Bitcoin Birthday is one day away, and that date carries real weight for crypto holders. On January 3, 2026, it turns 17—an age few people expected in the early days. Some traders are even asking a bold question: can this anniversary light the spark for a fresh rally and ignite a bull run in 2026?

To answer that, it helps to look back at how this story began, what changed in the last few years, and what the charts are saying right now.

The origin story starts on October 31, 2008. A short document titled “Bitcoin: A Peer-to-Peer Electronic Cash System” introduced a new idea: money that could move online without a central bank, right as the world was dealing with a major financial crisis.

The real “launch day” came later. The first block—called the genesis block—was mined on January 3, 2009. That date is the true Bitcoin Birthday, and it is why January 3 matters more than any marketing event.

Price discovery came slowly. The first documented exchange trading for dollars appeared in late 2009. Then came the Bitcoin pizza day, moment that made history feel real: on May 22, 2010, 10,000 coins were spent on pizza—proof that this internet money could buy something in the real world.

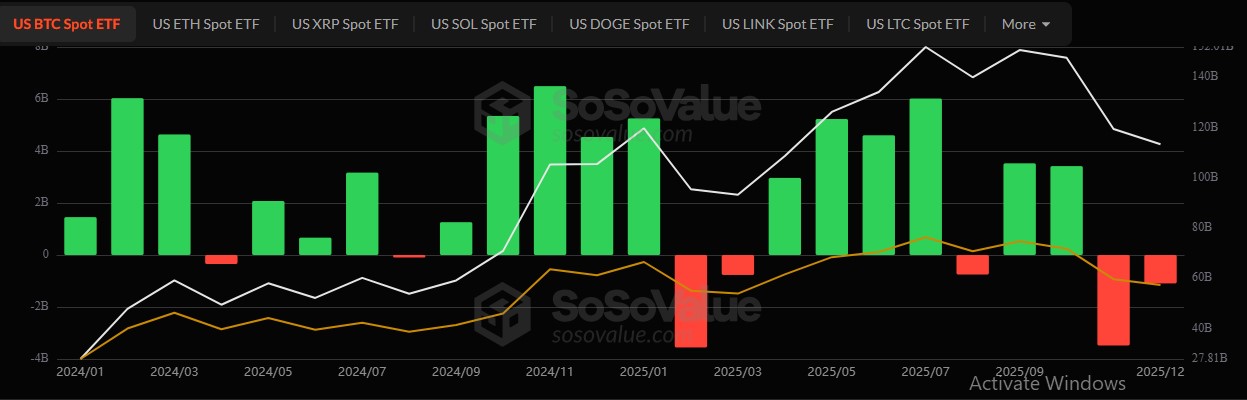

One significant turning point came in January 2024 with the U.S. SEC’s approval of spot ETFs related to the asset on a regulated market. This made it easier for big investors to access it.

However, there are still flow movements correlated with market sentiments. Based on the SoSoValue data, the spot ETFs finished the month of December 2025 with a net outflow of $348.10M on Dec 31, along with total inflows and outflows for 2025 as $31.02B and $9.65B, respectively.

Source: SoSoValue data

Then came a far more important political signal. On March 6, 2025, President Donald Trump signed an executive order to create a Strategic Bitcoin Reserve and a U.S. Digital Stockpile. Many market observers regard this as a significant turning point since it is no longer treated as a specialized asset but rather as an investment.

The other prime driver evident here that fuels this rise is the concept of supply. This will go on to lessen the rewards for miners every four years, or around 210,000 blocks on the network. The previous halving, which took place in April 2024, decreased rewards to 3.125 per block, down from 6.25. Prior to this, there have been previous instances of reward decreases in 2012, 2016, 2020, along with the next one set to occur in 2028, based on a Bitbo chart. The importance of this timeline was highlighted, as markets have a habit of "pricing the next cycle" earlier than anticipated.

Source: BitBo Chart

Q4 2025 drop represents the first definite warning signal in the story of Bitcoin’s 17th year, as the price dropped by more than 35% from October 1 to December 25, sliding from $125,922 to $81,072, eventually stabilizing at or around current prices.

As of now, Bitcoin price is trading around $88.8K, which is only a little above the current value of $88,852. The technical pattern of Bitcoin is quite clearly defined. The immediate support level lies in the $88,000-87,500 range, whereas the basic support for the bull trend is at $85,000.

Source: TradingView Website

Any hard break below $85K might unleash potential downside movements towards $80,000-$78,000, while in a deep bear market, the price might fall towards the $40,000 level. Resistance points on the flip side are $92,000, $96,000-$100,000, with a strong resistance level spanning $108,000 to $112,000.

Momentum stays weak with RSI close to 45 and MACD flat to slightly negative, implying a consolidation trend.

Bitcoin Birthday is more than a mere digit, as it has already overcome 17 long years, upgrades, and the worldwide spotlight. What’s next in 2026, most likely, is based on the return of demand for ETFs and the price remaining at or over $85K. A major move past $92K can reverse the situation, while remaining below $85K is a problem for the next couple of months.

YMYL Disclosure: This piece is intended solely for educational purposes, not a source of financial advice or a guide on how to engage in any kind of trading activity. The nature of the crypto market is such that it’s extremely volatile. It’s imperative to fact-check all the data provided here.

Deepmala Upadhyay is an experienced crypto journalist, content strategist, and News writer with over 5 years of expertise in writing and the crypto industry. Holding a Bachelor's Degree in Computer Science and a deep understanding of blockchain technology and financial markets, she excels in delivering exclusive news, in-depth research blogs, and expertly crafted on-page SEO content. As a team lead and content writer at CoinGabbar, Deepmala is responsible for analyzing blockchain technologies, cryptocurrency, price movements, and the crypto market with precision and insight. Her keen ability to create well-researched, impactful content, combined with her expertise in market analysis, makes her a trusted voice in the crypto space.