Highlights:

Binance Token Listing allocations mostly go back to users, not revenue

Over 84% of 2025 token launches trade below their listing price

Airdrops and Launchpool remain the safest ways for users to benefit

Binance token listing data shows that most token allocations reward users, not exchanges, while 2025 highlights a harsh reality where most newly launched tokens lose value after launch.

Recent research by Ash from Memento Research reveals what really happens during listings, challenging the long-standing myth of opaque “listing fees.”

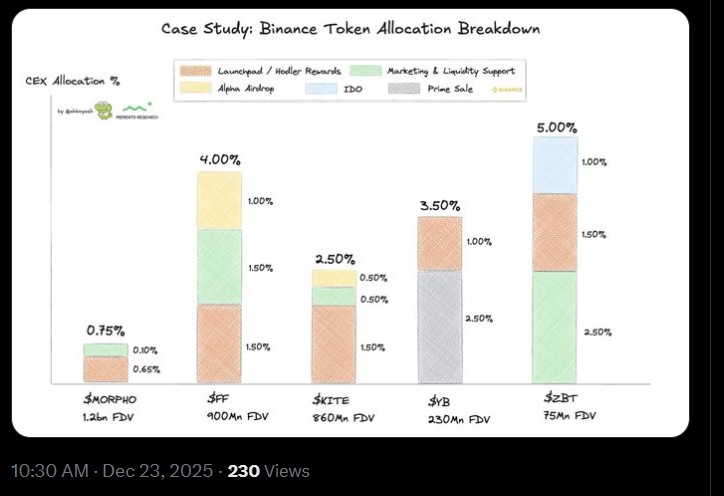

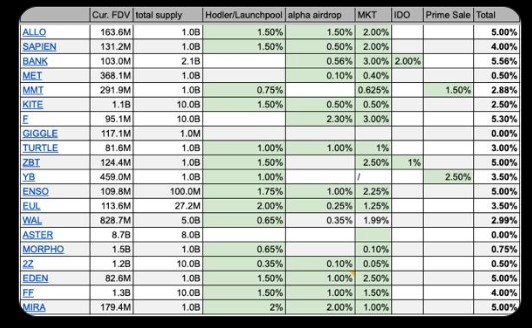

Public data from multiple listed projects shows that the total tokens allocation for listings usually stays below 5% of the total supply. Large, high-FDV projects often allocate less than 1%, while mid-sized projects allocate slightly more to support early liquidity and user incentives.

Importantly, these tokens do not go to Binance as revenue. Instead, allocations flow back into the ecosystem. The main destinations include Launchpool and HODLer rewards, Alpha airdrops, Prime Sale or IDO access for users, and liquidity or market support programs. Every allocation is designed to benefit real users and strengthen early trading conditions.

Source: X

For example, ALLO allocated 5% of its supply: 1.5% for Launchpool rewards, 1.5% for Alpha airdrops, and 2% for market support. ENSO followed a similar structure, also capping its allocation at 5%.

Across 20 recent listings, none show tokens recorded as direct Binance revenue. The listings prioritize community distribution, transparency, and ecosystem growth, not hidden exchange profits.

The trade continues to be robust even though the market is volatile. Bitcoin trading volume is the first to reach an excess of $26 billion, then Ethereum, Solana, XRP, and BNB.

ANIME, ASR, ALPine, and BANK are the top gainers with double-digit gains. In the meantime, ACT, VTHO, OXT, and AAVE are some of the worst losers. BTC and ETH market caps are experiencing low growth, and the majority of key assets are trapped.

The overall picture of token launching is bleak, even though the practices are transparent in 2025. Tracking of 118 events of token generation indicates that 84.7% currently trade at a lower valuation than when they were initially listed.

The median FDV is reduced by 71% and the median market capitalization decreased by 67%. Only an approximate of 15% of tokens are retained at a higher price than when they were launched.

Source: X

These are not local failures but a market-wide trend. Analysts cite a few reasons: the market is too saturated with new launches, TGE valuations are overly high, token utility is weak, and investors are afraid of new cycles due to prior cycles. Macroeconomic pressure has also decreased the desire to have speculative assets.

The concept of early involvement in the token launches as a guarantee of profit has obviously collapsed. The exchange listings can be open, but the success in the long term is still dictated by the fundamentals of the project.

The Binance-associated ecosystem activity is still rewarding its users with airdrops and incentive programs.

Recent include airdrops by RateX, Aster, vooi, River, Infrared, and Magma Finance.

The fifth airdrop of Aster starts on December 22, where the emission is less, and this is an indication of a more disciplined supply.

Rainbow Wallet has declared its RNBW token TGE in February 2026, whereas the ME sale in Magic Eden is active in MocaPortfolio.

These incidents demonstrate that airdrops are still among the least risky methods of exposure to users.

Source: X

Shareholders need to abandon the hyped-up decision-making and conduct serious research. Prioritize good teams, practical utility, sustainable tokenomics, transparent vesting, and actual user traction. Do not think that all new listings are going to be successful.

The listings are clearer than they seem, and 2025 shows that only well-founded fundamentals live. Binance Airdrops and Launchpool are less risky than risky launches.

Disclosure: The article is informational in nature and does not represent financial, investment, or trading advice. Investments in cryptocurrencies are market risky and volatile. It is recommended that the readers perform their own research (DYOR) prior to making any investment decisions. CoinGabbar is not liable for any financial loss.

Sakshi Jain is a crypto journalist with over 3 years of experience in industry research, financial analysis, and content creation. She specializes in producing insightful blogs, in-depth news coverage, and SEO-optimized content. Passionate about bringing clarity and engagement to the fast-changing world of cryptocurrencies, Sakshi focuses on delivering accurate and timely insights. As a crypto journalist at Coin Gabbar, she researches and analyzes market trends, reports on the latest crypto developments and regulations, and crafts high-quality content on emerging blockchain technologies.