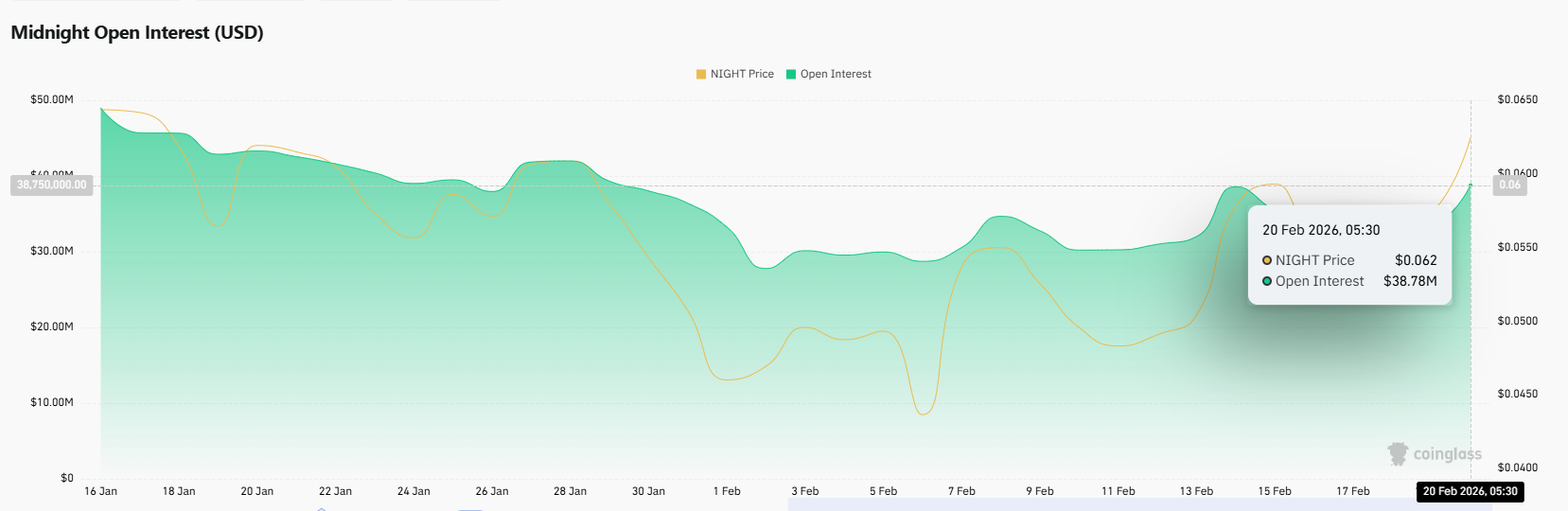

The reason behind this sharp price move becomes clearer when we examine recent Coinglass volume and open interest data alongside spot market activity.

• Volume Surge: Spot Market Strength

24-hour trading volume surged sharply, crossing the $69M mark.

This strong expansion in activity outpaced the broader crypto market.

This relative outperformance reflects targeted capital rotation, not random volatility.

• Open Interest Expansion: Derivatives Confirmation

Futures open interest climbed toward the $38–39 million range.

Rising prices along with rising open interest point to fresh position build-up.

This structure supports the idea of active accumulation rather than short covering.

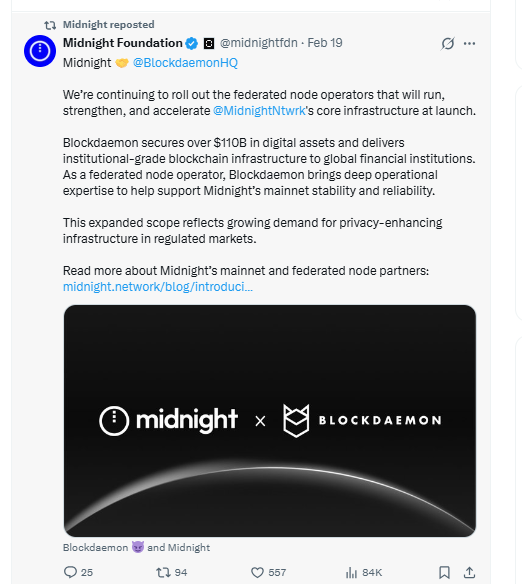

In a recent post on X, the Midnight Foundation confirmed that Blockdaemon will act as a federated node operator for Midnight Network.

