Highlights:

Detailed Analysis of Crypto ownership in the world and the 30 countries with the highest adoption and ownership.

Demographic and Regional Adoption Trends indicate the rate at which various people are adopting digital assets.

The future of cryptocurrency adoption in 2025 will be determined by Consumer Confidence and Future Crypto Trends.

By 2025, over 559 million users have been recorded to own cryptocurrencies in the world. This paper will discuss crypto adoption trends on the global front, regional patterns, demographic data, leading owning nations, consumer behavior, and future projections.

The year 2025 is a target year for cryptocurrency adoption. With the continued adoption of digital assets in mainstream finance and daily life, the number of crypto owners across the globe has grown to more than half a billion. Credible studies have indicated that there are about 559 million cryptocurrency holders in the world today, a figure that implies that 9.9% of the total internet users are cryptocurrency holders.

This is a minor decline of 0.4% compared to the higher levels in 2023-2024 (10.3%-10%), but the mere magnitude of global adoption illustrates a massive shift in the way people and organizations perceive and use digital money.

source: DemandSage

Crypto has ceased to be a marginal financial experiment, and it has become a worldwide trend with tangible economic and social consequences. Since the market dominance of Bitcoin, the increase in institutional involvement shows that the digital asset space will mature and change by 2025.

In 2025, the global cryptocurrency market is estimated to be at a value of $2.96 trillion, which is a figure that reflects its remarkable growth over the previous years. Analysts estimate that the market will reach almost $7.98 trillion by 2030 due to rising acceptance, innovation in technology, and diversified financial products.

This is the projected growth of a 30% annual growth rate (CAGR). Institutional investors have taken a significant share of the value of the crypto market. Significant investors constitute about 68.5% of the total market value, and they include hedge funds, corporate treasuries, and publicly traded companies. This change is an indication of an increasing institutional belief in digital currencies as a valid asset class and a store of value, and not only as speculative instruments.

Source: website

The other indication of maturity is the emergence of regulated investment products. Key financial markets have approved spot Bitcoin and Ethereum exchange-traded funds (ETFs), which provide a way to allow the traditional investor into the crypto world with a greater sense of security and organization.

The number of people who are holding crypto long-term has grown, and the number of merchants accepting it has grown significantly all over the world. The fact that almost 46% of the surveyed merchants accept cryptocurrency payments today indicates practical use and an increasing confidence of merchants in digital currencies.

