Ethereum had a strong rally earlier; that part is clear—price moved fast, sentiment flipped bullish, and a lot of traders jumped in. That phase looks done for now; recent price action feels slower, and follow-through is missing.

After the rally, ETH tried to hold higher levels, but momentum faded. Some buyers are still there, but not so aggressive; each bounce is getting sold into. Price is not falling like a crash, but strength is missing, and it looks like weakness is coming in.

Right now, Ethereum is moving into a cooldown phase; similar to the broader crypto market, volume is lighter, reactions are slower, and because of this, Ethereum price prediction is no longer about upside targets. It is about how much pressure ETH can absorb and where it finally stabilizes before the next real move.

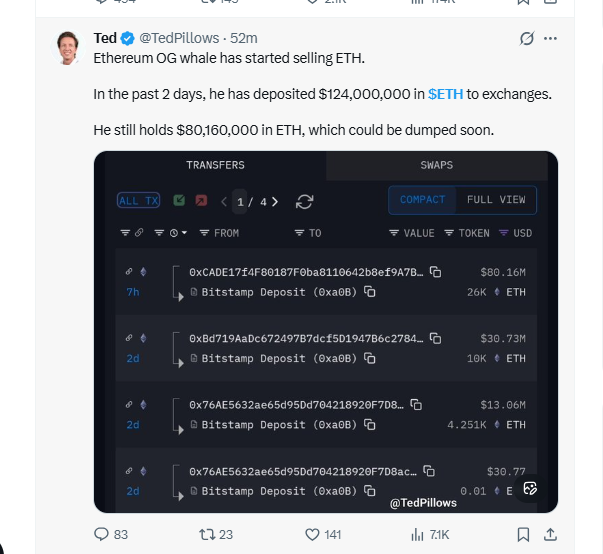

Recent on-chain data shows one thing clearly. An old Ethereum whale has started sending ETH to exchanges. In the last two days, approximately $124 million worth of ETH has been moved. This is usually not for holding; in most cases, it's for selling.

Source: @TedPillows

Even now, there's over $80 million of ETH sitting in that wallet. This means the pressure hasn't ended. When such supply hits the market, it becomes difficult for the price to go up, as large holder activity often keeps pressure on the price after a rally.

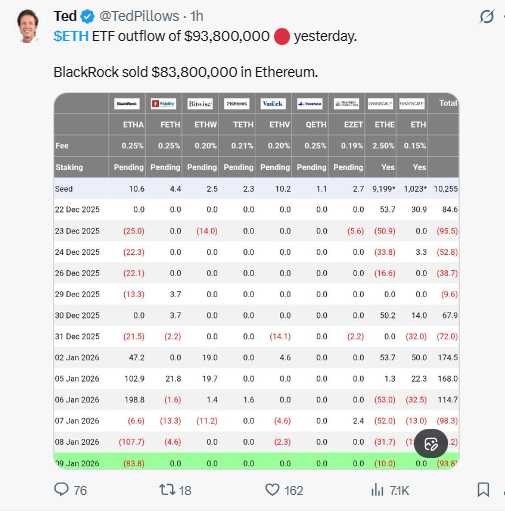

Things are looking soft on the ETF side as well. There was an outflow of approximately $93.8 million in a single day. Of this, BlackRock sold around $83.8 million worth of ETH. Institutions usually don't exit just like that. When they do, the market slows down.

Source: @TedPillows

If money is flowing out of ETFs after a rally, it's a sign of reduced demand. The effect isn't like an immediate crash, but the momentum gradually fades. And ETH seems to be in that phase right now.

Ethereum's rally structure on the 4-hour chart now appears to be weakening. Price rejected above the rising channel and fell back into the channel. The mid-level support that followed failed to hold. This means buyers are not in control in the short term.

Source: TradingView

Ethereum is trading below the 50 EMA, which was previously support and has become resistance. The $3,150–$3,180 zone appears to be a short-term selling zone. Every bounce is slowing here.

On the downside, $3,040–$3,000 is the first support. If this level is broken, the $2,950–$2,900 zone will be the next strong support. Unless ETH makes a strong close above $3,200, the short-term structure looks like a sell-on-bounce, not a fresh bullish continuation.

