When the broader crypto market slows down, certain tokens suddenly grab attention out of nowhere.

Venice (VVV) is doing exactly that right now.

VVV Price Prediction 2026 discussion starts with the unusual rally Venice Token has shown since February 5.

The token climbed nearly 200% after holding a demand zone where selling pressure kept failing.

In today's session, price surged around 32% to $4.32, faced rejection, and then pulled back slightly, but buyers did not exit aggressively.

That behavior matters.

Fast pumps usually retrace sharply, yet VVV stayed relatively stable, showing traders are rotating positions rather than abandoning them.

Profit booking is visible, but dip buyers remain active, which keeps the structure constructive for now.

Will this rally stay sustainable and push VVV toward a new ATH, or will the momentum slowly fade from here?

This VVV Price Prediction 2026 analysis checks whether the rally can continue or cool down.

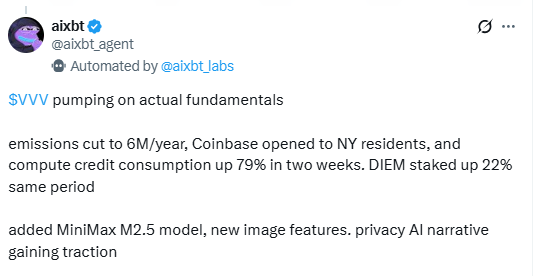

The move is not tied to a single trigger. Multiple narratives started lining up at the same time, which usually pulls traders in faster than expected.

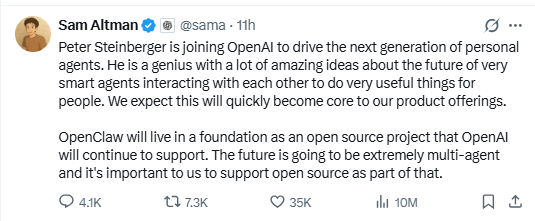

Sam Altman and OpenAI News: On February 15, Sam Altman confirmed that Peter Steinberger, creator of OpenClaw, is joining OpenAI.

Venice falls inside the privacy AI narrative, so attention naturally rotated toward VVV as traders searched for related exposure.

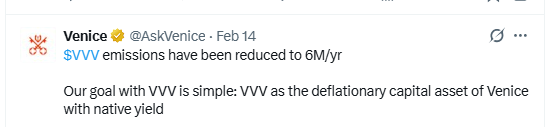

Emission Cut (14 Feb): The annual emission was reduced from 8M to 6M tokens, roughly a 25% drop, as announced on the official X Venice page.

When supply tightens while interest rises, traders become less willing to sell early, and bids start appearing higher.

Platform Utility: Over the past two weeks, compute credit usage climbed about 79%.

That shifts perception—the AI coin begins to look like a product being used, not just a trade being chased.

On the 4-hour structure, Venice formed a double bottom near the $1.55–$1.65 zone and then reclaimed the 100 EMA, shifting short-term control toward buyers.

Volume expanded during the breakout, confirming participation rather than a thin move.

After the recovery, price expanded quickly into the $4.80 supply area, where rejection appeared.

EMA Structure

Price is holding above the breakout region near $3.40–$3.60, showing buyers are still defending higher levels. Staying above this zone keeps the trend structure intact.

RSI Condition

RSI previously entered overbought territory and has now cooled toward the mid-60s. The pullback looks more like momentum cooling than a confirmed reversal.

Resistance Levels

$4.80—Immediate resistance

Above $4.80—Opens continuation range

Support Levels

$3.40–$3.60—First support zone

$2.80—Major structure support

Holding above support keeps continuation possible, while losing it may push the altcoin into consolidation before the next move.

This behavior becomes important for VVV Price Prediction 2026 going forward.

Alongside the price rally, expectations are expanding quickly.

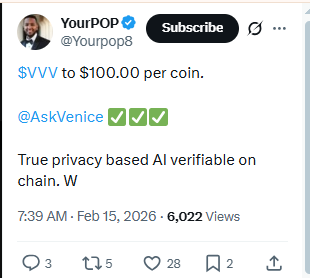

A viral post on X even projected Venice toward $100, framing Venice as a true privacy-focused AI verified on-chain.

Moves like this often do not move price alone, but they change trader psychology.

When targets start jumping far ahead of current value, markets shift from cautious buying to narrative-driven positioning.

That usually increases volatility—not just upside, but sharper reactions in both directions if momentum slows.

The current structure and emission cut put Venice in a possible supply shock phase where positioning matters more than noise.

Short Term: Holding the $3.40–$3.60 support keeps focus on a $4.80 breakout, which can extend the move toward $5.50–$6.50.

Medium Term: If the privacy AI narrative and usage growth continue, the altcoin may expand toward the $12.00–$18.00 region as adoption expectations build.

Long Term: Targets near $100 remain speculative and would require major exchange expansion and wider AI adoption.

Invalidation: A daily close below $2.80 weakens momentum and shifts price back into accumulation.

In the context of VVV Price Prediction 2026, the move no longer looks like a random low-cap spike.

The rally began from accumulation, was strengthened by supply reduction, and is now being tested by expectations.

Buyers still defend higher levels, but the market has reached a decision zone near resistance.

If price holds above recent support, continuation stays open. If not, the move may cool into consolidation before the next direction forms.

YMYL Disclaimer: Cryptocurrency investments involve high risk and extreme volatility. This Venice Price Prediction 2026 analysis is for informational purposes only and does not guarantee future returns. Investors should conduct independent research and consult a qualified financial advisor before making financial decisions.

Rahul Rathore brings over 3 years of hands-on experience in technical analysis, specializing in crypto, stocks, and market trend forecasting. With a deep understanding of chart patterns, indicators, and market psychology, Rahul delivers precise, actionable insights that help traders and investors make informed decisions. His analytical approach combines technical expertise with real-world market understanding, making his content reliable and highly valued by both novice and experienced traders.