PUMP is starting to move differently from how it did during its last quiet phase.

The price is no longer drifting without purpose.

The wider market is moving sideways, but Pump.fun is finding buyers again.

In the last 24 hours, coin rose nearly 22.7%, while the broader crypto market gained only around 0.3%, and this gap is hard to ignore.

There are signs of fresh activity in volume and short-term positioning.

Trading volume jumped by more than 53%, showing that interest has returned suddenly.

Pump.fun Price Prediction 2026 is no longer only about Memecoin’s quick hype cycles.

It is slowly turning into a question of whether money wants to stay here a little longer.

There is no fresh bullish news behind this rally; price is moving first, and the story is forming later.

This phase does not look loud, but it looks watchful.

And the question now is not about one green candle.

It is about whether price can challenge its old highs or whether this rally fades first.

On the TradingView 4-hour chart, coin is forming a clear cup and handle pattern and is now trading close to its neckline zone, where the price is trying to break out.

This structure usually appears after a long decline and shows that price is building strength for a possible upside move.

Volume has also increased during this move, matching the rise in price and showing fresh participation from traders.

What the Indicators Say

RSI: RSI is near 75, showing strong momentum with still some room for further upside before exhaustion.

200 EMA: Price has moved above the 200 EMA, and this level is now acting as short-term support, which improves the recovery structure of the short-term Pump.fun price outlook.