Blockdaemon secures over $110 billion in digital assets and provides infrastructure to global institutions.

This move strengthens Midnight’s mainnet stability and adds institutional credibility, especially as demand for privacy-focused infrastructure grows.

On the 1-hour chart, price was trading inside a rising channel and has now broken above the upper boundary, signaling short-term bullish momentum.

The breakout suggests buyers are gaining control after steady accumulation within the channel.

RSI is hovering around the 65 level, indicating strengthening momentum but not yet in extreme overbought territory. At the same time, price is holding above the 50 EMA, which is now acting as dynamic support.

Short-Term Support:

$0.0615

$0.0585

Short-Term Resistance:

$0.0673

$0.0700

As long as price sustains above the 50 EMA and the $0.0615 zone, short-term structure remains tilted in favor of buyers.

On the 1-day chart, token had been trading in a prolonged downtrend and was forming a bearish flag pattern.

However, the recent move above the upper trendline has invalidated that bearish setup, shifting short-term structure in favor of buyers.

This breakout suggests that selling pressure is weakening and dip buyers are stepping in at higher levels. RSI is currently hovering around the 65 zone, showing strengthening momentum without entering extreme overbought territory.

Key Support Levels:

$0.0550

$0.0478

$0.0420

Key Resistance Levels:

$0.0740

$0.0807

$0.0906

Holding above the $0.0550 zone keeps the breakout structure intact on the daily timeframe.

Key Risk: If NIGHT fails to hold $0.0550 on the daily timeframe, the bullish thesis will be neutralized, potentially leading to a retest of lower demand zones."

Recent price behavior and strengthened infrastructure support suggest NIGHT may be moving out of accumulation.

On the 1-hour chart, a rising channel breakout reflects improving short-term sentiment.

At the same time, the bearish flag visible on the daily chart has been invalidated after price pushed above the upper trendline, weakening the prior downtrend structure.

If NIGHT holds above the $0.061–$0.063 zone, upside toward $0.074 and then $0.080–$0.081 becomes more likely, provided momentum and volume remain supportive.

2026 Price Forecast

Period | Potential Low | Potential High | Key Driver |

Q1 2026 | 0.055 | 0.110 | Mainnet expansion |

Q2 2026 | 0.080 | 0.200 | Liquidity & listings |

Q3 2026 | 0.150 | 0.380 | Institutional interest |

Q4 2026 | 0.280 | 0.750 | Broader market rally |

These levels assume stable network growth and steady liquidity. Holding higher lows and key support is crucial for the next leg higher.

The answer to why is NIGHT price up today lies in a mix of rising volume, expanding open interest, and strengthening infrastructure confidence.

The breakout on lower timeframes and the invalidated bearish structure on the daily chart suggest that sentiment is gradually shifting in favor of buyers.

If key support levels continue to hold, the broader Midnight price prediction 2026 outlook remains structurally constructive.

Momentum is building—but follow-through will decide whether this move turns into sustained expansion or cools into consolidation.

Disclaimer: Cryptocurrency markets are highly volatile. This Midnight Price Prediction 2026 is based on technical structure and current developments, not financial advice. Investors should conduct independent research and assess risk tolerance before making decisions.

Rahul Rathore brings over 3 years of hands-on experience in technical analysis, specializing in crypto, stocks, and market trend forecasting. With a deep understanding of chart patterns, indicators, and market psychology, Rahul delivers precise, actionable insights that help traders and investors make informed decisions. His analytical approach combines technical expertise with real-world market understanding, making his content reliable and highly valued by both novice and experienced traders.