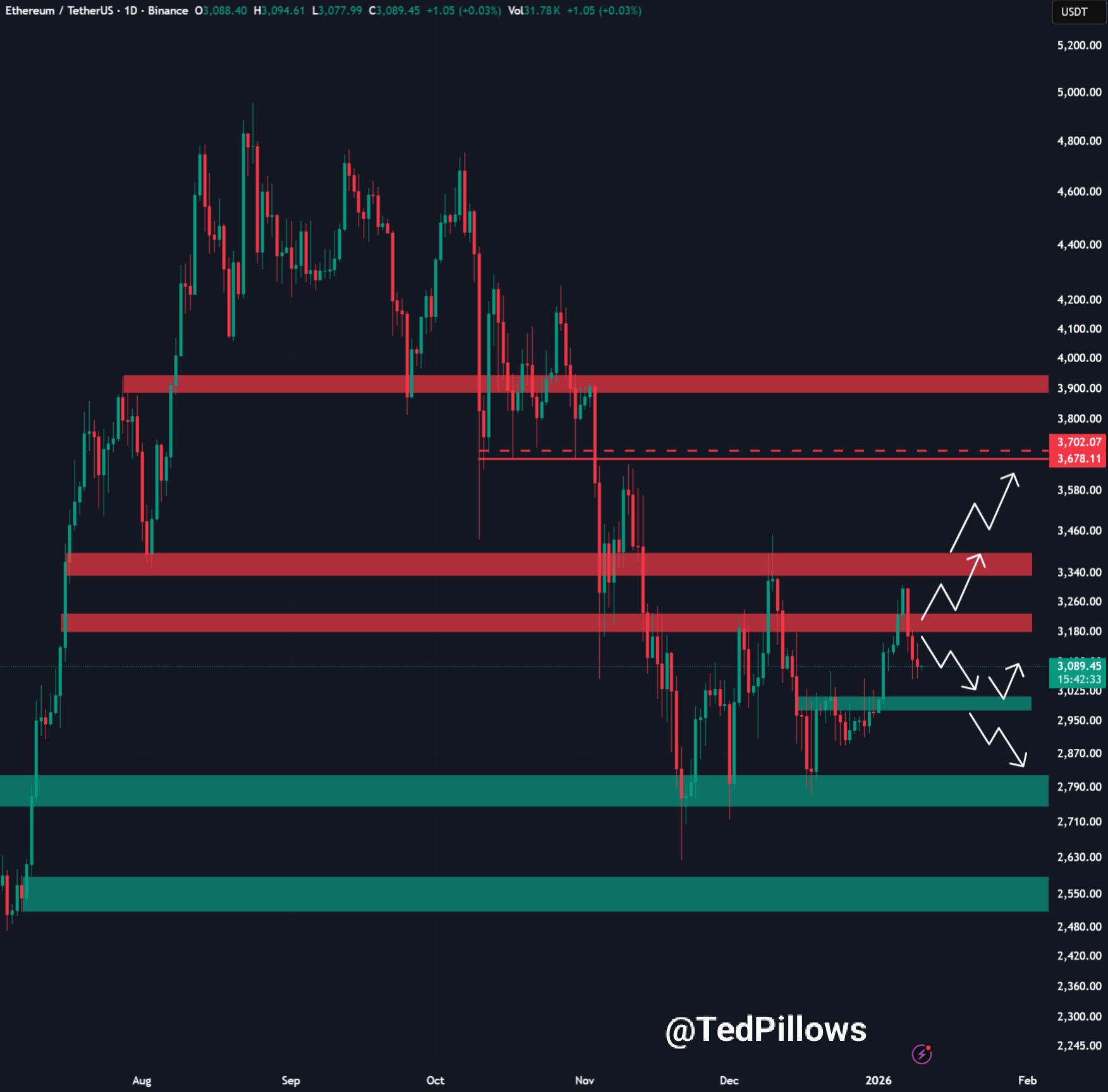

Looking at the daily chart, it appears that price has currently paused after a brief rally. According to an analyst, the price faced repeated rejections from the $3,350–$3,400 zone. Selling occurred from here each time. This area clearly behaved like a distribution.

After that, structure gradually changed. Where previously higher highs were being formed, now lower highs and lower lows began to appear. Meaning, long-term momentum was not strong. The price began to move in a range rather than trending.

Source: @TedPillows

Right now, ETH is mostly hovering between $3,000–$3,200. Neither buyers nor sellers are pushing much, nor are they in full control. On the upside, there is heavy resistance at $3,260–$3,350. Even if it breaks through here, selling could resume near $3,400–$3,450. A real bullish shift will occur only if ETH holds well above $3,600–$3,700.

Looking below, $2,950–$3,000 appears to be the main support. If this area is broken, $2,780–$2,700 could be the next demand zone. And if pressure increases further, a slide to $2,550 would not be surprising. Overall, until ETH reclaims its old highs, the long-term view will remain a bit cautious.

From an expert angle, Ethereum price prediction looks more cautious right now. After the rally, momentum has cooled. Whale selling and ETF outflows show that bigger players are stepping back, at least for now. This does not look like a crash, but it also does not look strong. As long as Ethereum stays below key resistance areas, upside may stay limited. The next move depends more on support holding than on fresh buying pressure.

YMYL Disclaimer: This article is strictly informational in nature and does not constitute an investment recommendation. Investment in cryptocurrencies is extremely volatile. It is always essential to do your own research before making any investment.

Rahul Rathore brings over 3 years of hands-on experience in technical analysis, specializing in crypto, stocks, and market trend forecasting. With a deep understanding of chart patterns, indicators, and market psychology, Rahul delivers precise, actionable insights that help traders and investors make informed decisions. His analytical approach combines technical expertise with real-world market understanding, making his content reliable and highly valued by both novice and experienced traders.