Source: Official Source

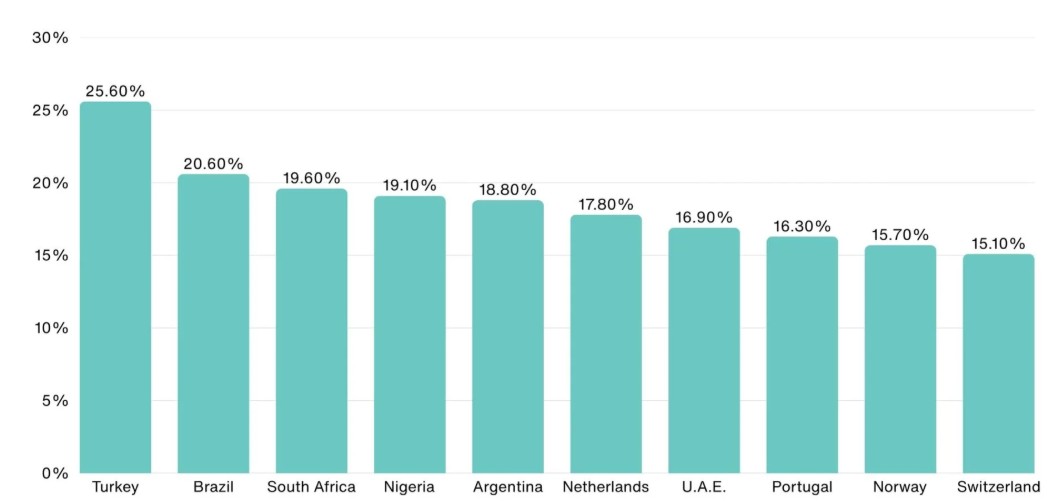

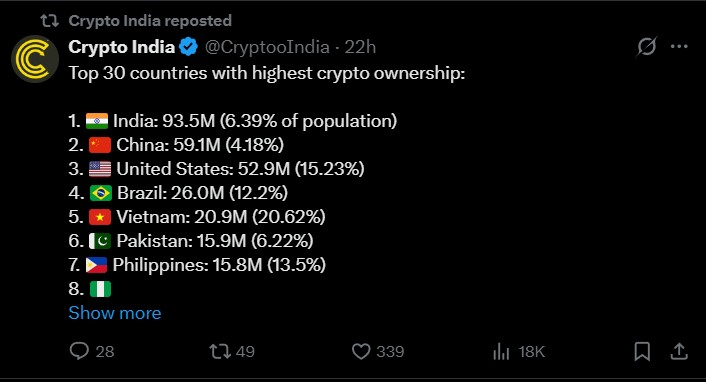

The knowledge of the leading countries in crypto ownership provides valuable information on the trends of crypto adoption in the world. According to the recent statistics, the following are the 30 leading countries in terms of crypto holders (2025), including the number of owners and percentages of the population:

India Crypto Holders – 93.5M holders (6.39%)

China – 59.1M (4.18%)

United States – 52.9M (15.23%)

Brazil crypto Holders– 26.0M (12.2%)

Vietnam – 20.9M (20.62%)

Pakistan – 15.9M (6.22%)

Philippines – 15.8M (13.5%)

Nigeria – 13.3M (5.58%)

Indonesia – 12.2M (4.27%)

Iran – 12.0M (12.98%)

Russia – 8.7M (6.08%)

Mexico – 8.4M (6.37%)

Thailand – 6.9M (9.64%)

South Africa – 6.0M (9.33%)

Japan – 5.1M (4.14%)

Turkey – 4.8M (5.5%)

Germany – 4.8M (5.73%)

Argentina – 4.5M (9.71%)

Bangladesh – 4.3M (2.46%)

Saudi Arabia – 4.2M (12.16%)

United Kingdom – 3.9M (5.59%)

Ukraine – 3.9M (9.97%)

Egypt – 3.4M (2.89%)

France – 3.1M (4.59%)

Venezuela – 3.0M (10.42%)

UAE – 2.9M (25.49%)

Kenya – 2.8M (4.86%)

Canada – 2.7M (6.76%)

Colombia – 2.6M (4.83%)

Ethiopia – 2.3M (1.67%)

These data show both the absolute and relative adoption. The top rank of India with crypto users 93.5 million not only an indication of the huge population, but also fast digitalization and financial innovation.

Source: CryptoIndia X

Likewise, nations such as Vietnam and the Philippines have high ownership percentages in comparison to population, which indicates a high local interest in crypto.

It is worth noting that the UAE has one of the highest ratios of adoption (25.49%), which means that more affluent and technologically advanced groups are quickly adopting crypto.

In the meantime, even medium percentages in large countries (such as China and Indonesia) also make a huge contribution to global ownership because of sheer population.

This heterogeneous international environment demonstrates that crypto adoption is not limited to a specific region or economic level; both developing and developed economies are actively involved in the crypto revolution.

Source: Official Source

Regional Insights:

Asia has been the most significant region in terms of total holders of crypto, with nations with enormous populations and digital penetration. In Asia, combined ownership is a major part of the world's ownership.

The United States and Canada have institutional and retail demand, which drives almost 39% of the total market share in North America.

Europe has good liquidity and active users with approximately 31 million holders distributed among the major economies.

Africa and Latin America have shown increasing Crypto adoption rates, particularly in nations where there is currency volatility or where access to traditional banking is limited.

