Have you ever wondered why a new token suddenly starts climbing after weeks of slow movement?

This is exactly what we are seeing right now, as the ZAMA price prediction 2026 becomes the main focus for many small investors.

While the market was busy watching the bigger coins, Zama Protocol quietly started building a base and is now showing signs of a fresh recovery.

With a sudden burst of momentum, Zama is up 21.82% to $0.0239 in 24h, catching many day traders by surprise.

After its big launch in early February, the price has been through a lot of ups and downs, but today’s action feels different.

Everyone is now asking: is this the start of a real rally, or just another small jump before more selling?

ZAMA’s jump is not just old news reacting. Three developments are aligning at the same time, pushing price toward $0.0239.

1. Roadmap Release Momentum

On February 19, 2026, Zama published its updated 2026 technical roadmap.

The key highlight was the mention of “FHE Coprocessors,” expected to increase network scalability to 1,000+ TPS. Earlier, scalability concerns were holding sentiment back. This update directly addressed that fear and restored confidence among investors.

The impact was visible. Volume started increasing the very next day, and that momentum has now translated into a price breakout.

2. Short-Term Short Squeeze on Exchanges

According to CoinMarketCap data, trading volume crossed $71 million in the past 24 hours.

When price broke above the $0.020 resistance level, many short positions were forced to close. Traders who had bet against the token had to buy back, creating sudden buying pressure.

The result was a sharp 21% move upward. This is a classic market psychology shift where momentum traders step in once resistance flips into support.

3. Institutional Accumulation Zones

In early February after the listing, most airdrop and auction-related selling pressure had already played out.

Earlier selling from airdrop and auction holders had already cooled off near the $0.016–$0.018 zone. With sell pressure reduced and fresh positive news in play, price discovery accelerated.

This move looks more like structured momentum than a random spike.

