The Indian Union Budget 2026 has added fresh pressure on the crypto market, and Ethereum is feeling the impact.

Investors were hoping for relief on the 30% tax or the 1% TDS.

That did not happen. Instead, stricter reporting rules and new penalties have increased fear across the market.

This shock has changed how traders look at Ethereum Price Prediction 2026.

As of February 2, 2026, Ethereum has dropped nearly 36% from its recent high and is now struggling near the $2,200 support level, while Bitcoin trades around $74,000.

The focus is no longer on buying dips; now it is on protecting capital.

New budget rules propose penalties for incorrect or delayed crypto reporting. This has made many traders cautious. At the same time, heavy liquidations on major exchanges are adding more selling pressure.

With the $2,400 support now broken, Ethereum price forecast centers on whether ETH can recover or continue sliding toward $1,500 after a 36% drop.

The question facing the market is simple:

Is this only a short-term correction, or is Ethereum preparing for a deeper move toward lower levels?

ETH plays a key role in the crypto market, but today it is under strong pressure.

A mix of regulatory fear, heavy liquidations, and institutional outflows has pushed ETH below the $2,200 level and changed short-term sentiment.

Reason One: Budget 2026 Pressure

The Union Budget 2026 triggered today’s sell-off in ETH. Investors expected relief on the 30% tax or 1% TDS, but instead got stricter reporting rules and new penalties.

The New Budget 2026 rules introduce a ₹200 per day fine for non-filing and a ₹50,000 penalty for misreporting, effective from April 1, 2026.

This has increased fear among retail traders.

Reason Two: Massive Liquidations Add Fuel to the Drop

Recent Coinglass data shared by TedPillows shows that over $2.18 billion in long positions has been liquidated in the last 24 hours across major exchanges.

In just a few hours, over $120 million worth of leveraged trades were wiped out.

This is the largest liquidation event of 2026 so far, wiping out months of gains in just 48 hours

This wave of liquidations started after price slipped below the $2,400 support level. When leveraged traders are forced to exit, they sell at market price.

Reason Three: ETF Outflows Add More Pressure

Recent ETF data shared by TheCryptoBasic shows heavy outflows from crypto ETFs.

Between Jan 26 and Jan 30, Bitcoin spot ETFs saw net outflows of $1.49 billion, while Ethereum spot ETFs recorded outflows of $326.93 million.

This shows that institutional money is moving away from crypto during rising macro uncertainty.

When large funds reduce exposure, market confidence weakens.

On the daily TradingView ETH chart, the price has been trading inside a falling channel for several months, showing a steady downward structure.

The recent move from the $3,000 area on January 29 turned into a sharp drop of nearly 37%, confirming strong selling pressure.

During this decline, price also broke below the $2,400 support level, which had acted as a base earlier.

Right now, price is trading near the lower end of the channel, where the $2,100 zone stands out as the next important ETH support area .

If the price slips below this channel structure, the chart opens space toward the $1,854 level.

Continued selling pressure could expose even lower zones over time.

On the momentum side, RSI is now in the oversold region, which means a short-term bounce is possible.

However, unless Ethereum moves back above $2,400 and holds, the broader trend remains bearish, and recovery attempts may struggle.