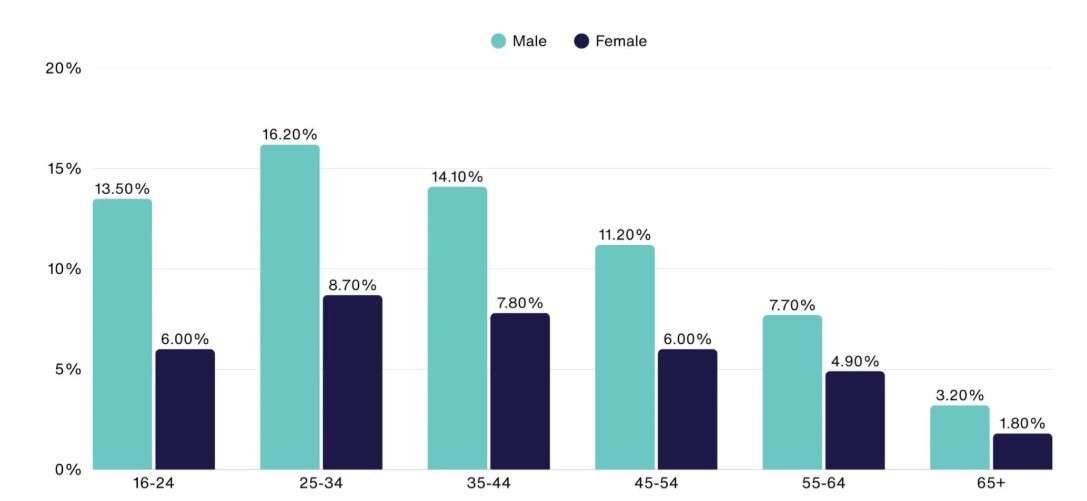

Age Breakdown:

The highest adoption is recorded between 25-34, with the greatest participation between men and women.

The younger adults (16-24) are active as well, albeit with a little lower rate than with the core adult segment.

There is a decrease in adoption with age, with individuals 65+ owning crypto at significantly lower rates.

These patterns indicate that digital natives and working adults are the most active in terms of cryptocurrencies, both as an investment and a utility.

Source: DemandSage

Gender Insights:

Men have almost twice as many chances of owning crypto as women.

The women also have the highest ownership rate in the 25-34 age group, although still very low compared to their male counterparts.

The gender gap in the adoption of crypto is also evident across the age groups, indicating both educational and cultural gaps.

This population segmentation shows that crypto is mainly accepted by younger and male, and digitally savvy groups, and there is still an opportunity to expand among older and female groups.

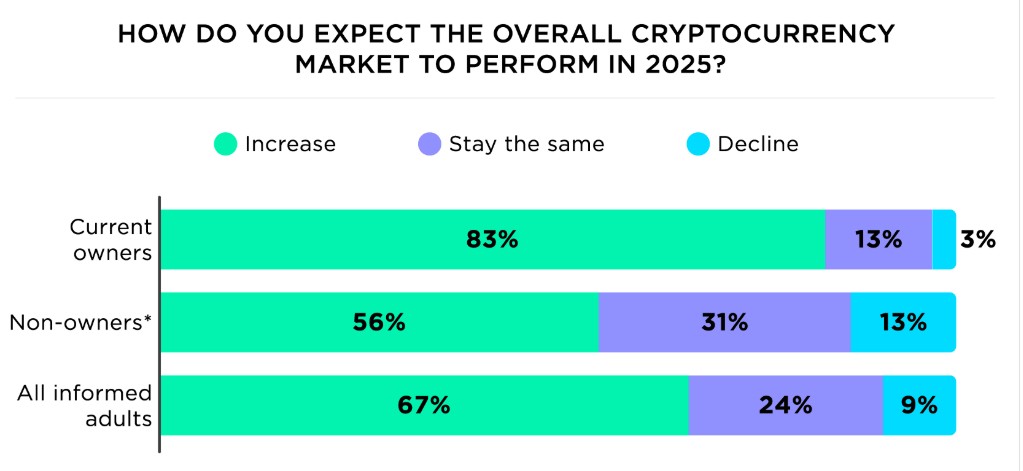

Most of the existing holders believe in the prospects of digital assets, particularly with institutional participation and regulated financial instruments, making them more legitimate.

