Highlights:

The MSV protocol is also extended to BingX, increasing accessibility and liquidity.

PoAI proposes stakeholder-backed verification of RWAs.

Testnet passes 30,000 users as the interest in RWA tokenization grows.

The MSVP coin launch in the market has become a trending hashtag in MetaSoilVerse News as the project becomes stronger on the decentralized and centralized exchanges. Following its release on DEXs such as PancakeSwap, Uniswap, Binance DEX, and OKX DEX, the token is currently operational on BingX, a significant milestone in the MSV protocol news cycle.

Although the early date and price of the coin were dictated by the liquidity discovery in the DEX, the shift to centralized exchanges is an indicator of greater retail and institutional penetration. The team has also alluded to other CEX listings, which may enhance liquidity and visibility in the next few months.

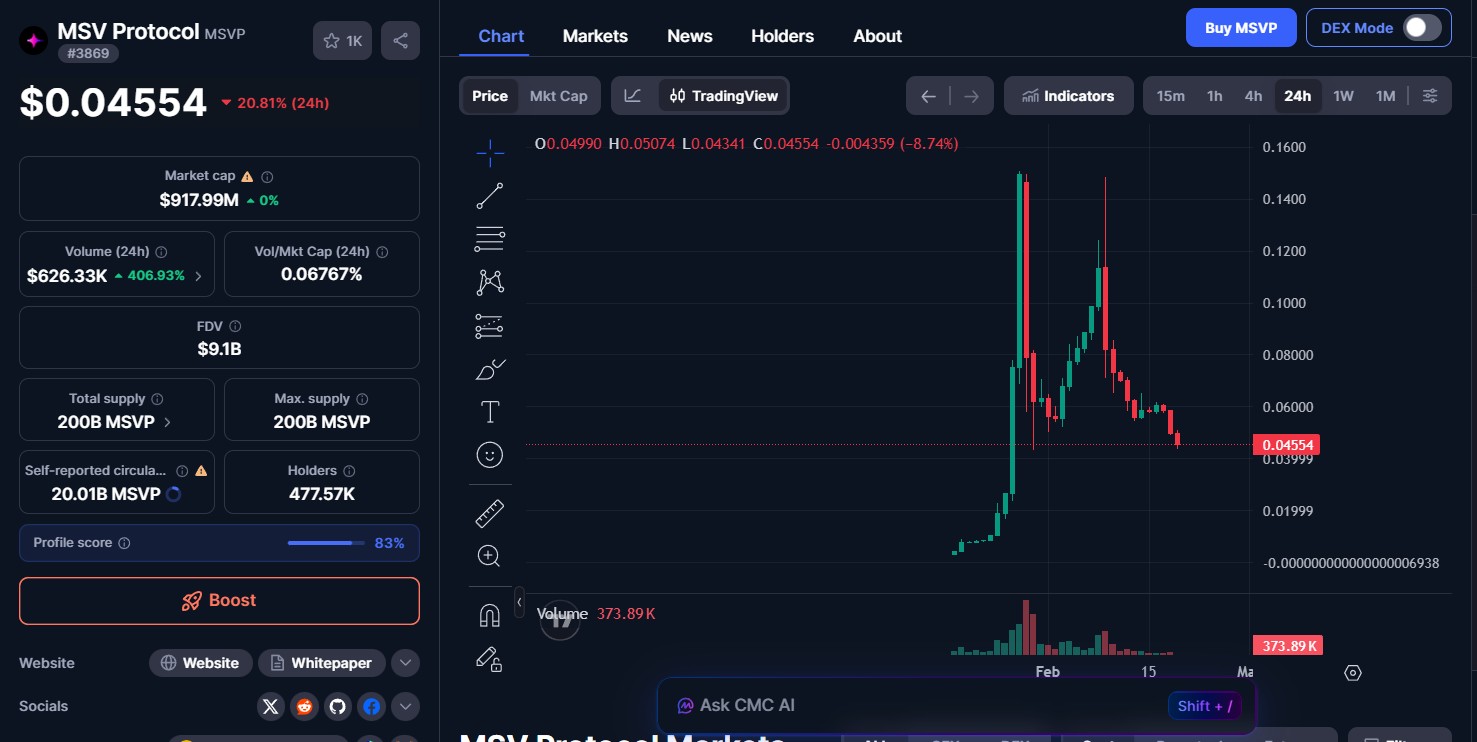

As of writing, the MSVP coin price is volatile in the short-term, down by about 3-4% in 24 hours and by almost 19% in seven days. But fully diluted valuation (FDV) is approximately $11-$12 billion at a total supply of $200 billion, although little circulating supply data is available.

Source: Official X

In contrast to most tokenization projects, which merely digitize ownership, the Metasoilverse protocol implements asset logic directly in smart contracts. On-chain, real estate, farmland, factories, commodities, and energy infrastructure can be leased, staked, and tracked in terms of performance.

The essence of the innovation is Proof-of-Asset-Integrity (PoAI). Validators put money as security to prove the location and performance of assets. False reporting may initiate fines, bringing about cryptoeconomic responsibility. The strategy converts conventional assets into programmable financial instruments.

Vault leasing also allows the generation of yields. Smart contracts issue returns according to a pre-established formula, and risk changes dynamically. The $MSVP token operates in governance, staking, transaction fee and leasing settlements- generating actual protocol utility.

Source: X

Recent statistics indicate a stable ecological footprint:

30,000+ testnet users

5+ exchange listings

10+ wallet integrations

$100K-$150K daily trading volume

These indicators emphasize the early adoption and not pure speculation.

Considering the growth of the wider RWA industry at 13.5% and the growing institutional interest in tokenized real-world assets, the MSVP coin price prediction case hinges on the growth of the exchange and the onboarding of assets.

Short term (1-3 months): In case of further CEX listing, it might retest the past highs, provided that the market is stable.

Mid-term (6-12 months): As adoption increases and asset onboarding is proven, it can gradually appreciate, particularly in the case of DeFi-based RWAs becoming more popular.

Long-term: In case the protocol can obtain institutional relationships and regulatory transparency, growth in valuation can be in line with the expansion of the RWA market in general.

Nevertheless, volatility risks and incomplete circulating supply transparency are some of the aspects that investors ought to consider when assessing MSV Protocol price prediction models.

Source: CoinMarketCap

Future benchmarks will be further listings, ecosystem alliances, and new asset classes like farmland and carbon credits. Speculation exists also of a possible MetaSoilVerse airdrop, but no official announcement has been made.

With the evolution of real-world asset tokenization, MetaSoilVerse crypto positions itself as infrastructure and not an issuance platform. The initial MSVp Coin Launch date and price were the starting point, but the continued growth will be pegged on the adoption, integrity of verification, and actual economic activity.

As RWAs are expected to be resilient even in the context of the wider market declines, MSV protocol coin news is still attracting the attention of investors who are observing the next stage of blockchain-supported real asset finance.

Disclaimer: This is not financial advice. Please DYOR before investing. CoinGabbar is not responsible for any financial losses. Crypto assets are highly volatile, and you can lose your entire investment.

Sakshi Jain is a crypto journalist with over 3 years of experience in industry research, financial analysis, and content creation. She specializes in producing insightful blogs, in-depth news coverage, and SEO-optimized content. Passionate about bringing clarity and engagement to the fast-changing world of cryptocurrencies, Sakshi focuses on delivering accurate and timely insights. As a crypto journalist at Coin Gabbar, she researches and analyzes market trends, reports on the latest crypto developments and regulations, and crafts high-quality content on emerging blockchain technologies.