Gold, silver, and the crypto market have already wiped out billions of dollars.

What began as a normal correction has now turned into real damage across portfolios.

Bitcoin is bleeding, and the market can feel it.

After forming a local high of $97,924 in January 2026, the price has fallen by nearly 24%.

This drop has changed how people view Bitcoin Price Prediction 2026. The focus is no longer on the upside.

It is now on how much downside may still be left.

As of February 2, 2026, Bitcoin is trading near its lowest levels in months, approx. $74,500–$76,000. This level matters. Technically, it acted as support before.

Psychologically, many traders believed this was a safe zone.

That belief is now under pressure.

The big question is simple:

Can BTC recover from $74,000, or is this support about to break and push the price lower?

Recent on-chain data shared by DeFiTracer shows that Binance has started liquidating millions of dollars' worth of crypto, with repeated BTC and ETH transfers hitting exchanges within minutes.

This data matters to traders because it adds a fresh supply to the market when buyers are already cautious.

Large transfers to exchanges usually appear when holders are preparing to sell, not to store assets.

This selling pressure feels more serious when it comes from old wallets, not just short-term traders.

According to a report shared by CryptoNobler, a Satoshi-era wallet that had remained inactive for nearly 15 years has moved around 11,000 BTC.

While this does not change total supply much, it sends a strong psychological signal to the market.

For many traders, the activity of such old wallets increases fear and weakens confidence at a time when price is already under pressure.