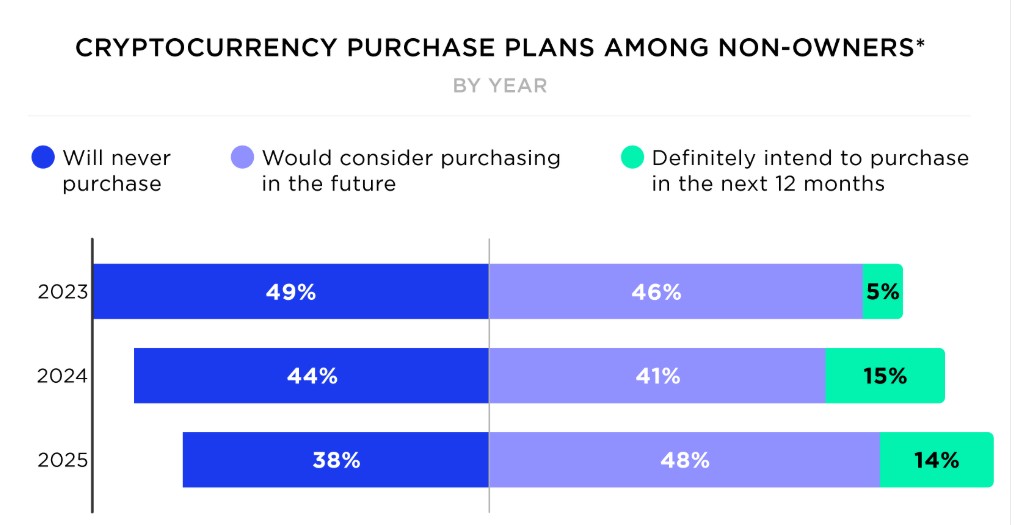

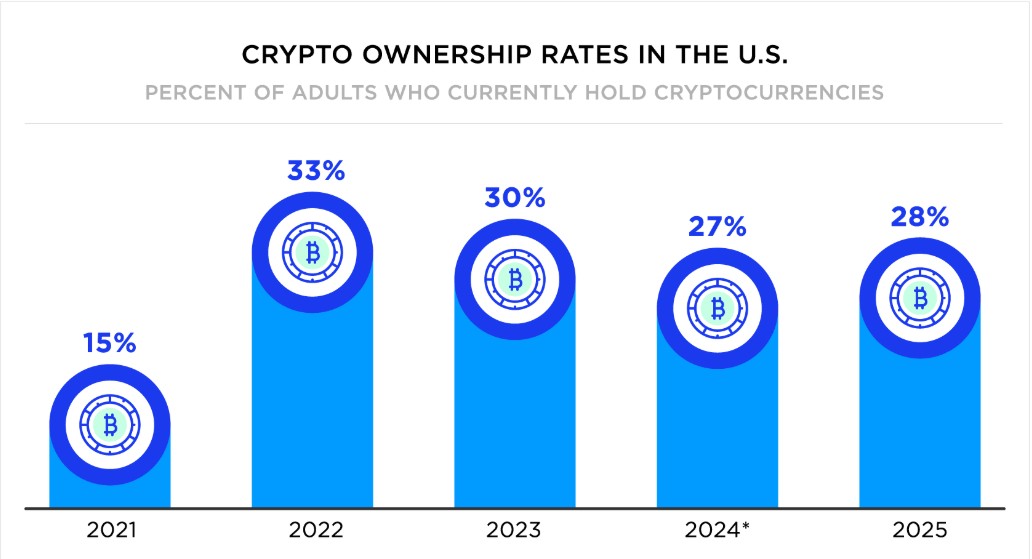

In the United States, an increasing number of owners intend to purchase additional crypto in 2025, with the greatest interest in Bitcoin adoption, Ethereum, and other popular coins. In the meantime, most non-owners cite volatility and security as the reason to hold back.

Source: Securityorg

The theme of security is still prevalent:

A considerable proportion of crypto users complain about problems with custodial services

Exchange trustworthiness

Difficulties with accessing wallets

Consequently, the level of awareness is high, but the level of trust is also unevenly distributed, as a significant portion of people still consider crypto to be more risky than traditional assets.

Sentiment has been increasing, notwithstanding these fears. The combination of ETFs, increased merchant uptake, and less ambiguous regulatory environments is helping to give consumers more confidence, although the cynics continue to be wary.

Source: Website

The crypto ownership 2025 is a narrative of change, one in which digital currency is no longer a choice but rather becoming a necessity.

Disclaimer: This is not financial advice. Please DYOR before investing. CoinGabbar is not responsible for any financial losses. Crypto assets are highly volatile, and you can lose your entire investment.

Sakshi Jain is a crypto journalist with over 3 years of experience in industry research, financial analysis, and content creation. She specializes in producing insightful blogs, in-depth news coverage, and SEO-optimized content. Passionate about bringing clarity and engagement to the fast-changing world of cryptocurrencies, Sakshi focuses on delivering accurate and timely insights. As a crypto journalist at Coin Gabbar, she researches and analyzes market trends, reports on the latest crypto developments and regulations, and crafts high-quality content on emerging blockchain technologies.