The Spur Protocol listing date has become one of the most talked-about and worrying topics in the crypto market today. What started as a simple $SON listing delay has now turned into a serious trust issue.

The launch was first planned for Q4 2025, then December 19, then January 8, then January 26, and now it has been pushed again to January 30. A legit project can shift a date, but a continuous Spur Protocol launch date postponement, and the website goes blocked within hours, sends a dangerous signal to investors.

In this article we will explore what's behind the debut date shift, what can happen after the new SON listing date Jan 30, and how the entire industry reacts to this shocking news.

Spur Protocol Listing Date Delayed To Jan 30: Website Down or Scam?

The official X account said the delay was for better marketing, a pre-TGE AMA, and final technical preparation. But within hours of this announcement, the official website showed a 403 Forbidden error. This means the server is alive, but users are blocked. The site is not “down,” it is restricted.

The 403 error usually means one of three things:

Loss of technical control

Information being hidden

Internal collapse

In crypto, timing plus transparency equals trust. The $SON coin failed both together. The date shift from Dec 19 < Jan 8 < Jan 26 < Jan 30 is acceptable. The website being restricted right after the new date update is not. That is why today's news is filled only with questions like "is the project scam or legit."

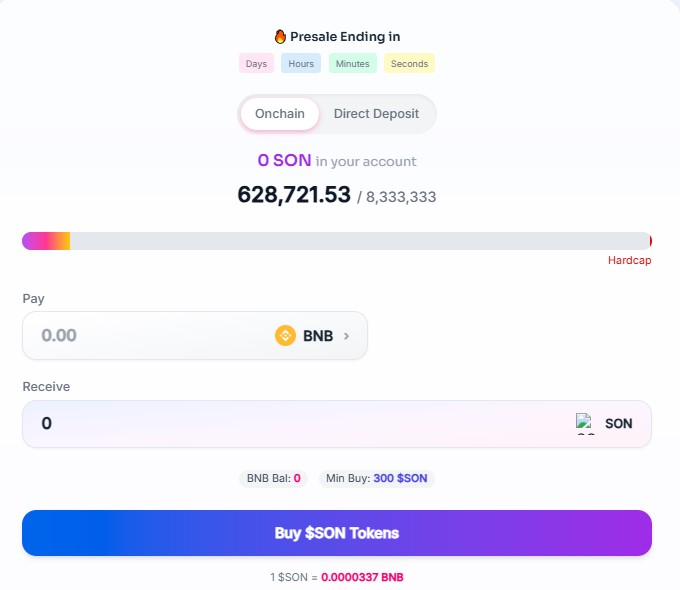

Spur Protocol Presale Ended: Weak Presale Numbers = Weak Demand

The Spur Protocol presale end data makes the situation much more serious. According to SpurSwap.com:

Presale end date: January 25

Total sold: 628,721.53 coins

Hardcap: 8,333,333 SON

1 $SON = 0.0000337 BNB

Minimum buy: 300 tokens

This means only about 7.5% of the hardcap was filled. Buy button still visible, but presale marked as ended. For a project claiming CEX readiness, failing to even fill 10% of its presale is a massive warning sign.

Low demand shows weak community strength and low investor confidence. This directly connects to fears around the Spur Protocol listing date and price stability.

Why $SON Listing Delayed: Presale Failure and Funding Problem

Strong projects delay listings because of audits or compliance. Weak projects delay because they lack liquidity. The airdrop was delayed because of financial stress. Without strong funds, launches on MEXC, CoinStore, SpurSwap, PancakeSwap, and BingX become difficult to support. Low liquidity leads to weak launches and higher dump risk.

This is why many traders now believe the Spur Protocol listing date postponed due to funding problems, not marketing. Recovery is possible only through immediate transparency, and execution.

Conclusion: January 30 Is No Longer a Date, It Is a Test

The new Spur Protocol listing date Jan 30 is now a survival deadline. Either the website comes back live, liquidity proof is shown, and real exchange listings happen, or the project loses trust completely.

Some voices like Bliss still support the project and believe the current crypto market dip is part of the reason for the delay. That view exists. But support without transparency cannot repair broken confidence.

YMYL Disclaimer: This article is strictly for informational purposes only and does not provide financial advice. Cryptocurrency investments are highly risky. Always do your own research before investing in any new project.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.