YMYL Disclaimer: This content is for informational purposes only and should not be considered financial or investment advice. Cryptocurrency markets are volatile. Always do your own research before making any investment decisions.

The Base OP Stack Shift has shaken the crypto market after Base announced it will move toward its own unified technology stack. This means it will slowly step away from relying fully on the OP Stack while still working with Optimism as an enterprise customer. Soon after this news, the token dropped sharply, showing how important ecosystem partnerships are in crypto.

The update is about Base building more of its own technology, its own code, infrastructure, and upgrade schedule. In simple words, Base wants more control so it can ship updates faster and scale the network better.

Source: X (formerly Twitter)

The platform plans to increase upgrades from three to six times a year. It also aims to support very high transaction capacity and improve reliability with stable fees. For developers, this sounds positive because it means faster improvements and a simpler system to build on.

But the news also created concern. Since it is one of the biggest chains using OP Stack, investors worry it may lose some influence and future revenue.

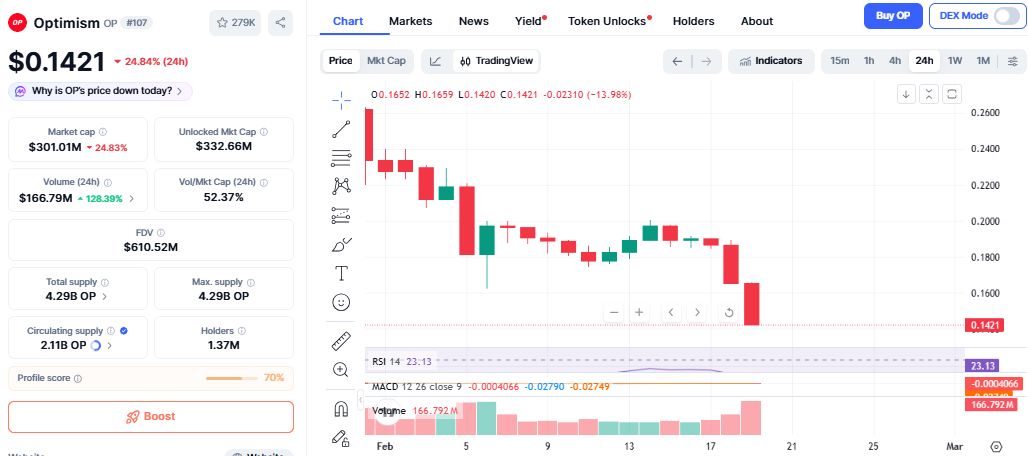

This news quickly affected market sentiment. Token's price today fell over 22% to around $0.147, performing worse than the overall crypto market.

Many traders reacted fast because the news suggests it might earn less from ecosystem activity in the future. That fear triggered selling pressure. Trading volume increased sharply, showing strong panic selling.

Technical indicators also showed the token became heavily oversold. This means the drop may have been driven by emotion as much as fundamentals.

Even though the Coinbase's Base transition caused negative sentiment, there was also a positive development. Ether.fi announced it will move its Cash product and card system to OP Mainnet.

This includes tens of thousands of active cards, hundreds of thousands of accounts, and millions in user funds. This shows the token is still attracting projects, even as the network becomes more independent.

Price remains under pressure after the news.

The most important level to watch is around $0.146. If the price stays above this support, a short-term bounce toward $0.158 is possible.

Source: Coinmarketcap Chart

However, if sentiment stays weak and support breaks, the price could fall further before stabilizing.

After the announcement, it dropped mainly due to sentiment and uncertainty about future revenue. If Optimism announces new partnerships or strategy updates, price could recover toward the $0.158 area.

But if uncertainty continues and no strong positive news appears, it may stay below $0.15 for a while. In the near term, price direction will depend more on ecosystem updates than technical signals.

The Base OP Stack Shift is a major moment for the Layer-2 ecosystem. It shows that projects want more independence while still collaborating with partners. For Optimism, this creates short-term uncertainty but not necessarily long-term weakness.

The recent optimism price crash reflects fear and market reaction to change. What matters now is whether Optimism can attract new builders and maintain strong network growth. The Base OP Stack Shift will likely remain an important story shaping OP price movement in the coming months.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.