Highlights

The US unemployment rate reduced to 4.4%, which is lower than expected in the market.

The top court puts the decision on the Trump Tariffs program of $600B on hold.

The markets and crypto remain volatile due to the persistence of uncertainty.

The US markets experienced intense volatility after the December employment report indicated that unemployment had dropped to 4.4% and the Supreme Court was yet to give its long-awaited decision on the tariffs that the President had imposed.

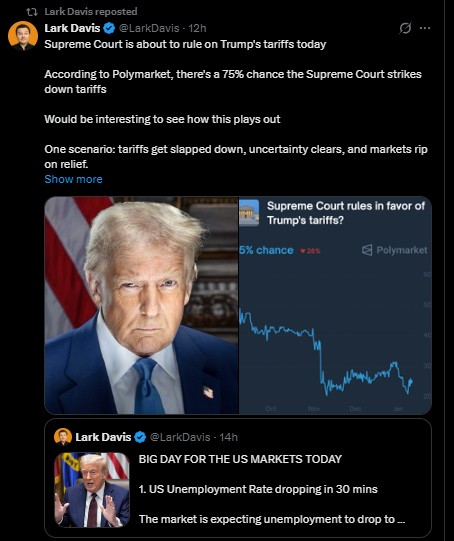

President Donald Trump’s long-standing tariff strategy is once again shaking US markets as the Supreme Court prepares to rule on the legality of his emergency trade measures. The decision, expected on January 14, could determine the future of nearly $600 billion worth of tariffs imposed since 2018 under emergency powers that bypassed Congress.

Source: Lark Davis X

According to Polymarket, the probability of the taxes being ruled illegal briefly surged above 70% before easing to around 31% after the court delayed its ruling. In case it is struck down, the US government might have to pay back about $133 billion that it has been collecting from importers, and this could have a ripple effect on the world trade and financial markets.

Trump has made an overt appeal to the Americans to pray that the court will reach a favorable decision, highlighting the importance of tariffs to his economic and political agenda.

The markets were on the verge of getting an instant decision on January 9, but the Supreme Court decided not to issue its verdict, prolonging the guessing. More than 1,000 companies have attacked the tariffs, claiming that Trump had gone beyond executive powers by citing national emergency legislation as a means of long-term trade policy.

An earlier Federal Reserve study in 2021 had previously estimated the tariffs to have cost the US economy almost $195 billion, but the proponents claim that they served to shield the home manufacturing. No verdict is reached yet, and the investors are waiting anxiously, either a relief rally or the new turbulence, depending on the result.

Source: X

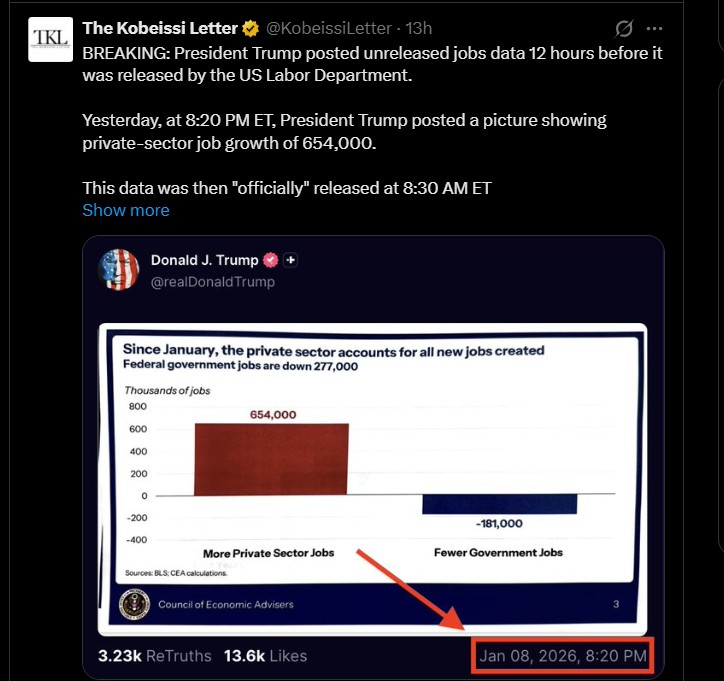

As the crypto markets were shaken by tariff uncertainty, new labor data was a shock. In December, the US unemployment rate dropped to 4.4%, which is below the expectations of 4.5%.

The figure for November was also adjusted downwards, which supports the evidence of a strong labor market. Nevertheless, the rate of job creation was low, as only 50,000 new jobs were created, which was lower than expected. This ambivalent image indicates that there is no growth in the economy that is accelerated; rather, it is stable.

Source: X

The higher unemployment indicator makes the economic story of rates difficult. Advocates claim that tariffs have served to preserve jobs and manufacturing in the country, whereas opponents fear they contribute to inflation and increased consumer prices.

A strong labor market will minimize the pressure on the Federal Reserve to lower the rates aggressively. Falling unemployment will further reinforce the Fed's pause position, with January rate cut odds already approaching 13 percent, which will provide Trump with additional ammunition to justify tariffs as economically viable.

Source: X

The Trump tariffs that have been introduced have turned out to be a significant political and economic concern before the midterm election. Recently, the President has further increased the populist economic policies, such as demands for lower gas prices, limits on credit card interest rates, and vigorous arm-twisting of the Fed to reduce rates.

Should the tariff be ruled unconstitutional by the Supreme Court, there would be relief in the markets as uncertainty is eliminated. Nevertheless, traders are also worried about unforeseen policy moves by Trump, which would create new volatility in stocks, bonds, and cryptocurrencies.

Source: X

The fact that the labor market has improved to a greater extent than was expected, combined with uncertainty regarding the rates proposed by Trump, has preconditioned further volatility. As a major Supreme Court ruling approaches, the US markets are going into a critical and uncertain phase.

Disclaimer: This is not financial advice. Please DYOR before investing. CoinGabbar is not responsible for any financial losses. Crypto assets are highly volatile, and you can lose your entire investment.

Sakshi Jain is a crypto journalist with over 3 years of experience in industry research, financial analysis, and content creation. She specializes in producing insightful blogs, in-depth news coverage, and SEO-optimized content. Passionate about bringing clarity and engagement to the fast-changing world of cryptocurrencies, Sakshi focuses on delivering accurate and timely insights. As a crypto journalist at Coin Gabbar, she researches and analyzes market trends, reports on the latest crypto developments and regulations, and crafts high-quality content on emerging blockchain technologies.