The Binance Tesla listing is now official through Binance Futures, allowing crypto traders to follow Tesla’s stock price without using traditional stock markets. The biggest digital asset exchange has confirmed the launch of TSLAUSDT Equity Perpetual Contract on January 28, 2026, at 14:30 UTC, under its TradFi section.

Source: BinanceFutures Official

This contract tracks the price of Tesla Inc. (NASDAQ: TSLA) and lets users trade it 24/7, including weekends and holidays, something regular stocks market do not offer. Key details of the launch include:

TSLAUSDT USDⓈ-margined perpetual contract

Up to 5x leverage with USDT settlement

Minimum trade size of 0.01 TSLA

Minimum notional value of 5 USDT

Funding fees settled every four hours

The announcement follows Binance’s recent futures products tied to gold and silver. These launches show the exchange’s push to give crypto traders access to major traditional assets without relying on stock market hours.

The product tracks the TSLA stocks but does not offer ownership of real shares. A perpetual contract is a type of futures trade that has no expiry date, meaning traders can hold positions as long as they maintain enough margin. Since it is USDT-margined, profit, losses, and collateral are all in USDT, making it easy and familiar.

How does it work for everyday participants?

With Binance-Tesla contract, traders can use up to 5x leverage, meaning a small amount of money controls a bigger position. For example, $100 can control $500. This can boost profits but also raises the risk of liquidation if losses grow.

The minimum trade is small (0.01 TSLA and 5 USDT), so even small traders can participate. Binance also uses a funding rate every four hours to keep prices close to real Tesla stock. When funding is positive, longs pay shorts; when negative, shorts pay longs. This helps keep the market balanced, even when stock markets are closed.

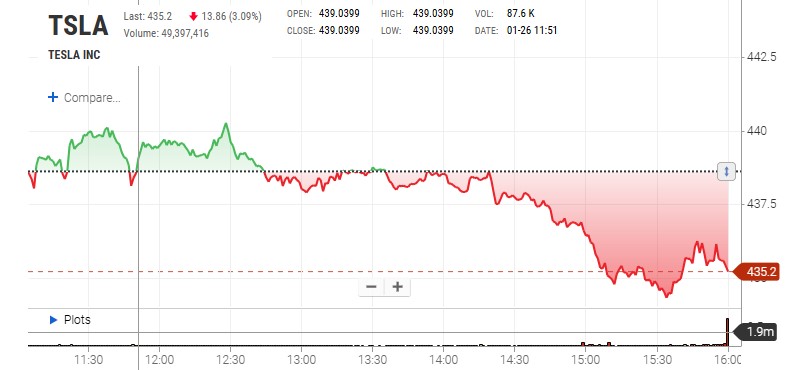

The Binance Tesla listing arrives as investor sentiment around it turns cautious. The stock recently dropped over 3%, closing at $435.20 on Monday, as markets wait for upcoming quarterly earnings.

Source: Nasdaq Official

Recent performance data shows:

Q4 deliveries: 418,227 vehicles (below expectations)

2025 total deliveries: 1.64 million vehicles, down 9% year over year

Competition: BYD delivered 2.26 million EVs in the same period

The long-term confidence is still potential on the shares however the numbers above creates at the moment pressures.

Binance’s Futures launch generally follows the spot listing within weeks or sometimes months. Communities are already hyped on its spot listing, offering major price and easy access, however, the platform didn’t mention anything regarding spot listings.

Binance has not announced any spot market, or tokenized stock, and no confirmation of $TSLA being available for direct spot trading. The existing Binance Tesla listing remains strictly a futures-only product and is not connected to the firm in any official way.

While this opens new opportunities, traders should note that leveraged futures can lead to rapid losses, especially with volatile stocks.

Until the exchange makes an official announcement, traders should treat the listing strictly as a high-risk leveraged futures product, not a substitute for owning Tesla shares.

Bhumika Baghel is a rising crypto content writer with a deepening interest in blockchain technology and digital finance. With a keen understanding of market trends and cryptocurrency ecosystems, she breaks down intricate subjects like Bitcoin, altcoins, DeFi, and NFTs into accessible and engaging content. Bhumika blends well-researched insights with a clear, concise writing style that resonates with both newcomers and experienced crypto enthusiasts. Committed to tracking price fluctuations, new project developments, and regulatory shifts, she ensures her readers stay informed in the fast-moving world of crypto. Bhumika is a strong advocate of blockchain’s potential to drive innovation and promote financial inclusion on a global scale.