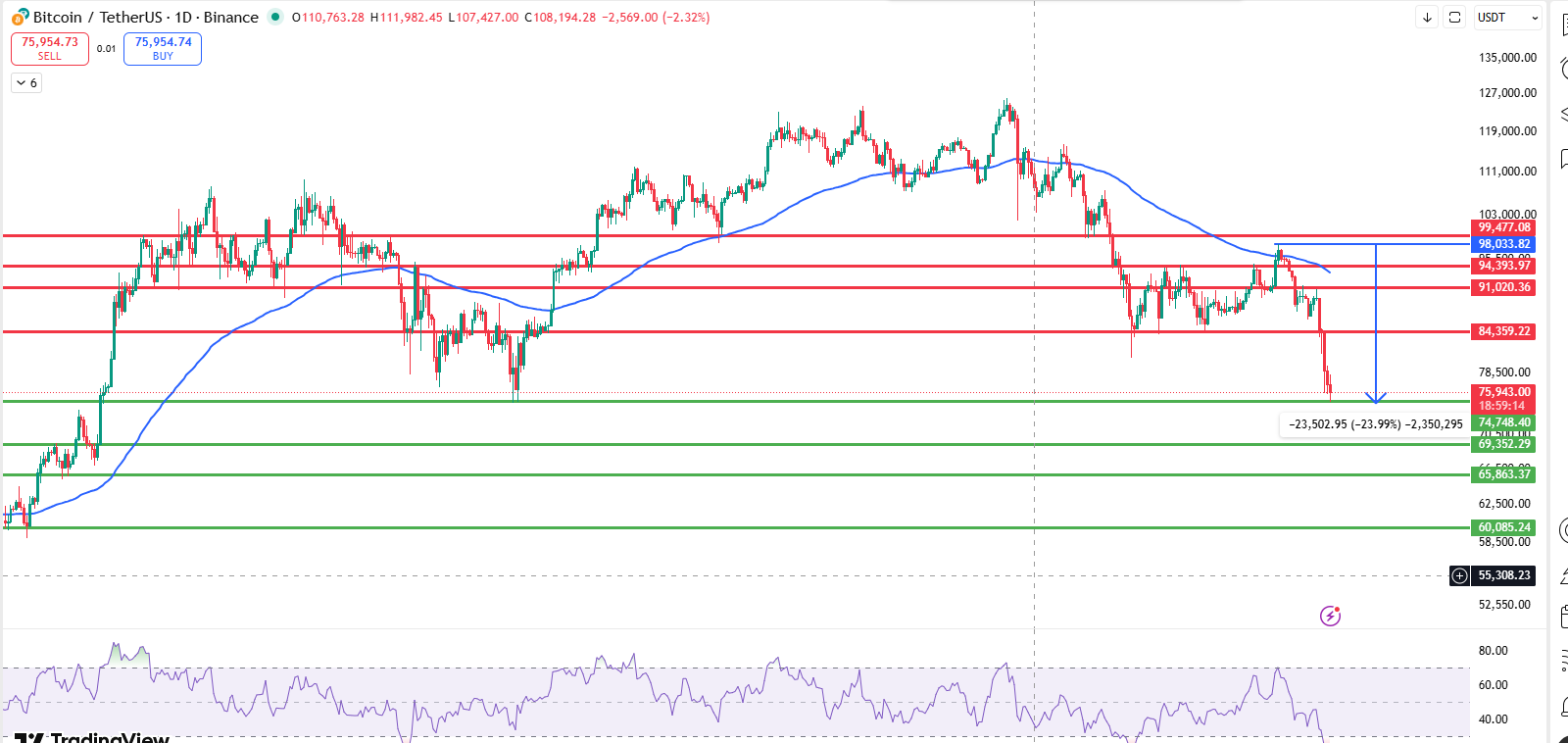

On the daily chart on TradingView, Bitcoin is currently standing on its 2025 low, which is an important support zone. This level has acted as a base before, so the market is watching it closely.

If this support fails, the next downside levels to watch are around $69,352 and then near $65,863.

These zones previously showed buying interest and could act as the next areas where price may try to stabilize.

On the indicator side, RSI is now in the oversold zone, which means a short-term recovery is possible.

Such rebounds usually come from short covering and dip buyers stepping in.

However, any recovery from here may face strong resistance near $84,359 and then around $91,020.

These levels were earlier support and are now turning into selling zones.

For now, price is sitting at a decision point.

A hold keeps recovery hopes alive, and a break opens the door to deeper levels.

Recent data shared by analyst TedPillows shows that Bitcoin has closed below the 100-week EMA for the first time in this cycle.

This is a level that previously acted as long-term trend support.

The last time Bitcoin lost this zone, price fell by nearly 58% before finding stability again.

This does not mean the same drop must repeat, but it changes how traders look at risk.

When a long-term support breaks, the market usually searches for a deeper base before confidence returns.

Right now, this adds weight to the fear already building around current support levels.