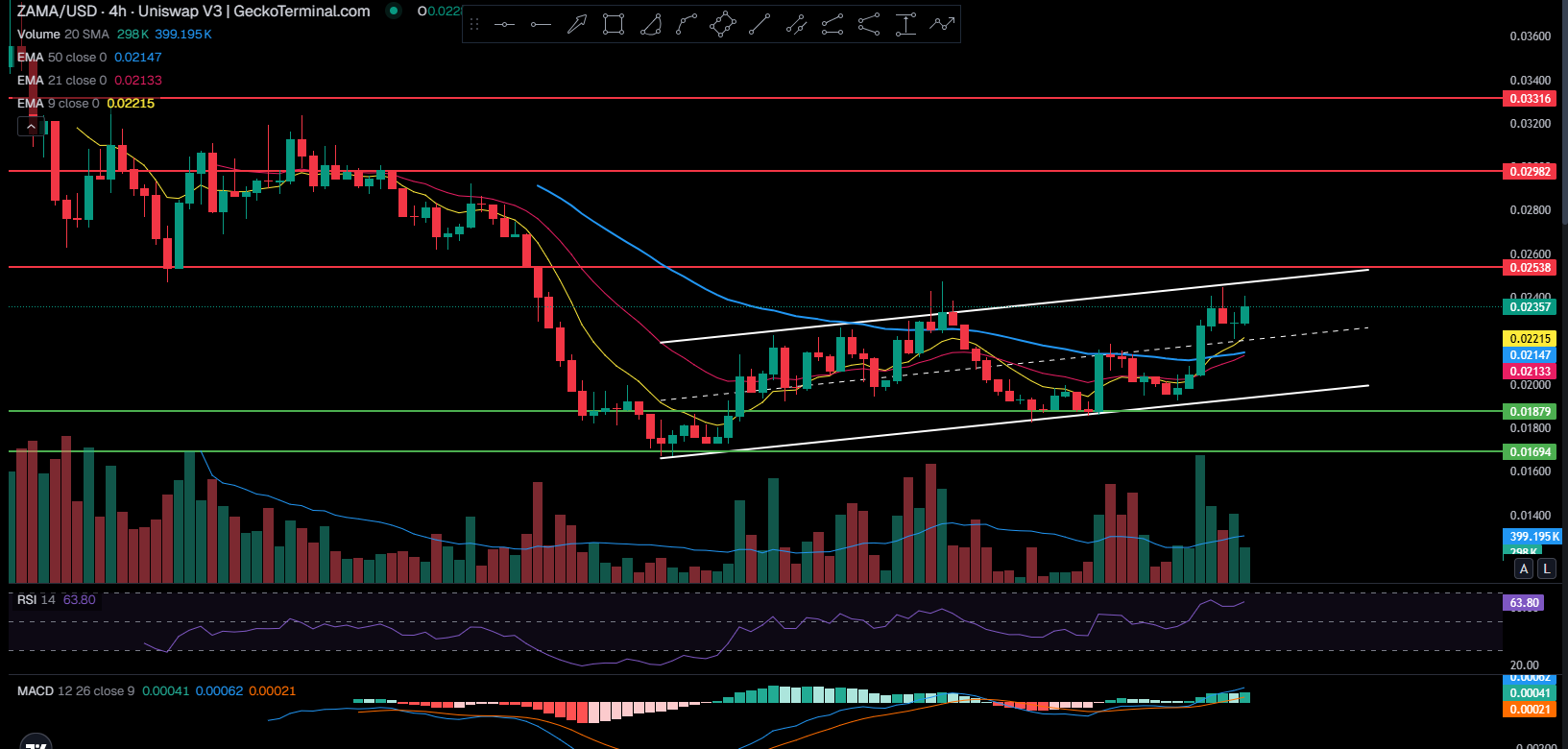

ZAMA’s move does not look like a random spike. On the 4-hour timeframe, the structure is gradually shifting in favor of buyers.

First, price bounced from the lower range and began forming higher lows. A rising channel is developing, with price pushing toward the upper boundary. This usually reflects a shift from accumulation toward expansion.

Break Above Short-Term Resistance: Price broke above the recent consolidation zone near $0.022–$0.023, a level where sellers had repeatedly rejected it before

Once resistance gave way, stop losses were triggered and buying pressure increased, accelerating momentum.

EMA Structure Turning Bullish: The 9 and 21 EMAs have crossed upward, and price is holding above them, and the 50 EMA is flattening and starting to turn higher.

When price sustains above key EMAs, they tend to act as dynamic support. No strong rejection is visible so far.

Volume Confirmation: Recent green candles are backed by rising volume, showing genuine market participation rather than a weak liquidity spike.

RSI & MACD Support: RSI sits around 63–64, leaving room before overbought conditions appear. The MACD histogram has moved into positive territory, aligning with the current bullish momentum.

Key Support Levels

$0.02150 – Immediate short-term support inside the rising channel

$0.02000 – Psychological and structure support zone

$0.01879 – Previous accumulation and bounce area

$0.01694 – Major base support from recent lows

Key Resistance Levels

$0.02538 – Immediate breakout resistance

$0.02982 – Mid-range supply zone

$0.03316 – Strong overhead resistance

$0.03500 – Psychological resistance level

Token is currently entering a price discovery phase. Today’s 21.82% rally clearly shows the market shifting from accumulation toward expansion.

Short-Term Forecast (Q1–Q2 2026)

Target: $0.033 – $0.035

Logic: If ZAMA breaks above the $0.025 resistance level, momentum and FOMO could push price toward the next psychological zone.

Support: The $0.021 area remains a strong short-term entry and defense level.

Long-Term Outlook: Reclaiming the Auction Price

Zama’s core technology, Fully Homomorphic Encryption (FHE), gives it a unique long-term positioning in the market.

The $0.05 Goal: By mid-2026, ZAMA could retest its $0.05 auction price if momentum is sustained.

Key Trigger: As staking adoption increases and Confidential Yield through AAVE integration goes live, circulating supply may tighten, supporting further upside.

If ZAMA sustains momentum above key resistance and holds its higher-low structure, the ZAMA Price Prediction 2026 outlook could gradually shift from short-term recovery to a stronger trend continuation toward the $0.05 zone.

The outlook remains bullish as long as price holds above the $0.021–$0.020 support zone. A sustained breakdown below $0.01879 would weaken the structure and invalidate the short-term bullish thesis.

Disclaimer: Cryptocurrency markets are highly volatile. This price prediction is based on technical structure and current developments, not financial advice. Investors should conduct independent research and assess risk tolerance before making decisions.

Rahul Rathore brings over 3 years of hands-on experience in technical analysis, specializing in crypto, stocks, and market trend forecasting. With a deep understanding of chart patterns, indicators, and market psychology, Rahul delivers precise, actionable insights that help traders and investors make informed decisions. His analytical approach combines technical expertise with real-world market understanding, making his content reliable and highly valued by both novice and experienced traders.