How did ESP manage to rally 42% in a red market where even Espresso Price Prediction 2026 was not on most traders' radar this week?

The broader crypto market opened weak.

Bitcoin faced selling pressure, major altcoins followed, and derivatives sentiment turned cautious. Liquidity was thinning, and most charts were flashing red candles.

And then Espresso (ESP) moved the other way.

ESP surged nearly 42.35% toward $0.0840, printing strong green candles while Bitcoin and several top altcoins struggled near support.

That kind of relative strength rarely appears without a trigger.

Either quiet accumulation was already building beneath the surface, or short positions were forced to unwind quickly once resistance broke.

As price cleared a key level, momentum traders stepped in and volume expanded.

Now the focus shifts to sustainability. Is this the base for bigger Espresso Price Prediction 2026 targets, or just a sharp move inside a fragile market backdrop?

Espresso is not just another altcoin riding short-term momentum. It is an infrastructure layer designed to solve Ethereum fragmentation across Layer 2 networks.

Platforms like Arbitrum and Optimism operate separately, which splits liquidity and reduces capital efficiency.

Espresso introduces a shared sequencing layer that connects rollups, helping transactions move in a more coordinated way.

That foundation matters for Espresso Price Outlook 2026 because long-term value in crypto usually follows real utility.

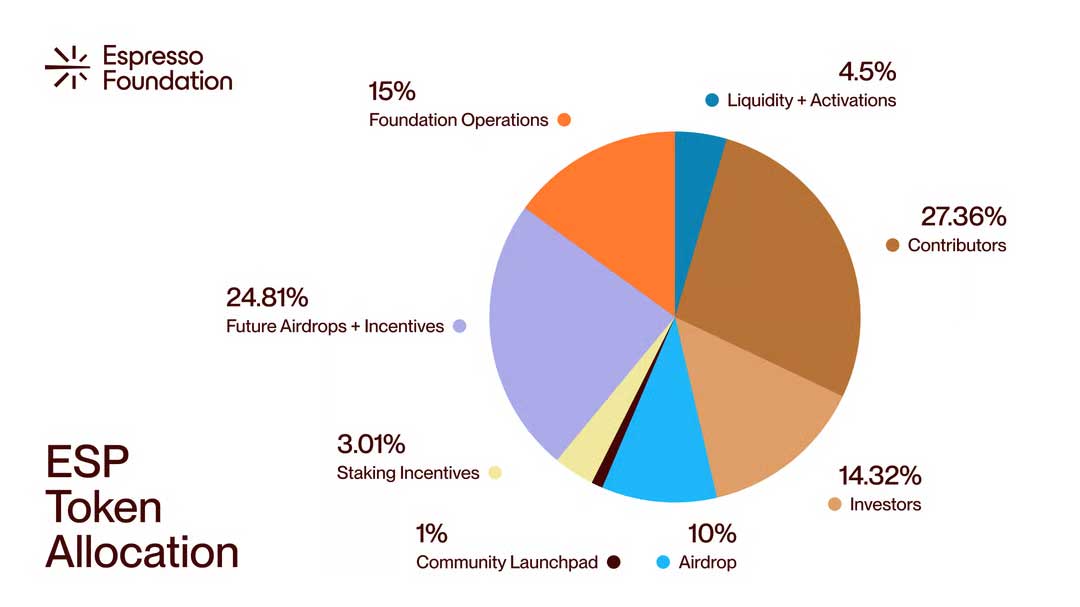

27.36% – Contributors

14.32% – Investors

24.81% – Future Airdrops and Incentives

15% – Foundation Operations

10% – Airdrop

4.5% – Liquidity and Activations

3.01% – Staking Incentives

1% – Community Launchpad

As per the on-chain data shared by Crypto_Pranjal, ESP has a total supply of 3.59 billion tokens, with a circulating supply of 520.55 million ESP.

Currently, the market capitalization stands near $42.21M.

10% of the total supply was allocated to the airdrop, with over 1 million addresses qualifying under a detailed 40+ criteria system.

The airdrop was fully unlocked at TGE, increasing early circulating supply and short-term volatility risk.

Incentives support ecosystem growth, but contributor and investor unlock schedules could create future supply pressure.

Adoption builds demand, while supply timing ultimately shapes price movement.

Espresso is up 42.35% to $0.0840, mainly due to a sharp surge in trading activity.

As per CoinMarketCap's recent data, 24-hour volume jumped 238% to $163M, with a high turnover ratio of 3.73. That signals aggressive speculative interest and strong short-term liquidity.

On the broader side, the Altcoin Season Index rose 6.9% to 31, showing mild capital rotation into select altcoins despite a slightly weak overall market.

Volume came first, and sentiment supported it, but sustainability depends on whether liquidity stays.

ESP was listed on February 12 on Binance, Coinbase, and KuCoin around $0.02780 and quickly spiked to $0.08086.

Looking at the TradingView 4-hour chart, after that strong listing move, the price pulled back and started trading inside a falling channel, showing controlled profit booking.

A solid base formed near $0.05200. That level acted as demand, and once buyers stepped in, ESP broke the falling channel structure and pushed to a new high of $0.09524.

RSI, which had dipped into oversold territory post-listing, has now recovered near 65. Momentum is improving but not overheated yet.

Key Levels

Resistance:

$0.08868

$0.09524

$0.10167

Support:

$0.05814

$0.05200

$0.02749

Holding above $0.08868 keeps upside pressure intact. Losing $0.05200 weakens will invalidate the current bullish structure

Espresso Price Prediction 2026: Short, Mid, and Long-Term Outlook

The recent 42% rally clearly shows rising trader interest. But whether that momentum holds into 2026 depends on structure, adoption, and supply flow.

Short-Term Outlook 2026: Volatility Phase

In the next 3–6 months, Espresso's future price will largely depend on supply absorption. With 10% of airdrop tokens already unlocked, selling pressure can appear on rallies.

If ESP flips $0.08868 into support, a move toward $0.12 is possible. However, due to Binance Seed Tag classification, sharp 20–30% pullbacks should be expected during volatility spikes.

Mid-Term Outlook 2026: Adoption Catalyst

If Espresso delivers roadmap milestones like sub-second finality and deepens integration with major Layer 2 ecosystems, utility demand could strengthen.

Under stable liquidity conditions, price may test the $0.15–$0.22 zone during this phase.

Long-Term Outlook 2026: Structural Expansion

If Espresso establishes itself as a shared sequencer standard within modular blockchain infrastructure, upside toward $0.35–$0.48 becomes achievable.

However, investor and contributor unlock schedules may limit sustained moves above $0.50 due to gradual supply expansion.

Espresso Price Prediction 2026 hinges on adoption and how unlocked supply is absorbed.

A strong infrastructure narrative supports the long-term case, but volatility is expected.

$0.05200 remains the key support for Espresso Price Forecast 2026.

A break below it invalidates the bullish structure.

Disclaimer: Cryptocurrency markets are highly volatile. This analysis is based on technical structure and publicly available information and does not constitute financial advice. Investors should conduct their own research and assess risk tolerance before making investment decisions.

Rahul Rathore brings over 3 years of hands-on experience in technical analysis, specializing in crypto, stocks, and market trend forecasting. With a deep understanding of chart patterns, indicators, and market psychology, Rahul delivers precise, actionable insights that help traders and investors make informed decisions. His analytical approach combines technical expertise with real-world market understanding, making his content reliable and highly valued by both novice and experienced traders.