Key Levels to Watch

Short-Term Resistance: $0.00320 – $0.00330

Short-Term Support: $0.00260 – $0.00270

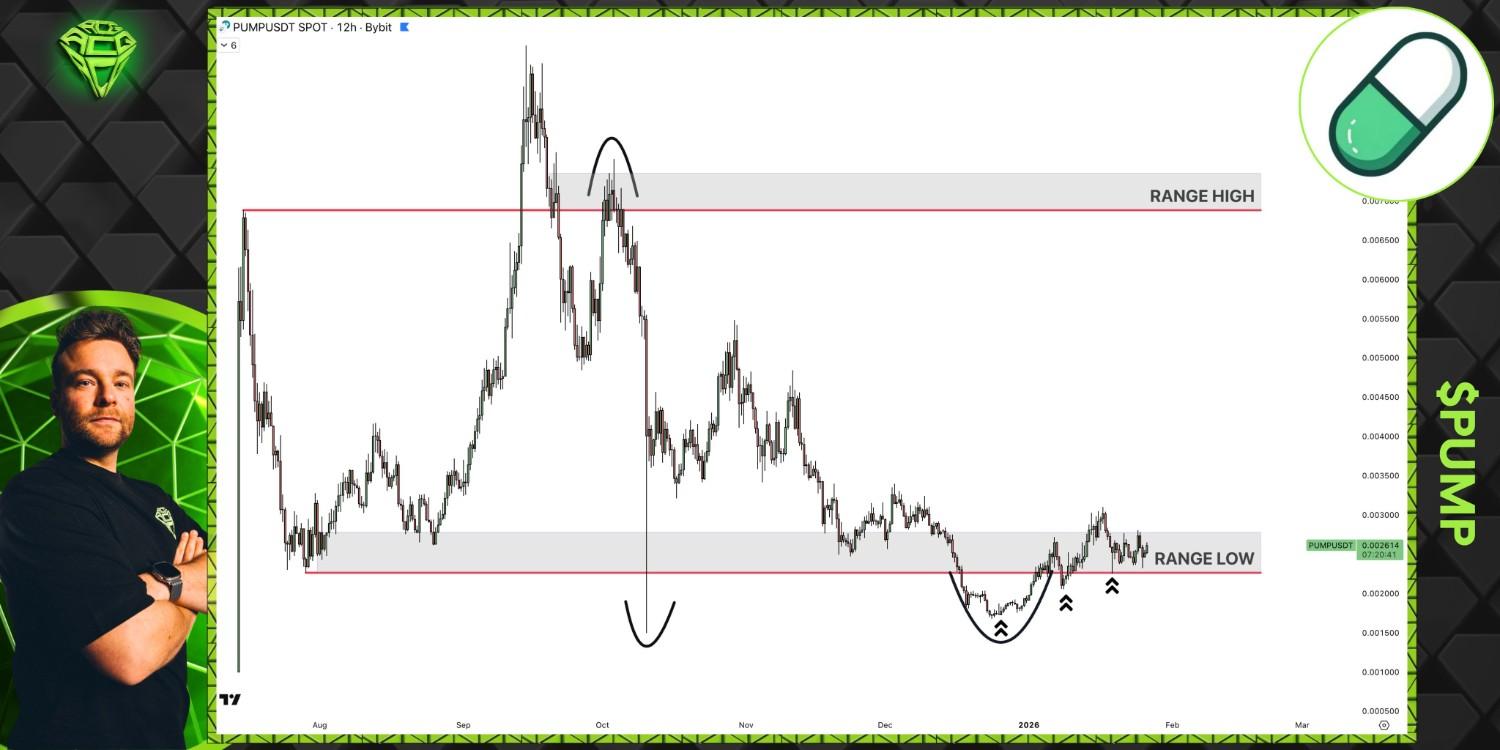

Technical market analyst Sjuul Follings (@AltCryptoGems) has highlighted on X that Pump.fun is still holding its key support area near the $0.0022–$0.0025 zone, even as many altcoins continue to trend lower.

While several tokens are breaking structure, Coin price is spending time defending this lower range instead of slipping further down.

This behavior usually shows that selling pressure is thinning out around this level.

It also suggests that buyers are stepping in earlier, rather than waiting for deeper drops.

Sjuul Follings adds that if the broader crypto market sees a relief move, this coin could start reacting faster than many other small tokens that have already lost their range structure.

On the upside, the broader range high sits near the $0.0058–$0.0062 zone, which remains the area traders will watch if momentum builds.

Market analyst Hailey Elizabeth Routzon (@TheMoonHailey) has noted that coins's price is getting a strong bounce from its long-term support zone on the daily chart.

For many weeks, price had been trading inside a falling wedge structure, showing a slow decline with tightening price action.

This pattern often appears when selling pressure starts to weaken rather than expand. The recent bounce from support suggests that buyers are beginning to step in where price had been compressing for a long time.

Price is no longer sliding freely lower and is instead holding inside a base area after that prolonged wedge breakdown phase.

Based on this structure, the next major upside zone sits near the $0.010 area if momentum continues to build.

Short-Term Price Prediction: If price stays above its current support zone, it can attempt a move toward the $0.004062–$0.004574 area in the near term.

This zone marks the first major test for buyers after the recent breakout attempt.

Long-Term Price Prediction: On higher timeframes, the structure still looks like an early recovery phase rather than a confirmed trend shift.

If momentum continues to build, the chart keeps the $0.005039, $0.007553, $0.009056, and $0.010 zones in focus as the next major upside areas over time.

Invalidation: A sustained close below the 200 EMA would weaken the current bullish setup. Such a move would shift focus back toward the lower trading range and reduce the probability of higher targets in the near term.

Pump.fun Price Prediction 2026 is now moving through a phase where structure matters more than speed. Short-term charts show momentum, while higher timeframes still demand patience.

The next direction will depend on how price behaves near support, as analysts see Pump.fun in an early recovery phase where buyer defense will decide whether this move grows into a broader shift or fades back into its range.

YMYL Disclaimer: This cryptocurrency article is strictly informational in nature and does not constitute an investment recommendation. Investment in cryptocurrencies is extremely volatile. It is always essential to do your own research before making any investment.

Rahul Rathore brings over 3 years of hands-on experience in technical analysis, specializing in crypto, stocks, and market trend forecasting. With a deep understanding of chart patterns, indicators, and market psychology, Rahul delivers precise, actionable insights that help traders and investors make informed decisions. His analytical approach combines technical expertise with real-world market understanding, making his content reliable and highly valued by both novice and experienced traders.