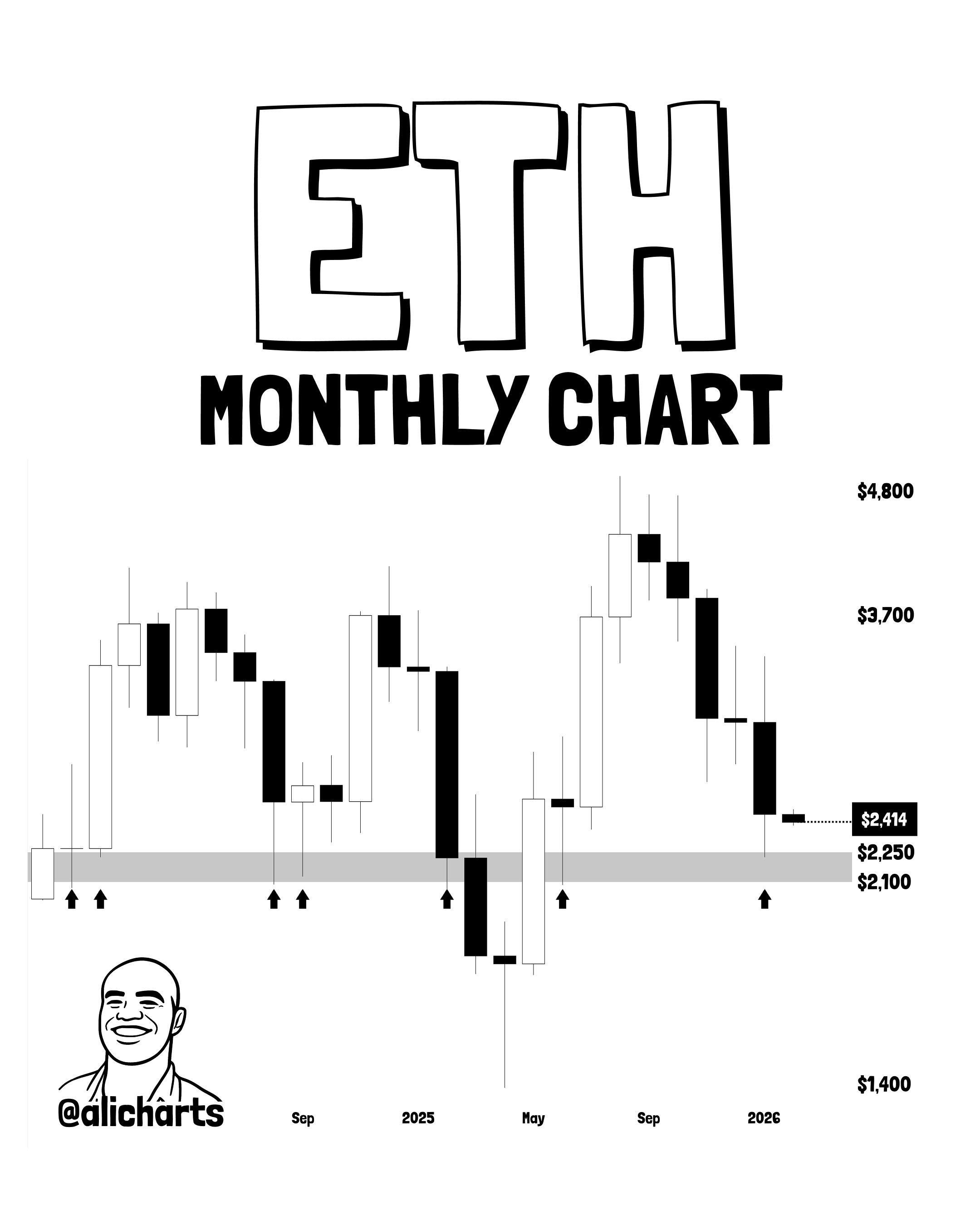

Data shared by Ali Martinez shows that the $2,250 to $2,100 zone has acted as a major support range for Ethereum over the past two years.

Now, Ethereum is once again testing this zone. If this support holds, the market may try to stabilize or bounce in the short term.

However, if price breaks below this range and sustains under it, the chart opens space toward the $1,400 region.

This level marks the next visible long-term demand area on the monthly structure.

From an analyst perspective, Ethereum Price Prediction 2026 now depends on whether ETH can hold the $2,100–$2,200 support zone under ongoing regulatory and market pressure.

Budget 2026 fears, heavy liquidations, and ETF outflows have weakened confidence and shifted trader focus toward risk control.

If this support fails, deeper zones near $1,854 and even $1,400 may come into play.

On the upside, any recovery attempt will need a strong move back above $2,400 to ease bearish pressure.

Until then, market behavior remains cautious, and volatility is likely to stay high.

YMYL Disclaimer: This article is strictly informational in nature and does not constitute an investment recommendation. Investment in cryptocurrencies is extremely volatile, and market conditions can change quickly based on macro data. It is always essential to do your own research before making any investment.

Rahul Rathore brings over 3 years of hands-on experience in technical analysis, specializing in crypto, stocks, and market trend forecasting. With a deep understanding of chart patterns, indicators, and market psychology, Rahul delivers precise, actionable insights that help traders and investors make informed decisions. His analytical approach combines technical expertise with real-world market understanding, making his content reliable and highly valued by both novice and experienced traders.