What happens when a privacy-focused crypto project launches on Binance, OKX, Bybit, and several top exchanges on the same day? That’s the key question investors are asking as the token circulation begins on February 2, 2026.

The early hype is strong, trading access is global, and the technology narrative is powerful. Now, the real test begins—can it turn this momentum into lasting price growth?

The token officially enters circulation at 12:00 UTC on February 2, 2026. Users who claimed Prime Sale Keys can start trading immediately on Binance Alpha, where it is listed with a Seed Tag, indicating higher volatility but strong innovation potential.

Beyond Binance, the coin is launching across multiple major platforms. Gate opens pair at 13:00 UTC, followed by zero-fee conversion at 14:00 UTC.

KuCoin supports across Futures, Convert, and Payment services, while OKX, Bybit, Bitget, MEXC, LBank, and Bitrue provide broad global liquidity from day one.

ZAMA is the native token of the Zama Protocol, an open-source cryptography company focused on Fully Homomorphic Encryption (FHE). FHE allows smart contracts to compute encrypted data without revealing sensitive information.

As blockchain adoption grows, privacy and compliance are becoming essential. Because of this, many investors view as a long term infrastructure asset, not just a short-term speculative asset.

The token has a fixed total supply of 11 billion, designed to support long-term growth rather than quick inflation.

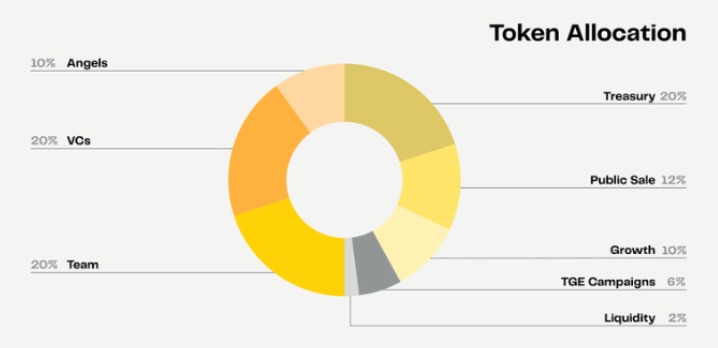

Key Tokenomics Highlights:

20% circulating at TGE, limiting early supply

20% each for Treasury, Team, and VCs, aligned with long-term development

12% Public Sale for broader participation

10% Growth + 10% Angels to expand the ecosystem

6% TGE campaigns and 2% liquidity for launch stability

This structure reduces sell pressure early while supporting gradual adoption.

Given the low initial circulation and multiple top-tier exchange listings, it is expected to launch with volatility but strong support.

Expected Listing Range:

$0.015 to $0.025

Early price movement will likely depend on:

TGE reward selling

Binance Seed Tag risk awareness

Short-term trader demand

Still, broad liquidity across exchanges gives the project a solid launch base.

In the first few months, strong trading volume and the FHE narrative could push prices higher.

Short-Term Target:

$0.025 to $0.04

However, pullbacks are possible as early investors take profits and token unlocks begin. This phase may favor swing traders rather than long term holders.

If it successfully drives real adoption of FHE in blockchain, it could see meaningful long-term growth.

Long-Term Outlook:

$0.10+ in a strong market cycle

This target depends on:

Developer adoption

Enterprise use cases

Consistent ecosystem growth

Favorable crypto market conditions

ZAMA’s gradual vesting schedule may help stabilize prices over time.

This content is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency investments carry high risk. Always conduct your own research before investing.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.