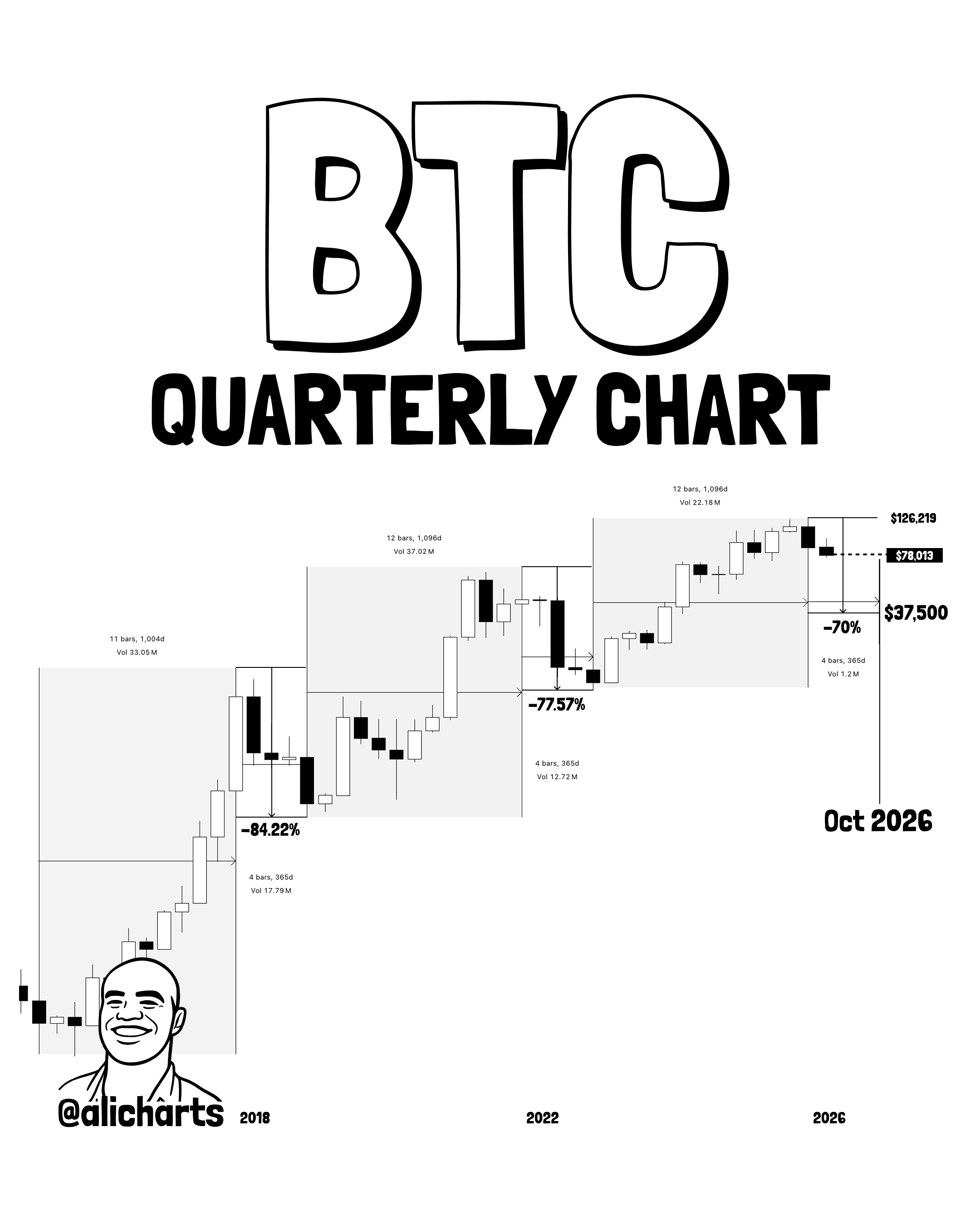

Data shared by Ali Martinez highlights a repeating pattern on the quarterly chart.

Bitcoin has previously seen deep pullbacks of around 70% to 80% after major cycle tops.

Based on this structure, some projections point toward a possible move near the $37,500 zone by October 2026 if history plays out in a similar way.

This scenario is based on past cycle behavior, not a fixed outcome.

Market structure can change when sentiment and liquidity shift.

Invalidation: If Bitcoin holds above current long-term support and reclaims key resistance zones on higher time frames, this deep-drop scenario would lose relevance.

A sustained move back above major trend levels would signal that the market is choosing recovery over another historical-style reset.

From an analyst perspective, BTC Price Prediction 2026 now depends on how Bitcoin behaves near the $74,000 support zone.

Price has already dropped nearly 24% from the January high, shifting trader focus from upside to capital protection.

If this level breaks, demand zones near $69,352 and $65,863 come into focus. Deeper cycle-based projections also point toward the $37,500 region.

On the upside, any recovery is likely to face resistance near $84,359 and $91,020, where selling pressure appeared earlier.

The next move depends on whether buyers defend current levels or step aside.

YMYL Disclaimer: This article is strictly informational in nature and does not constitute an investment recommendation. Investment in cryptocurrencies is extremely volatile, and market conditions can change quickly based on macro data. It is always essential to do your own research before making any investment.

Rahul Rathore brings over 3 years of hands-on experience in technical analysis, specializing in crypto, stocks, and market trend forecasting. With a deep understanding of chart patterns, indicators, and market psychology, Rahul delivers precise, actionable insights that help traders and investors make informed decisions. His analytical approach combines technical expertise with real-world market understanding, making his content reliable and highly valued by both novice and experienced traders.