After suffering a rare 6% yearly loss in 2025, is Bitcoin preparing for a comeback in 2026 that would be powerful?

According to the past, whenever there is a silence in Bitcoin, something gigantic is usually a surprise. Along with macro indicators becoming better, high-quality long-term charts, plus analysts foreseeing the market reaching new highs, it is a common question among the investors: Is the year 2026 going to be the year of $BTC stunning the market again?

Let us take it one step at a time.

BTC came to the end of 2025 with a 6% yearly loss, which was only the fifth instance out of the tenth history of BTC where the closing was in red. The years that faced red at the end of the year—2011, 2014, 2018, and 2022—were very close to the market getting reset.

Any of these years were not breakdowns, but rather reset phases. In fact, red yearly candles have been associated with the end of market corrections, followed by strong multi-year recoveries. The pattern this time is that the strength of the market might not be the issue in 2025 but rather the long-term accumulation of the asset.

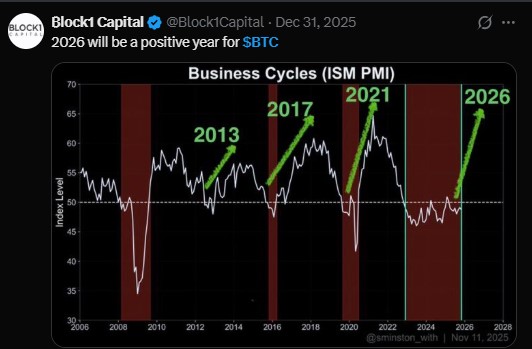

Of all the macro signals that have favored Bitcoin’s image throughout the years, the ISM PMI (Purchasing Managers’ Index) is the top one. In the past, the price went up after the PMI recovered following the economic slowdown.

2013: PMI recovery → Bull run

2017: PMI rebound → Major BTC expansion

2021: Economic recovery → New BTC highs

Since the PMI is assumed to rise until 2026, the market might have a new business cycle expansion which will act as a very strong force behind the rise in prices.

Crypto Rover reports that during Q4 2025, BTC was the worst performer compared to gold, silver, bonds, stocks, and real estate. Nonetheless, this lag is typical.

To put it differently, BTC has frequently been the last to take the stage after traditional assets but eventually succeeded them in a big way. The present circumstances imply that 2025 is a year of consolidation for the asset, which will ultimately lead to a price shift and a rally in 2026.

As per CryptoXLARGE, The world largest crypto currency remains in a long-term ascendant channel, a shape that the leading coin has been following for years.

BTC has just bounced back from the lowest support of the channel

The pattern of higher highs and higher lows is seen

Resistance on the upside is around $210,000 in 2026

If this channel remains intact, then the broader bullish macro trend is still valid, albeit accompanied by short-term volatility.

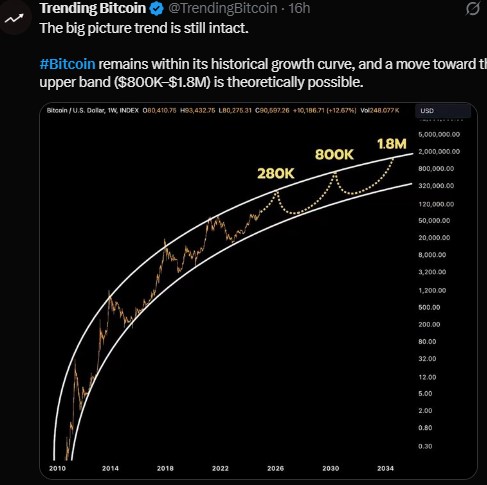

As per Trending Bitcoin, The asset is still in line with its long-term logarithmic growth curve that has traced every major cycle since it was born.

BTC has never broken this structure during pullbacks. If history gives a repeat performance, it might slowly move to the upper band of the curve as the market continues to be in an expansion phase rather than at the top of a cycle.

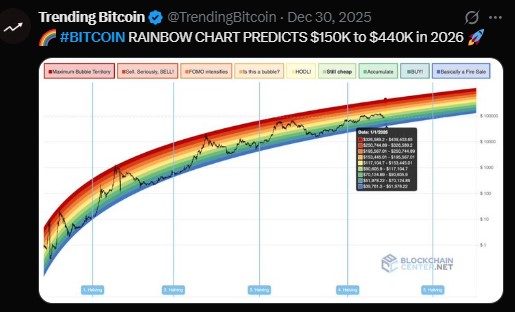

The Bitcoin Rainbow Chart, which is another long-term valuation model, has indicated that BTC is still trading inside its historical growth limits.

Projected range for 2026: $150,000 to $440,000

Current prices are in the accumulation or fair-value zones

Similar situations in past cycles led to big rallies

Thus, the scenario that Bitcoin could still be a bit over the hill is not the only one possible; rather, it is the scenario that it still has great potential for upside.

In an interview, Charles Hoskinson, Mastercard of Input Output and Ethereum co-founder, thinks that by the end of 2026, it might reach a whopping $250,000.

He stated that:

Increased institutional adoption

The crypto market is becoming more mature

The overall narrative is scarcity and macro hedge

Nonetheless, Hoskinson has cautioned that $BTC is still an economic-sensitive commodity in the full sense, i.e. it's affected by interest rates, liquidity and global economic situations. So, he emphasizes the role of macro trends.

Taking a step back and considering Bitcoin's historical cycles, macroeconomic indicators, long-term technical structures, and analysts' forecasts, we can safely say that the digital asset is going to be in a very good spot come 2026 when it will be opening up to a bullish phase.

Bitcoin Price Targets for 2026 (Conservative to Bullish)

Conservative range: $150,000 – $180,000

Base case: $200,000 – $250,000

Bullish scenario: $300,000+ (Depending on macro factors)

There will be volatility, but a range of different models indicate that 2025 will be a year of reset and consolidation, while the following year will be one of expansion and new highs.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Crypto investments involve risk; always do your own research.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.