Is PIPPIN Price Prediction suddenly pointing toward the $1 mark, or is this rally running ahead of itself?

In just two weeks, this memecoin has delivered a stunning 350% surge, with the token now trading near $0.488 after gaining another 4.97% today.

What makes this move stand out even more is the broader backdrop the overall crypto market is down nearly 1.29%, with several major altcoins trading in the red.

While larger caps struggle to regain momentum, this Solana-based meme coin continues to attract aggressive buying interest.

Volume expansion, visible whale accumulation, and rising social buzz have fueled the breakout.

But vertical rallies often invite sharp pullbacks.

The real question now is whether this memecoin can convert this momentum into a sustained structure or if profit-booking will slow the move before the psychological $1 level comes into focus.

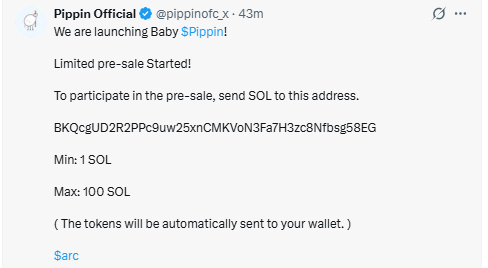

1. Presale Announcement Triggered Buying Interest

The official launch of the “Baby $Pippin” presale on February 19, requiring SOL contributions, acted as a direct catalyst.

Trading volume jumped to $76.5 million within 24 hours, showing strong speculative inflows. Presale hype often boosts short-term momentum, but post-event sell pressure remains a risk.

2. Solana Momentum and Futures Activity

Memecoin is benefiting from ongoing Solana ecosystem buzz. At the same time, a 7.56% spike on Binance Futures indicates leveraged positions amplified volatility.

If SOL strength continues and futures open interest stays elevated, momentum may persist — but leverage-driven moves can unwind quickly.

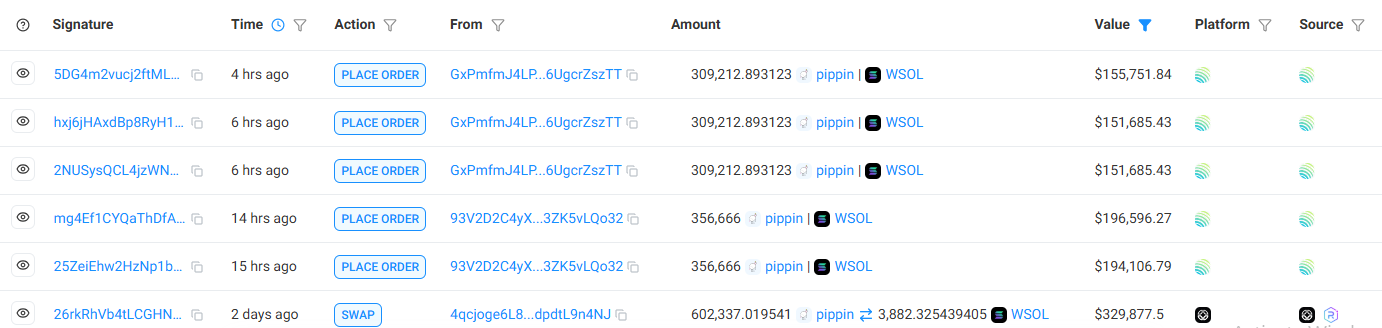

This rally is not driven by retail FOMO alone.

Recent on-chain data from Solscan shows that top-tier wallets and “smart money” accumulated heavily in the $0.40–$0.45 zone.

Whale Activity: In the past 24 hours, 5+ new whale wallets have opened positions in this memecoin.

Liquidity: Liquidity depth on Solana DEXs (Raydium/Jupiter) has improved, reducing slippage on large orders.

On the daily chart, price formed a strong base near $0.1574 over the past two weeks and completed a rounded recovery pattern from that zone.

From the bottom, the price rallied nearly 350%, eventually printing a local high around $0.7692 before entering a short-term profit-booking phase.

Currently, price is trading above the 21 EMA, 50 EMA, and 100 EMA, with a clear bullish crossover structure in place.

This alignment typically reflects a strong upward trend. As long as price holds above these moving averages, the broader bullish structure remains intact.

However, if price breaks below the EMA cluster, downside levels could open toward $0.2768, followed by the major base support near $0.1574.

Key Resistance Levels:

$0.5310

$0.6880

$0.7692

Key Support Levels:

$0.4457

$0.2768

$0.1574

A sustained move above $0.6880 could renew upside momentum, while losing $0.2768 would signal deeper correction risk.

While the 350% rally has been explosive, the long-term PIPPIN Price Prediction depends on the sustainability of the AI-agent narrative on Solana.

Short-Term Outlook: If price flips the $0.5310 resistance into support, a re-test of the $0.7692 ATH is likely. A breakout above this could push the price toward the psychological $1.00 mark sooner than expected.

Mid-Term 2026: As the "Baby $Pippin" ecosystem expands, utility-driven demand could stabilize the price in the $0.85–$1.20 range, provided the overall meme-market liquidity remains healthy.

Long-Term Perspective: If PIPPIN cements itself as the primary AI-mascot on Solana, we could see an expansion toward $1.50–$2.10 by late 2026. However, heavy whale profit-booking at the $1 mark remains a key risk factor.

Invalidation: A daily close below the 100 EMA or the $0.2768 major support will invalidate this bullish structure and shift momentum to the downside.

While the 350% surge is historic, the current PIPPIN Price Prediction remains bullish as long as the $0.4457 support holds.

If price flips $0.6880 into support, the $1.00 mark becomes a realistic target for 2026. However, always watch the $0.2768 invalidation level to manage risk in this volatile Solana AI-agent rally.

Disclaimer: Cryptocurrency investments are highly volatile. This analysis is for informational purposes only and does not constitute financial advice. Always conduct your own research (DYOR) before investing.

Rahul Rathore brings over 3 years of hands-on experience in technical analysis, specializing in crypto, stocks, and market trend forecasting. With a deep understanding of chart patterns, indicators, and market psychology, Rahul delivers precise, actionable insights that help traders and investors make informed decisions. His analytical approach combines technical expertise with real-world market understanding, making his content reliable and highly valued by both novice and experienced traders.