The conversation around XRP Price Prediction 2026 is no longer just about short-term speculation.

With regulatory clarity improving and Ripple gaining stronger institutional footing, Ripple is gradually shifting from a legal uncertainty story to a utility-driven narrative.

The resolution of Ripple’s battle with the SEC has reduced a major overhang that previously limited investor confidence.

As regulatory risks fade, institutional interest in cross-border payment solutions is becoming more visible.

This Altcoin is positioning as a bridge currency in global settlements adds a structural layer to its long-term outlook.

If liquidity continues to expand and adoption strengthens, the Ripple Price Prediction 2026 discussion could realistically move toward higher psychological levels, including the $13 zone.

The key focus now is sustained demand, not just temporary hype.

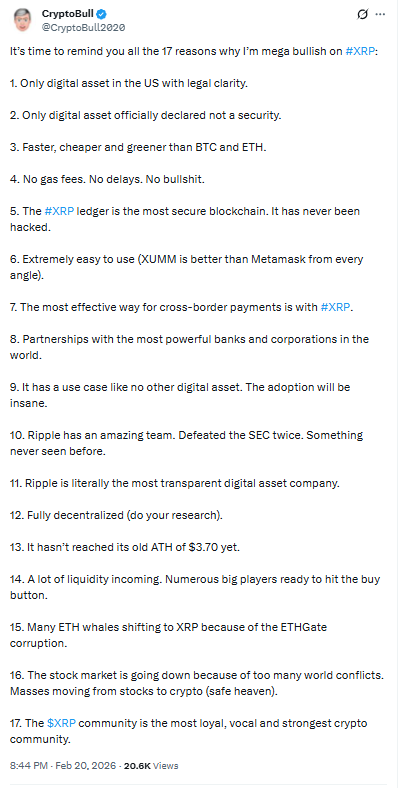

As highlighted by CryptoBull (@CryptoBull2020) on X, he outlined 17 reasons for his strong bullish stance on Ripple , pointing to legal clarity, institutional backing, major banking partnerships, and expanding real-world use cases.

The thread reflects growing confidence within the community, emphasizing regulatory advantage, liquidity growth, and Ripple positioning in global cross-border payments.

As reported by BSC News (@BSCNews), altcoin is outperforming Bitcoin and Ethereum in institutional capital flows.

According to CoinShares data, XRP has seen $150 million in fresh inflows this year, while Bitcoin and Ethereum have recorded roughly $1.5 billion in combined outflows, signaling relative strength in institutional positioning.

Price is currently trading inside a falling channel on the daily timeframe, reflecting sustained downward pressure.

However, RSI is attempting to move higher from the oversold zone, signaling a potential short-term relief bounce.

The 21 EMA is acting as dynamic resistance, capping upside attempts.

A decisive close above the $1.59 level, followed by reclaiming the 21 EMA, could open room for a recovery toward higher resistance zones.

Until that happens, the broader structure remains corrective within the channel.

Key Support Levels

$1.25

$1.05

Key Resistance Levels

$1.59

$2.00

$2.34

On the 3-day timeframe shared by CryptoBull, price appears to be moving within a long-term ascending structure.

The chart highlights a breakout trajectory that, if momentum is sustained, projects a potential move toward the $13 level in the coming weeks.

The setup assumes continuation above the rising trendline support and strong bullish expansion.

However, such a sharp move would require significant volume confirmation and broader market alignment.

While the structure shows upside potential, follow-through strength will determine whether this projection materializes.

As noted by ChartNerdTA, XRP is once again approaching its long-term 9-year ascending support trendline, marking what could be a third major point of contact on this structural base.

Historically, each bounce from this support has led to significant upside expansion. However, for bullish continuation to accelerate, price would need to break above the white descending resistance trendline.

A confirmed breakout above that level could shift momentum sharply and open the door for stronger euphoric upside moves.

The XRP Price Prediction 2026 outlook is increasingly shaped by a mix of regulatory clarity, institutional inflows, and long-term structural support.

While real-world adoption and on-chain developments strengthen the bullish narrative, price still needs to reclaim key resistance levels to confirm momentum.

Short-term recovery hinges on breaking above the falling channel and reclaiming the 21 EMA, while higher timeframe breakouts could unlock larger targets discussed by analysts.

Until those confirmations arrive, token remains positioned between structural opportunity and technical validation, with risk management remaining essential.

YMYL Disclaimer: This article is for informational purposes only and does not constitute financial advice. Crypto investments carry high market risk. Always do your own research or consult a professional advisor before investing.

Rahul Rathore brings over 3 years of hands-on experience in technical analysis, specializing in crypto, stocks, and market trend forecasting. With a deep understanding of chart patterns, indicators, and market psychology, Rahul delivers precise, actionable insights that help traders and investors make informed decisions. His analytical approach combines technical expertise with real-world market understanding, making his content reliable and highly valued by both novice and experienced traders.