The price of gold and silver reached record highs while Bitcoin experienced a slight decline, which raised a wide inquiry about its potential impact on cryptocurrency or its fundamental effects on the market.

Investors are currently buying safe-haven assets because of macroeconomic uncertainties, which makes Bitcoin's short-term decline appear serious.

Historical data reveal that this situation usually results in temporary capital shifts. Past bitcoin cycles show that gold price increases precede bitcoin's most substantial price increases.

Gold price increases will not stop the crypto bull rally because they currently absorb liquidity, which will eventually return to high-growth investments.

Traders need to understand macro trends, essential technical levels, and structure to predict Bitcoin's upcoming movements.

Gold prices increased by almost 8 percent during a four-day period, which brought the price to approximately $4,980 per ounce, while silver prices reached $100 per ounce for the first time in history. The market shows strong risk-off behavior through this abrupt movement.

The charge is being led by retail investors. The single-day GLD flow reached over $95 million, which marks the largest increase since October 2025. The silver ETFs experienced their strongest monthly demand, according to the $922 million inflow, which occurred over 30 days.

Tom Lee states that current gold and silver investment activities lead to liquidity reductions, which impact risk assets such as Bitcoin. He believes that this situation will not have negative effects on the long-term performance of crypto assets.

After precious metals reach their peak, investors typically shift their investments toward BTC and other high-growth investments. Gold's price increase functions as a cycle predictor that secretly establishes the next cryptocurrency movement while ending the current bull scenario.

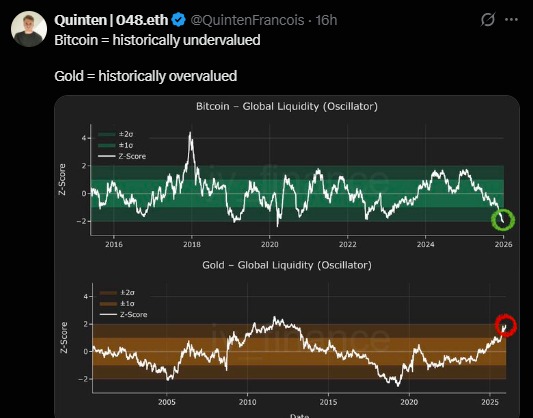

According to Quinten Francois, the world's largest cryptocurrency is currently in a historically undervalued zone, while gold appears significantly overvalued. The accompanying charts use a global liquidity oscillator and Z-scores to illustrate this divergence.

Bitcoin’s Z-score has dipped below the -1 standard deviation mark, signaling potential buying opportunities, whereas gold’s Z-score has climbed above +1, indicating overextension. This contrast highlights a possible rotation of capital from overvalued traditional assets like gold into undervalued digital assets such as Bitcoin.

BTC is trading below $90,000, but the bigger picture remains intact—for now. The whole structure indicates that the current short-term price movement will end while the market enters a period of stability. The next price movement will emerge from a single price level, which traders monitor for market changes.

Ali states that BTC displays a well-established price range, which shows controlled market activity while maintaining its overall upward trend according to its 4-hour price chart. The $87,400 zone stands out as a critical support, and staying above it supports the case for a potential rebound.

BTC will test the channel's middle and upper boundaries if buyers sustain their defense of this price level. The $87,400 support level becomes crucial to observe because a decisive move below it will decrease immediate market energy while driving more extended price range activity.

According to Changpeng Zhao (CZ), the upcoming US regulatory changes will generate positive market conditions for the coin because the SEC has taken cryptocurrencies off its priority risk list for 2026. The news has raised market confidence, according to CZ, who warned about the potential inaccuracy because it showed that regulators would impose fewer restrictions.

If confirmed, this change could encourage greater institutional participation, as regulatory clarity has historically supported stronger price performance.

The expanding super cycle prediction supports long-term Bitcoin projections. Crypto GEMs reports that BTC follows a specific market pattern, which includes accumulation followed by corrections and then strong price increases.

The current market consolidation period reflects the historical price pattern, which shows that companies create their base operations until they achieve their maximum capability.

The bullish thesis maintains its strength because the long-term forecasts show a continuous upward trend toward the $230,000 target despite current market disruptions.

Technical analysis shows that BTC maintains a bullish trend because its price stays above $87,400, which enables traders to target upward movements towards the $95,000 to $100,000 range.

A breakdown below this support could lead to range-bound action or deeper consolidation without invalidating the broader uptrend.

The recent pullback functions as a corrective pause, which does not alter existing trends. The technical bias continues to favor higher levels because long-term cycle indicators remain aligned with pattern developments despite short-term price fluctuations.

Disclaimer: The content on this page is for informational and educational purposes only and does not constitute financial, investment, or trading advice. Cryptocurrency investments are highly volatile and involve significant risk.

Always conduct your own research (DYOR) and consult with a licensed financial advisor before making any investment decisions. The authors and publishers are not responsible for any profits, losses, or damages arising from your use of this information.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.