In what comes as a big update for the global crypto industry, Binance Co CEO Yi He has confirmed that India is one of the major markets for Binance. This is a clear indication of the growing importance of the country in the digital asset economy.

She also revealed that big stock-market players are rapidly moving into digital currency, signaling a powerful shift in global capital flow.

This is the second big India-focused statement from the largest exchange's leadership in recent weeks, after Richard Teng recently emphasized long-term digital assets potential in the country. For now, Yi He's remarks further strengthen Binance's strategy and signal deeper engagement with regulators and users.

Source: X (formerly Twitter)

Despite some regulatory setbacks, the nation already boasts more than 100 million users, ranking it among the largest digital asset communities in the world.

The comment of Yi He that stock-market players are entering this industry reflects a major change in how traditional finance now looks at digital assets.

The digital asset market for years was highly driven by retail traders. Today, institutional investors from the equity markets are rotating into crypto with long-term strategies.

This shift is expected to bring stronger liquidity, better risk controls, and a more mature market structure.

Yi He's latest statement closely aligns with recent Richard Teng India news when he described the country as one of the most important growth markets for global crypto adoption.

During Binance Blockchain Week in Dubai, Teng confirmed a leadership shift where Yi He became the Binance New Co-CEO while he continues guiding the regulatory strategy.

Teng has time and again said the country has the right mix of a young digital population, strong fintech rails like UPI and Aadhaar, and fast-growing blockchain adoption. With Binance Co CEO news now repeating the same message, Binance's long-term commitment to the nation indeed seems firmly established.

Many believe across the industry that India's crypto growth is now moving at a faster pace than expected. Participation is rising not only among retail investors but also among professional traders and institutions.

Recent India crypto news, latest trends have shown higher trading volumes, growth in new digital asset investment accounts, and stronger participation across every major Indian exchange. The market is also expanding beyond metro cities, with Tier-2 and Tier-3 regions seeing rapid user growth.

This surge supports the view that the country is becoming one of the most important global hubs for digital assets adoption.

Despite strong momentum, India crypto regulation remains the biggest hurdle. Current rules still include:

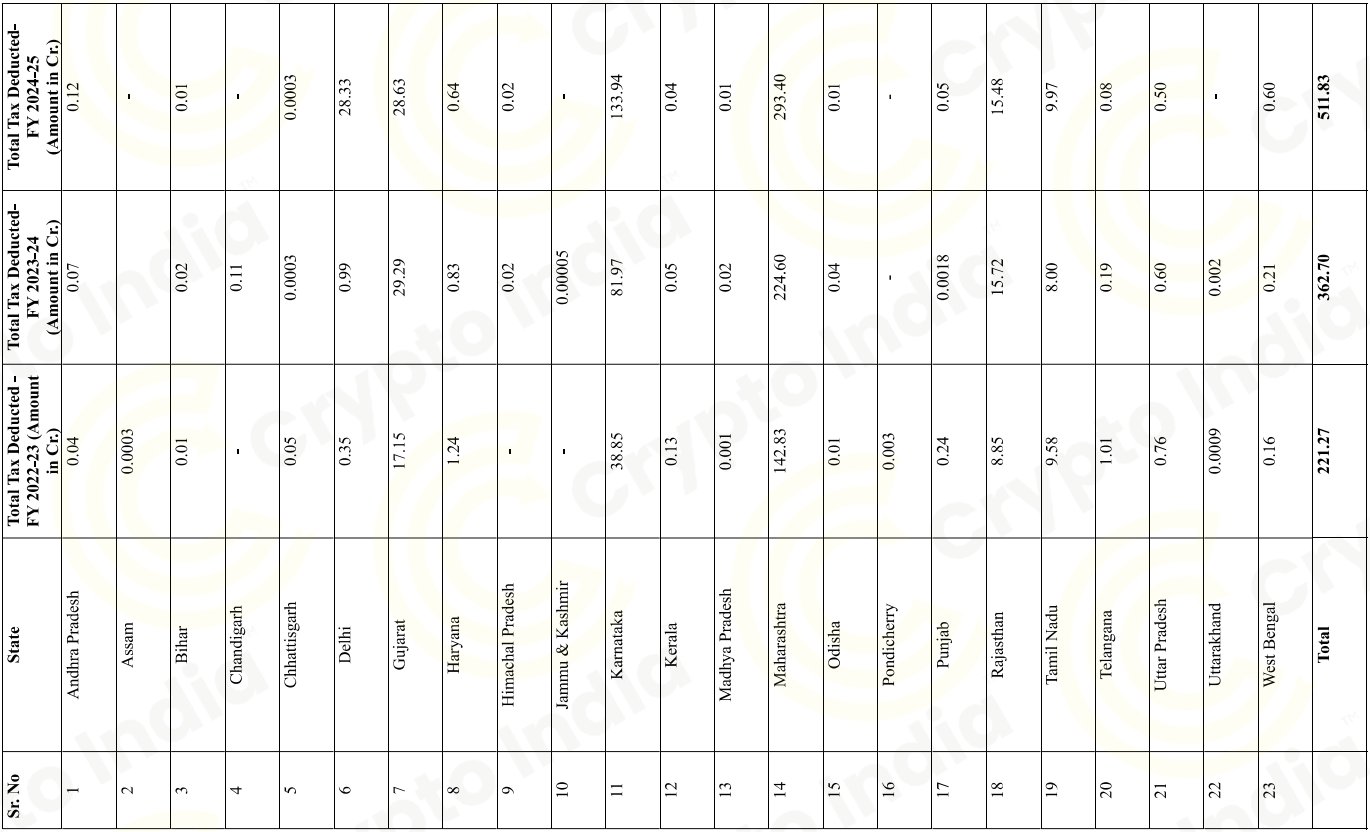

A 30% tax onprofits

1% TDS on every transaction

Many traders say it limits active participation. However, positive regulatory signals are already emerging.

Source: X (formerly Twitter)

Binance recently signed up with FIU-IND under the Prevention of Money Laundering Act and thus could operate legally in the country again. This may also pave a clear compliance road map for other platforms.

The exchange has expanded education through regional-language programs to strengthen India blockchain growth and reduce user risks.

With both Binance Co CEO Yi He and Richard Teng India crypto openly backing the country, The exchange's roadmap now rests on compliance, regulatory cooperation, and protection for its users.

Global platforms such as Coinbase and Binance have continued to show great confidence in the long-term potential of the country despite strict India crypto tax rules.

Disclaimer: This article is for informational purposes only and not a financial advice, kindly do your own research before investing.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.